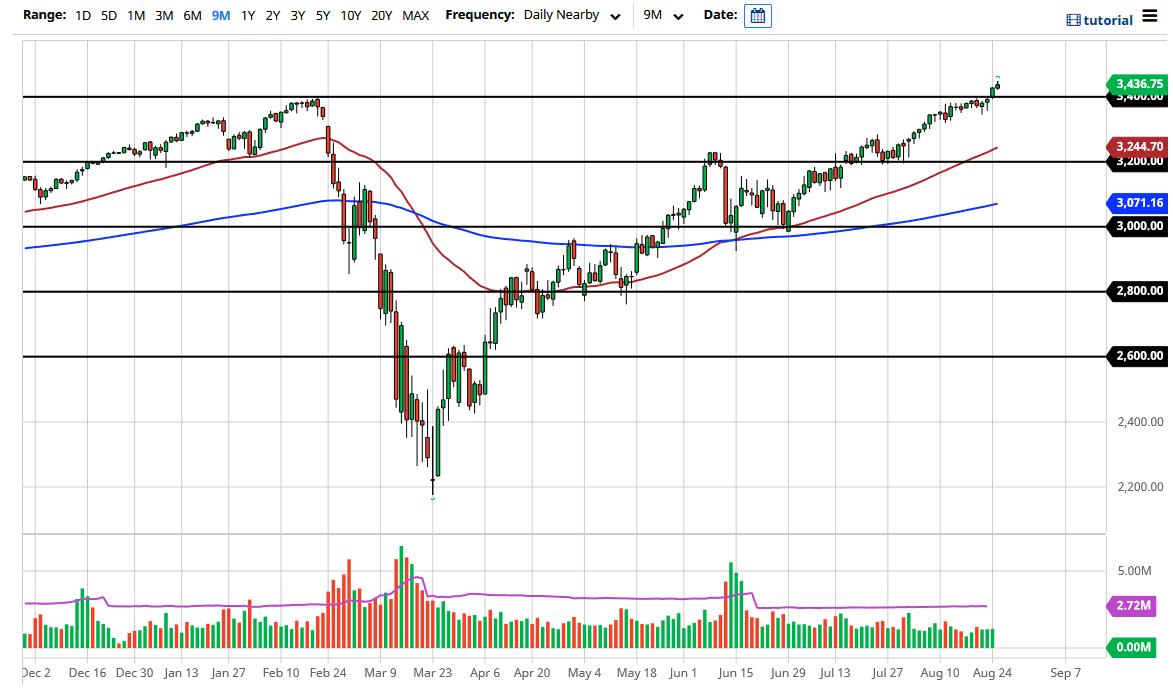

The S&P 500 is likely to continue going higher longer term, but at this point in time, it is likely that we will see the market pull back just a bit, perhaps looking for some type of stabilization or validation to go higher. The 3400 level was a massive resistance level previously, and it should now offer support based upon “market memory.” After all, we do have to worry about Jerome Powell's speech on Thursday, but it is difficult to imagine a scenario where he goes out of his way to cause any type of issue. If you look in the past, you can see that every time the Federal Reserve Chairman has said something that rattled the market, he did a complete 180 within the next couple of days to turn things around.

I also recognize that there are a couple of hammers just below the 3400 level that should offer structural support as well. With that being the case, I anticipate that there are a lot of buyers just below there as well that will be very difficult to breakthrough. If we did, that would be an extraordinarily negative sign. At this point, in time it would take something rather extraordinary to make that happen. I think we are much more likely to see this market looking towards the 3500 level, which is the next large, round, psychologically significant figure. I do think that it is only a matter of time before sellers will come back in to push this market lower, but I think that would be a short-term pullback more than anything else. I believe that the S&P 500 will continue to go higher due to the fact that “there is no alternative” for a lot of money managers out there right now. While this has been a relentless march higher, the angle of attack has a bit overdone, so I think that a pullback will more than likely bring in even more buyers. Do not be wrong, I can give you 100 reasons why stock markets should not be as high as they are, but at the end of the day, there is no point in fighting the momentum. I do not have any scenario in which I’m willing to short this market in the near term.