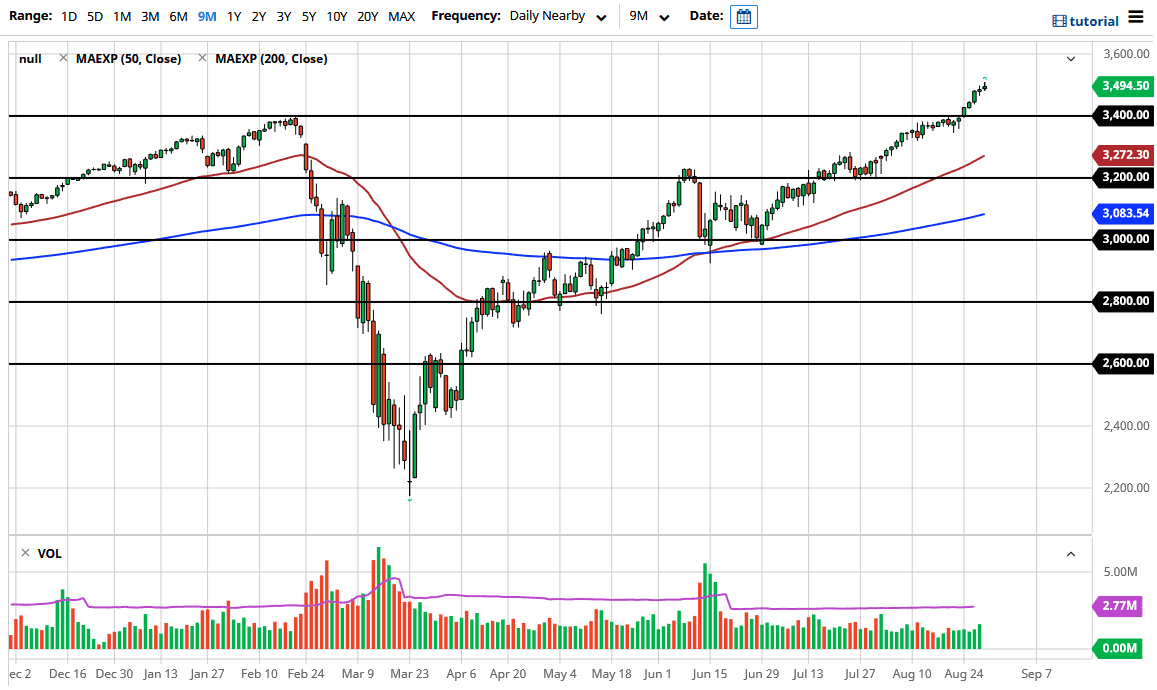

The S&P 500 initially tried to rally during the trading session on Friday but did pull back a little bit from the 3500 level which is a large, round, psychologically significant figure. Forming a shooting star, this suggests that we may get a little bit of a pullback, but I think that pullbacks will continue to value propositions. I would like to see this market reach down towards the 3400 level. That is an area that has been important previously, and I like the idea of buying dips.

The 3400 level is a massive amount of support ready to continue going forward, as it was a major resistance barrier. Furthermore, when you look at the candlestick from the end of last week, you can see that we formed a couple of hammers in that area, so I think that we will continue to see a lot of buying.

Eventually, I think we go looking towards the 3600 level, which makes sense considering that this market continues to move in 200 point increments. That does not mean that we move in all 200 points in one shot, just that we will eventually get there. I believe that the 3400 level is an excellent buying opportunity, but if we break down below there then I will be looking at the 50 day EMA as well. After that, the 3200 level is even more supportive. I have no scenario in which I’m willing to short this market anytime soon, and even if we were to get a 10% drop, something that I think could happen sooner or later, I look at that as a buying opportunity. I will not be shorting the S&P 500, after the move that we have seen as it makes no sense. As long as the Federal Reserve is out there pumping the markets full of liquidity, money has to go somewhere and that typically means assets such as stocks.

For a long time, my target for the year has been 3500 but clearly, we are going to break above given enough time. With this, I believe that 3600 is a fairly safe bet, possibly even 4000 by the end of the year at this rate. It comes down to how quickly the value of the US dollar happens more than anything else now.