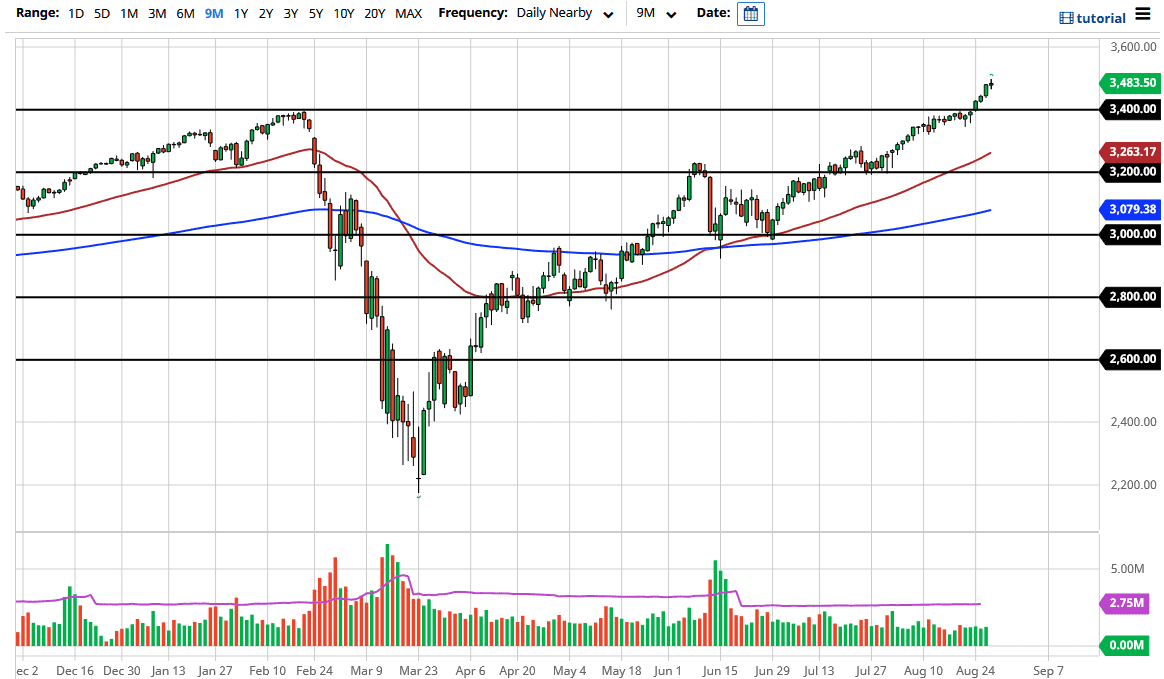

The S&P 500 has gone back and forth during the trading session on Thursday as we had been waiting for the Jerome Powell speech. The market is likely to continue to see a lot of back and forth volatility as we had gotten a bit ahead of ourselves. Do not get me wrong, I have no interest in shorting this market, but I recognize that we may get a short-term pullback. This is especially true considering that the 3500 level is just above, and that has been a longer-term target for a lot of analysts on Wall Street.

The market did not get the massive amount of liquidity injection that they were hoping for from Jerome Powell, and we had perhaps seen a bit of front running of the announcement. To the downside, I believe that the 3400 level is massive support, extending down to the 3350 level. In that area, I would anticipate that a lot of value investing would go on, and of course a lot of “FOMO trading”, as a lot of people probably exited right before the 3400 level God broke. With that being said, fund managers will also be chasing performance, something that has been driving this market for a while.

Even though the Federal Reserve did not add more quantitative easing, the reality is that it still extraordinarily loose and a lot of money will flow into the stock market regardless. With this being the case, I think it is simply a matter of finding value every time we pull back, and therefore I think it is only a matter of time before we see plenty of buyers jumping in and try to push higher. If we break above the 3500 level, then it is likely we go looking towards the 3600 level after that. After all, the S&P 500 does tend to move in 200 point increments, so I do not think it is that much out of the realm of reality to go up to that level given enough time. I do expect 3500 to cause some issues though, so be aware the fact that we may have some choppiness in the short term ahead of us. Regardless, it has an uptrend and you simply cannot fight this type of momentum, regardless of how much it seems to be getting out of control.