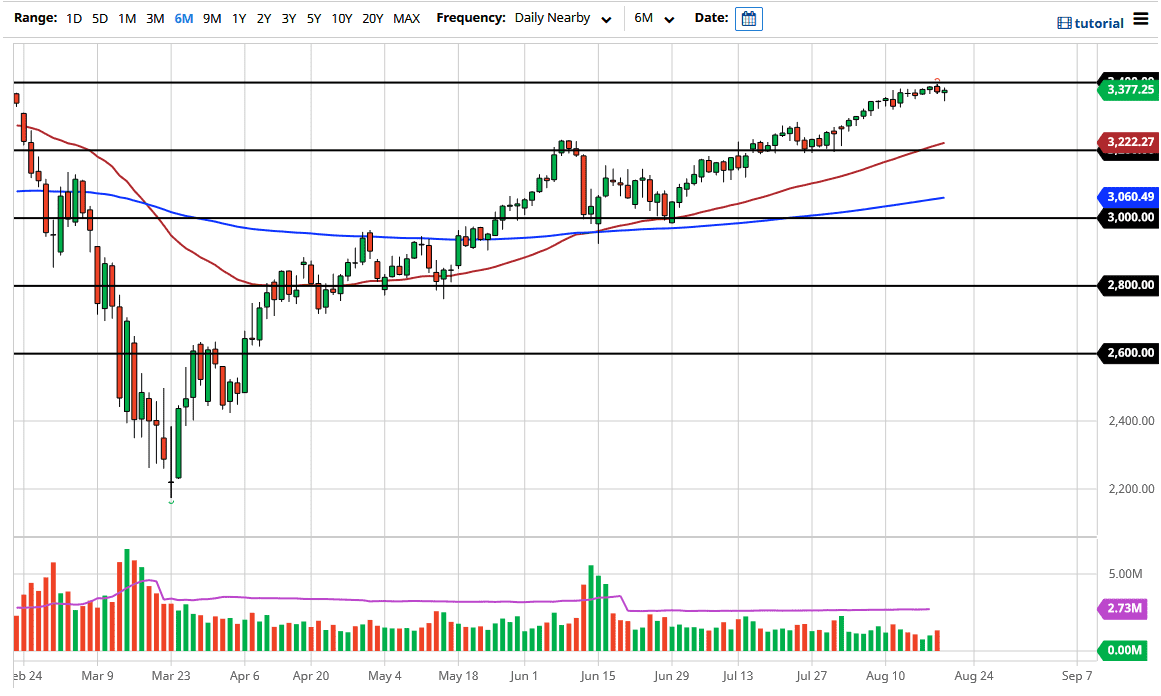

The S&P 500 initially fell during the trading session on Thursday but as you can see the market has turned around to show signs of life again. By doing so, we ended up forming a nice-looking bullish hammer, and it looks as if we will make another attempt at the 3400 level. At this point, the market continues to find buyers every time it dips, and the candlestick during the trading session on Thursday was more of the same.

The US dollar to gain initially during the trading session and that may have at traders a little bit concerned, but ultimately it ended up losing a bit of value, and therefore plenty of buyers came back into the market as the S&P 500 continues to grind its way towards the all-time highs. Furthermore, you should keep in mind the fact that the all-time highs almost always bring in a bit of selling pressure due to the fact that people get a little bit tenuous. Nonetheless, the way the market has been so resilient I fully anticipate that we will break out to a fresh, new highs and continue reaching towards 3500 level. After all, the market is moving on the Federal Reserve liquidity measures, and now that we are through the earnings season dangers, the market will start to focus more on that liquidity again.

If we were to break down below the hammer from the trading session on Thursday, I think there is still plenty of room underneath that could offer support, including levels such as 3350, 3300, and most certainly the 3200 level which was massive support and also now features the 50 day EMA. With that being the case, I do not have any interest whatsoever in trying to short this market, at least not until we break below that level. Even then, there are some other areas that I would have to pay attention to. With the liquidity measures being taken by the Federal Reserve, I think this market will eventually find a reason to go higher, if for no other reason than a day where the US dollar gets hammered again. Ultimately, I think that buying dips continues to work, until one day we find ourselves well above the 3400 level and continue to go much higher. Unless the Federal Reserve changes its tune or we get some type of massive headline shot, shorting is an even a thought anytime soon.