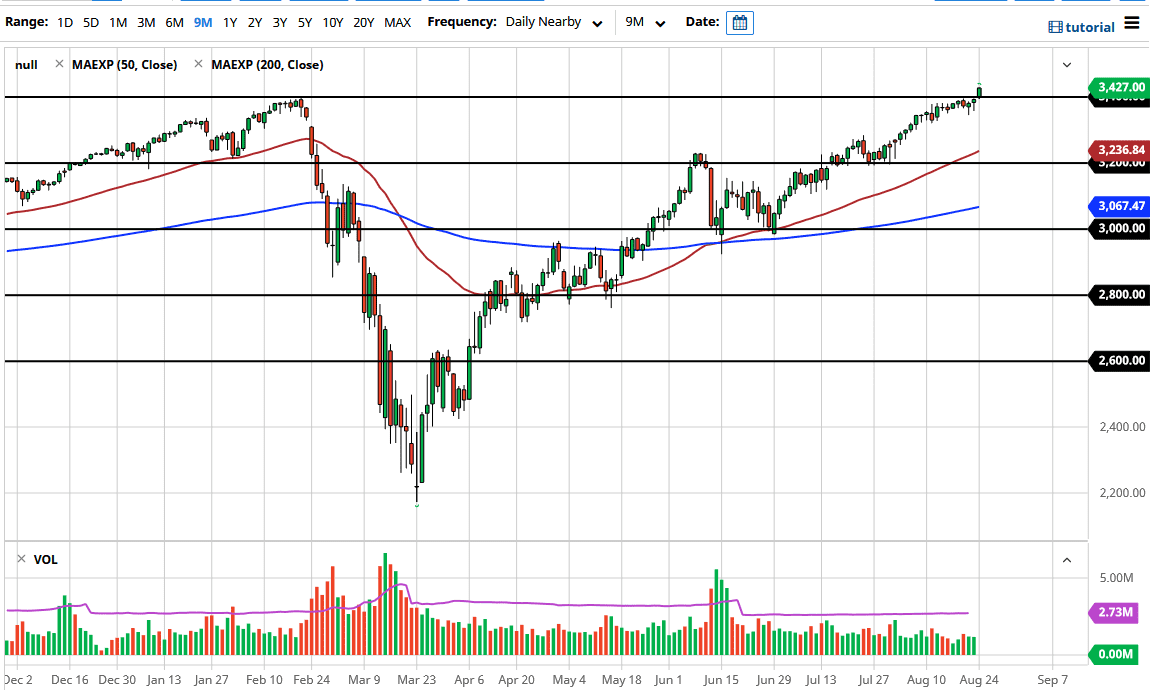

The S&P 500 has rallied quite nicely during the session on Monday, breaking above the 3400 level and making an all-time high finally. Ultimately, I think that short-term pullbacks will continue to attract a lot of attention due to the fact that we have broken massive resistance, and of course there is a certain amount of psychology that comes along with these fresh, new highs. This is just the same as there was psychology going into this level, and fears that it would hold. We are now above where we had melted down from during the pandemic, meaning that the market is completely looking past it now.

I give you a million reasons why the market should be the sign, but there is only one thing that matters at this point, and that is going to be the Federal Reserve pumping liquidity into the markets. It sounds cynical, but that has been the way markets have behaved for over a decade, to one extent or the other. As long as that is going to be the case, and the fact that indices are pegged to just a handful of stocks, we will get the S&P 500 defying what most people would consider logic.

When I look at the Thursday and Friday candlesticks of last week, to me it is obvious that there is a certain amount of support just below. That was an area where the buyers came in to try to push higher and break out, and that is exactly what they did. There is a lot of money just below the 3400 level, so I think that the simply going to be the first place that buyers would make a stand based upon some type of pullback that offers value.

If we break above the highs of the candlestick for the trading session on Monday, then I think the next target will be 3450, followed by the 3500 level which has been my longer-term target for some time, although I am the first to admit that we are probably going to get there sooner rather than later. That is essentially a “midcentury mark”, so there could be a little bit of psychological resistance there. However, I think that it is only a matter of time before we break above there as well, if for no other reason than the devalued greenback.