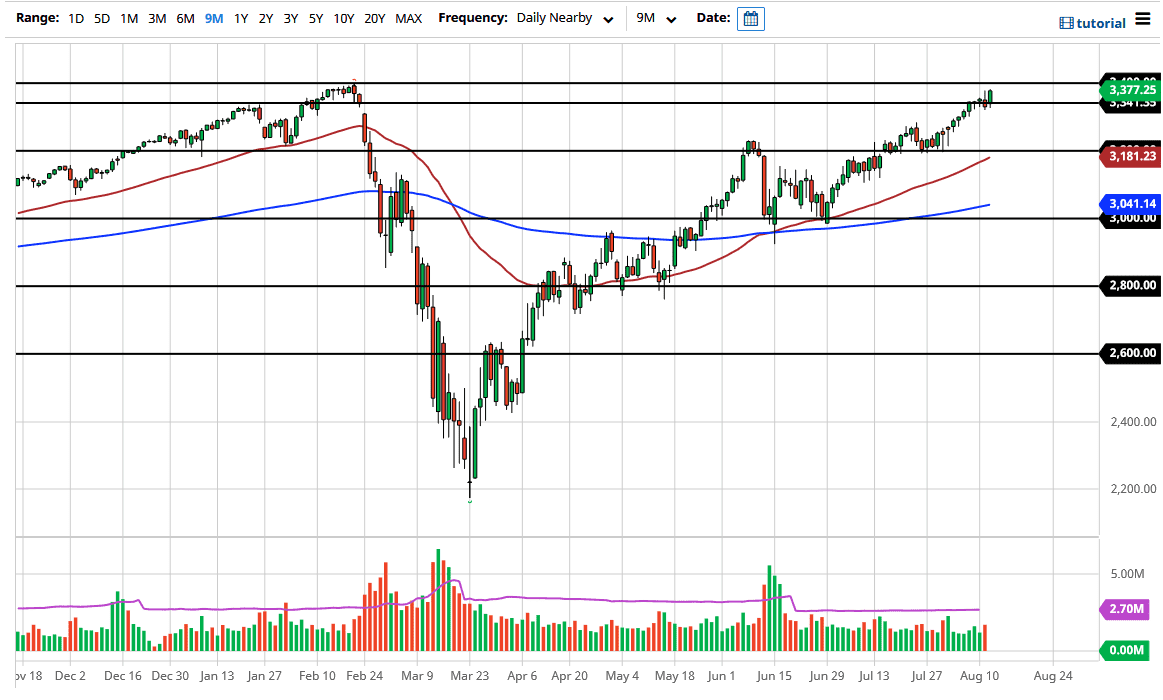

The S&P 500 has initially pulled back a bit during the trading session on Wednesday after gapping ever so slightly to the upside. By pulling back and then shooting above the highs of the previous session, it shows just how bullish this market truly is. We are not that far from all-time highs, and it is hard to imagine what is going to change the overall attitude of the market, so I believe that we will eventually shoot through the 3400 level. This makes quite a bit of sense considering that the Federal Reserve is going out of its way to flood the overall financial system with greenbacks, so therefore people are looking to buy assets.

Eventually, we could break above the 3400 level in the next couple of days, and when we do it is likely that we could go looking towards the 3500 level. The level, of course, has been an area that I have talked about recently because it is a large, round, psychologically significant figure that will attract a lot of attention. That being said, I can say that about a lot of the levels underneath that has already been broken to the upside.

Underneath, I look at the 3200 level as massive support, and it should continue to be an area that a lot of players pay attention to. The 50 day EMA is just underneath there and we have already seen buyers support the market in that general vicinity. With this, I think that the value hunters would come out in full force and push this market from there. Quite frankly, I do not even know that we get in that area without some type of catalyst, but then again, the way that the markets are behaving, anything is possible. Buying on short-term dips should continue to work through, and that is certainly how I am going to play the market each day. The move above the 3400 level could be rather swift, so keep that in mind as it would be a major breakout and could attract a lot of attention. The velocity of the breakout could be quite strong, and at this point, it is likely that the market would see fresh money jumping in to take advantage of the “FOMO trade.” Until then, be careful with your position size but ultimately, I do think we go higher.