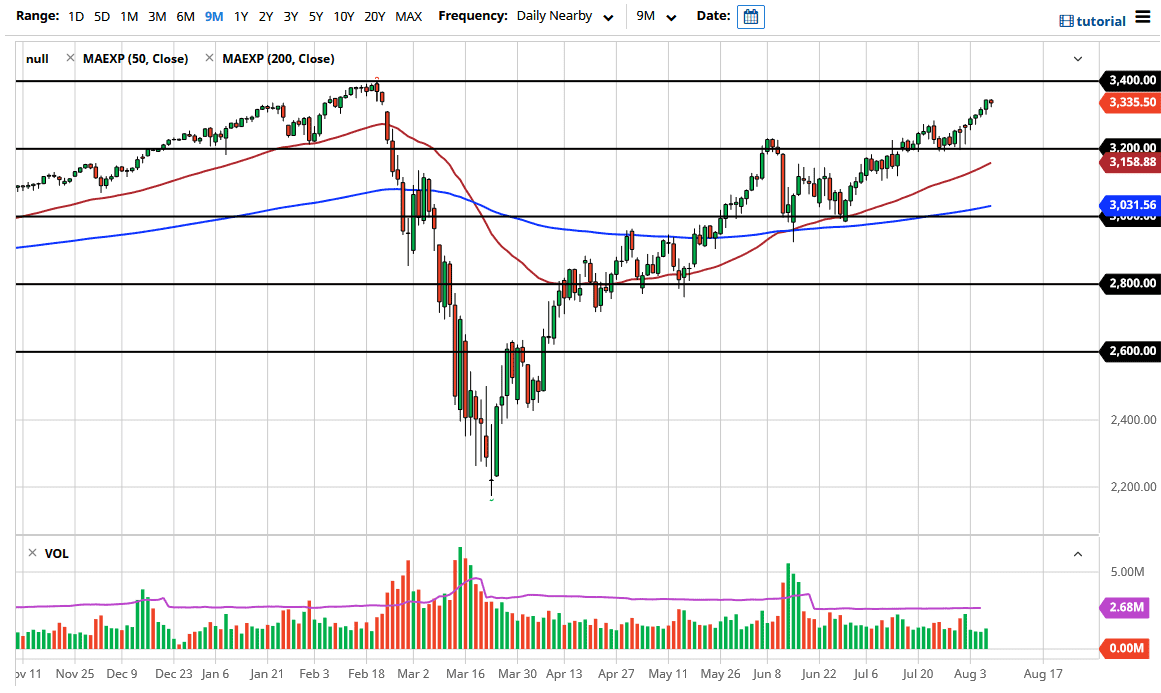

The S&P 500 rallied enough on Friday to fill the gap from the previous trading. That being the case, the market is likely to continue to see buyers on dips, as we try to break towards the recent all-time highs. The 3400 level would be the initial target, but I think in the short term it is likely we continue to see short-term pullbacks in order to build up the necessary momentum.

At this point in time, I believe that a pullback is healthy because the market has gone straight up for several days in a row. We could drop to the 3200 level, an area where I would anticipate seeing a lot of support. I would be more than willing to take a shot at the S&P 500 in that general vicinity, as the level had been previous support and resistance. In fact, you can see two weeks ago we really tested it for support, and it held quite nicely.

If we simply break higher, then it is likely we go looking towards the 3400 level before breaking towards the 3500 level which is my longer-term target. The S&P 500 is moving based upon liquidity measures coming out of the Federal Reserve and trying to do some type of fundamental analysis at this point does not make any sense. This is because liquidity measures are the only thing that matters at this point. The earnings season has done nothing to dissuade buying measures, and for the last several earnings seasons, they turned out to be relatively uneventful. This one was no different because the stock market does not move on fundamentals, rather money flowing through the system.

As the Federal Reserve continues to work to devalue the US dollar, it makes quite a bit of sense that the stock market rallies due to the fact that people are trying to buy “things” in order to get rid of currency exposure that is losing purchasing power almost daily. Beyond that, the cheap US dollar tends to help multinational companies, at least that’s the theory that most traders work upon. The 3400 level being broken will attract a lot of attention and will probably bring in a flood of fresh money to the upside. I have no interest in shorting this market right now as it is so obviously bullish.