The S&P 500 pulled back initially during the trading session on Tuesday but gained a bit more than some of the other bigger ones that I follow, most specifically the NASDAQ 100. It looks as if we may be rotating a bit in the stock market, perhaps trying to get involved in other stocks instead of just the six usual suspects. If that is going to be the case, we may even see the Dow Jones Industrial Average to fairly well. In other words, perhaps people will start buying things besides Apple and Amazon.

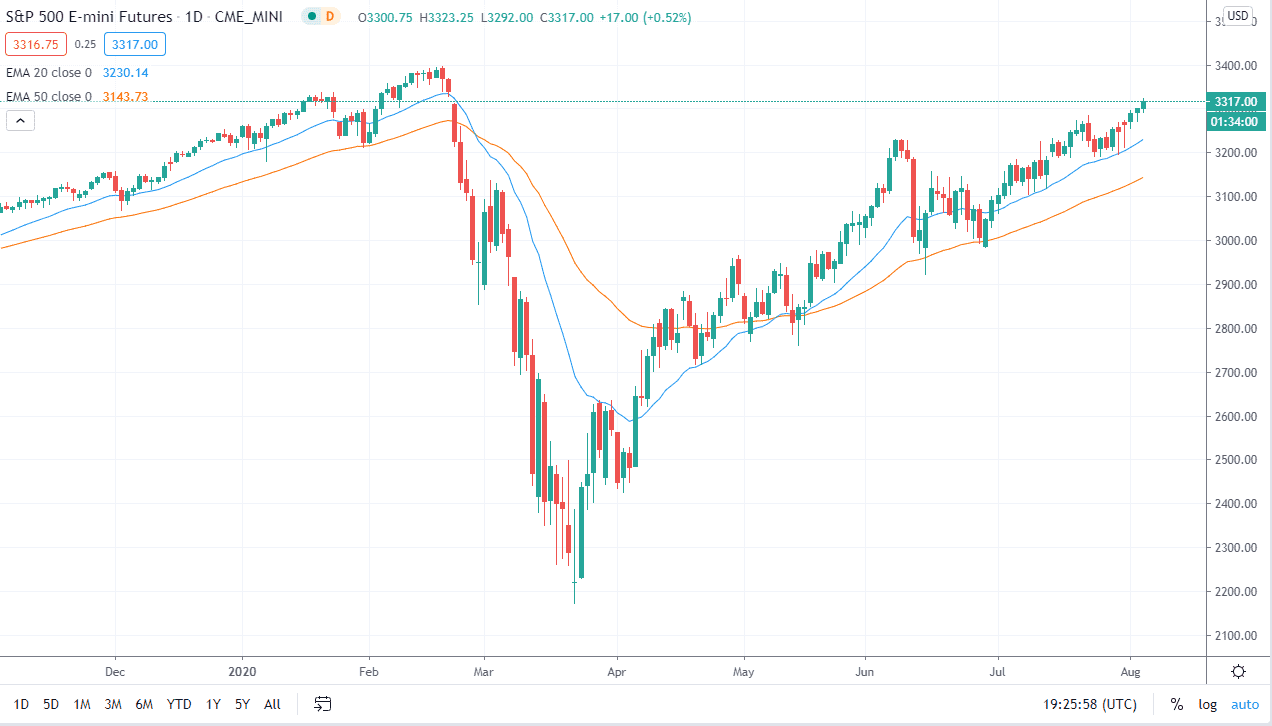

Nonetheless, the stock markets are moving more or less based upon Federal Reserve liquidity, as the central bank continues to bail out Wall Street every time it drops. All things being equal, the market is likely to continue to offer a “buy on the dip” opportunities. Ultimately, I think we are looking towards the 3400 level, which was the most recent high. All things being equal, I think that the 20 day EMA underneath is offering support, just as the 50 day EMA well. In fact, I do not even have a scenario where I’m willing to sell the S&P 500.

Keep in mind that we do have the unemployment claims in the Non-Farm Payroll numbers coming out this week, on Thursday and Friday, respectively. If that is the case, that means we may get a bit of volatility, and the earnings season going on right now can cause the occasional move back and forth. We are in an uptrend, and there is no reason to fight that.

Late last week, we had seen a couple of hammers form, and it looks likely that we are ready to continue to go higher. In fact, the hammers formed right at the 3200 level so I would not be surprised at all to see this market show plenty of buyers that would be interested in picking up the value that it represents. Longer-term, I believe that we are going to go higher, breaking above the 3400 level and beyond. In fact, I have a target of 3500 given enough time. That does not mean we get there overnight, but every time we pull back, I start to look for support and small bounces that I can take advantage of in order to continue to ride the overall uptrend.