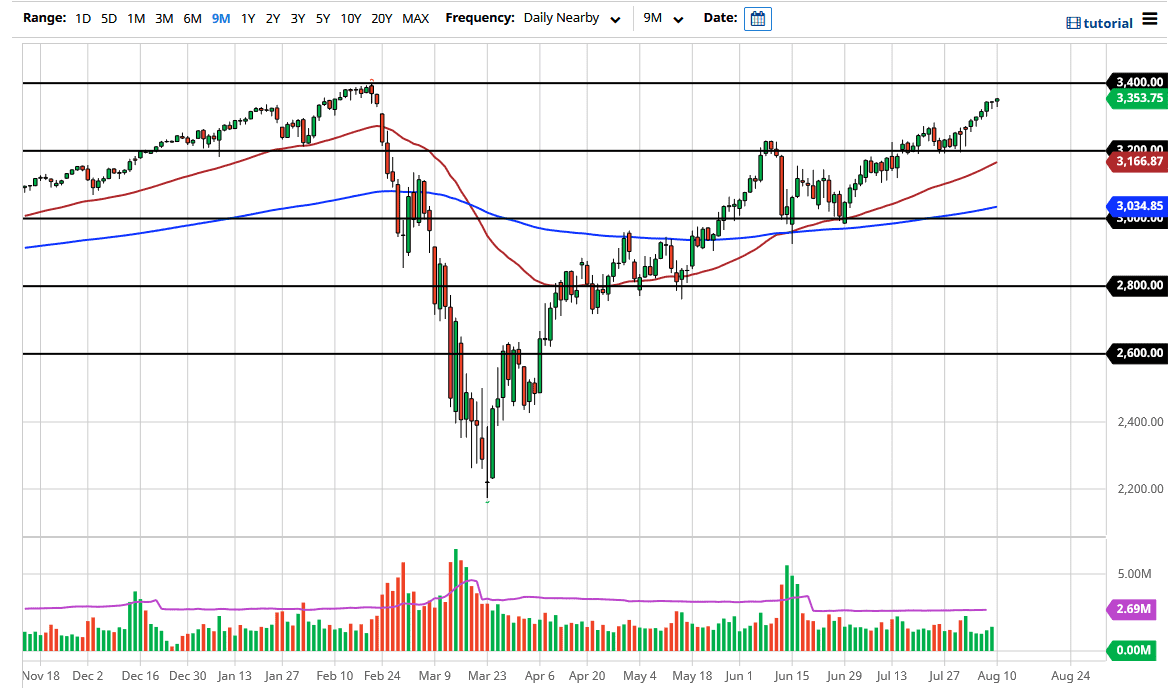

The S&P 500 pulled back slightly during the trading session on Monday to kick off the week but continues to find buyers on these dips. As technology stocks got hit hard, the S&P 500 seem to ignore that. At this point in time, it is likely that the market is going to reach towards the 3400 level, where the all-time highs had been hit. Even if we do break down from here, technically that would make this candlestick a “hanging man”. I have no interest whatsoever in trying to short this market. I think that there are plenty of buyers underneath and that should continue to propel this market higher. I believe there is a significant amount of support underneath at the 3200 level, which is an area that previously had been resistant.

Furthermore, the 3200 level is held up by the 50 day EMA sitting underneath there, and the fact that the area had been so resistive in the past attracts a lot of attention. The Federal Reserve flooding the markets with currency helps people get bullish on the stock market because that is basically what has been driving it higher for the last 12 years or so, to one degree or another.

At this point, it is not until we break below the 3000 level that I would be a seller of this market, and even then I would have to see the circumstances surrounding that. I do think that we will eventually break the 3400 level in charge much higher, with the 3500 level at least being an intermediate target. Expect choppy behavior, but I continue to find buyers every time I look at pullbacks, so I do not think that will change anytime soon. Remember, stocks run on liquidity more than anything else these days and now that we are basically at all-time highs, I do not see that changing anytime soon. As long as the main stocks that everybody follows continue to find buyers, the S&P 500 is not going anywhere anytime soon. Ultimately, this is a market that will continue to be volatile, but most certainly with an upward presence overall. In fact, I do not even have a scenario in which I am selling anytime soon, just as everybody else does not.