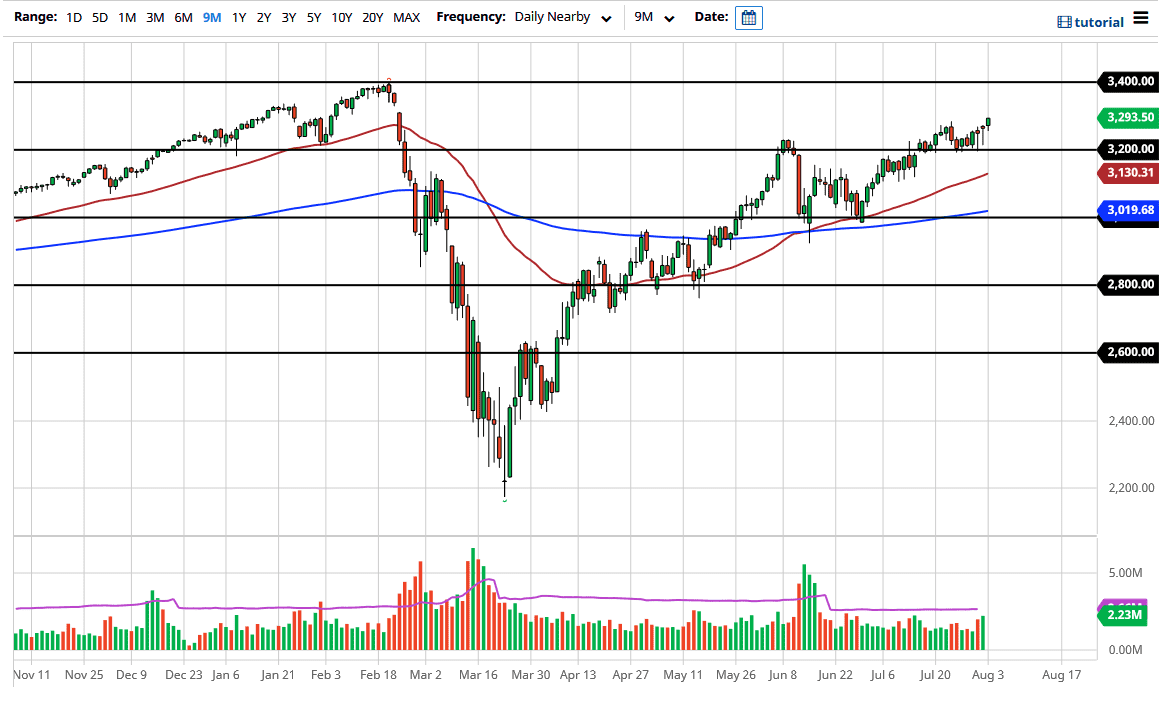

The S&P 500 has initially pulled back on Monday only to turn around and show signs of strength again as we are threatening 3300 towards the end of the session. Ultimately, if we do break above there and go looking towards the little gap that is roughly 40 points above. Furthermore, I think there is almost nothing to stop this market from going towards the 3400 level, which was the overall high. 3400 is a nice round number and will attract a lot of attention as the stock market completely recovers from the COBIT numbers, while the economy languishes.

All that being said, do not waste your time trying to make this make sense. It is what it is. Price is everything. I have quite a few friends in the financial services sector right now that are beating their heads into the wall trying to figure out why stock markets continue to go higher. If you really need to have a theory, perhaps it is because the Federal Reserve is doing everything it can to jam as much liquidity into the system, thereby forcing money managers to do something. Remember, the Federal Reserve works to save Wall Street every time it falls, and it has nothing to do with the economy. If you truly believe that economic conditions and Wall Street run parallel, and you have not been paying attention for the last 12 years.

Do not try to overthink this, it is obvious that the market wants to go higher. If the S&P 500 drops, there should be significant support at 3250 and most certainly at 3200. Underneath there, there should be plenty of support at the 50 day EMA which is currently at the 3130 handle. With all that being said, buying dips should continue to work, despite the fact that we are in earnings season. After all, the stock market only focuses on Federal Reserve liquidity and a handful of stocks. Keep in mind that the indices are not equally weighted, meaning that some of the biggest household names control what happens next with the index, not the overall attitude of the markets. This is probably one of the biggest mistakes at retail traders make, assuming that the S&P 500 or the NASDAQ 100 will go up or down based upon economic reality or the overall attitude of the market. There are essentially six stocks moving the indexes right now.