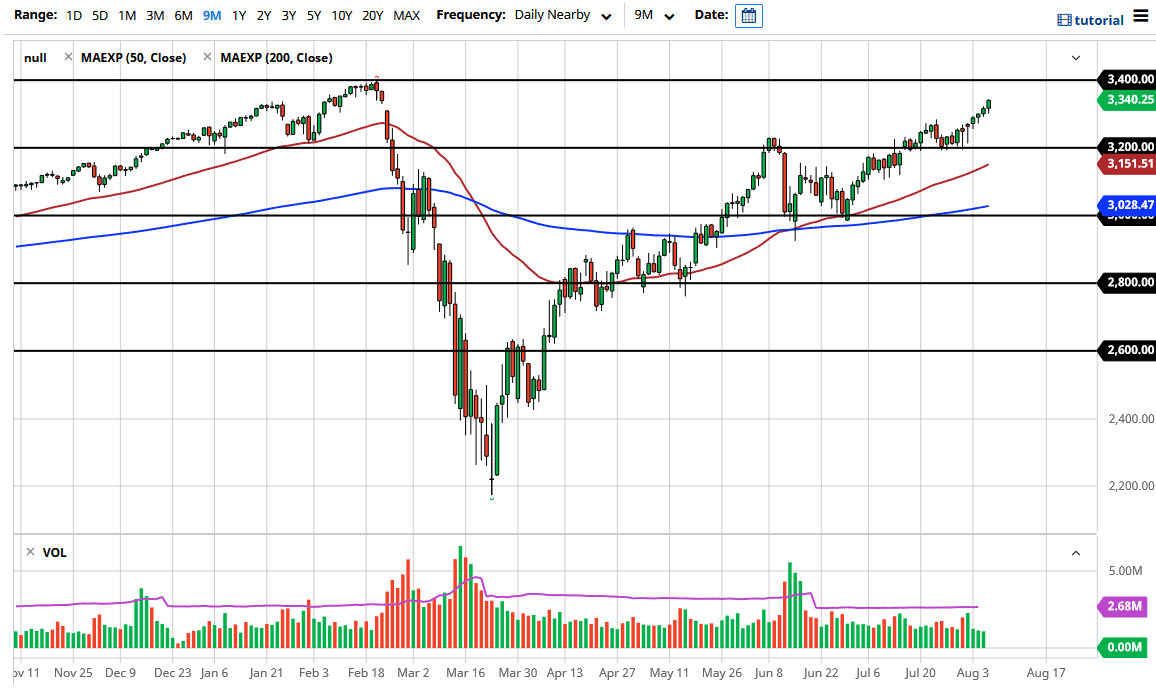

The S&P 500 pulled back slightly during the trading session on Thursday only to turn around and fill the gap. Now that we have filled the gap from so many months ago, then it is likely that there could be a bit of resistance. Having said that though, the markets continue to grind higher and I think that eventually it is only a matter of time before the brakes to those all-time highs at the 3400 level, and then possibly even to the 3500 level which is my longer-term target. After all, the Federal Reserve continues with the loose monetary policy and that is the only thing Wall Street cares about, cheap money.

Earnings season has been somewhat not eventful, so at this point it is likely that we will continue to see the upward trend without much in the way of concern. Pullbacks at this point in time offer value, and the Non-Farm Payroll announcement will probably cause that pullback, at least temporarily. If we do get that short-term pullback, I think that there will be plenty of buyers underneath the pick this market up. After all, the “FOMO” is real, and a lot of people will look at any pullback as an opportunity. Wall Street continues to look at the Federal Reserve for direction, and that direction is always up.

The 3200 level underneath would be massive support, just as the 3100 level will. The 3150 level features the 50 day EMA, and then at this point in time it is likely that somewhere in that area there should be plenty of buyers. Having said that, we could just go straight up in the air, because so many other markets are right now as the cheap US dollar continues to push everything higher. The grind higher has been pretty relentless, and I just do not see how that changes anytime soon. Another thing that I would draw your attention to as all of the support that we had seen last week at 3200. If we can somehow pull back to that area, I anticipate that a longer-term trader would be very interested in getting involved in that vicinity. To the upside, I expect significant resistance at the 3400 level, but it eventually will get broken due to everything that is going on right now.