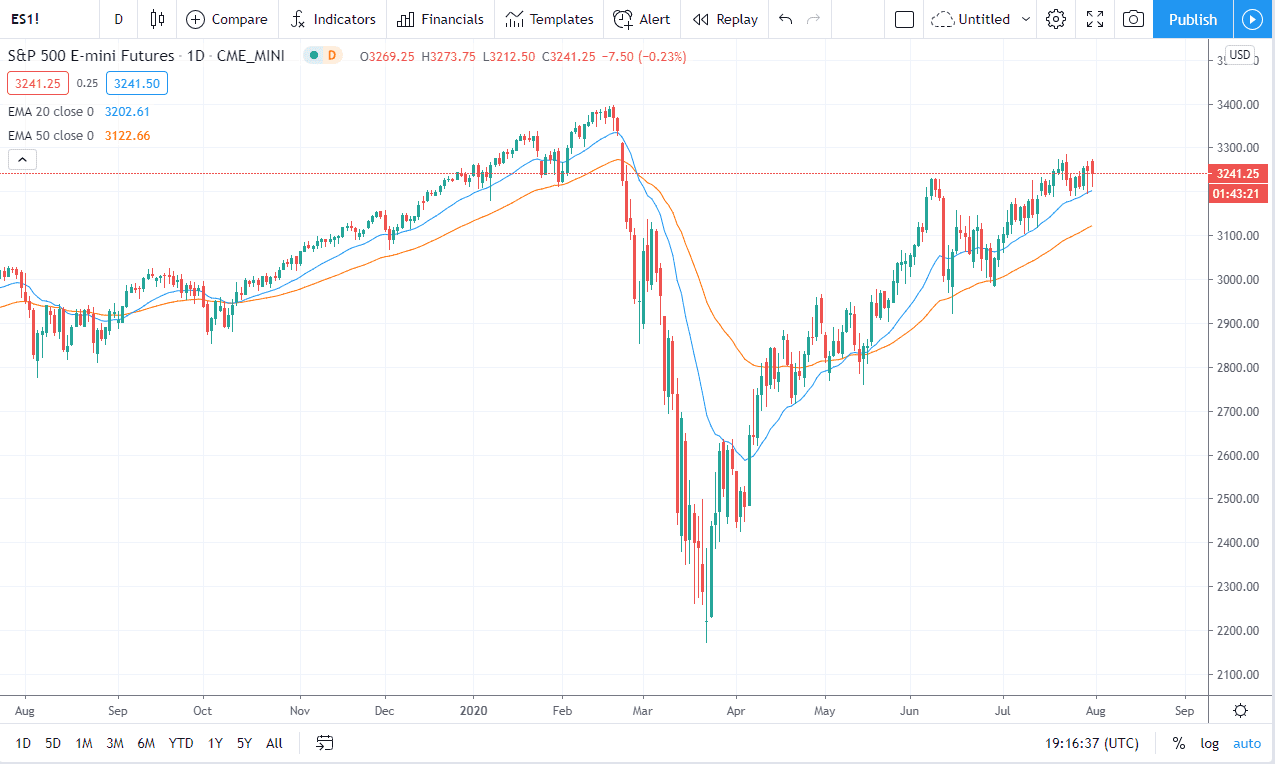

The S&P 500 fell during the trading session on Friday but as you can see, we ended up turning around to show signs of resiliency yet again. The 20 day EMA has offered support, and I think that there is a “zone of support” extending down to the 50 day EMA. This is a market that is very technically driven at the moment, and dips continue to find buyers.

Keep in mind that we are in the midst of earnings season, so that of course means that we will see a lot of noise. However, that excuse is an excellent opportunity to take advantage of the market when it gets a little bit on the cheap side. The candlestick is not quite a hammer, but it tells the same story. Furthermore, the candlestick from the Thursday session was also a hammer so I do think that we have more momentum to the upside which of course is not much of a surprise considering were in an uptrend anyway.

The 3300 level above will probably be the next target, and then if we can break above there the market will go looking towards the small gap and then eventually the 3400 level. The 3400 level is a big figure that was also the all-time high. I think we will eventually break through there, especially considering that the Federal Reserve is out there loosening monetary policy at the first signs of trouble. Remember, stocks have nothing to do with the underlying fundamentals but everything to do with liquidity. The truth be known, there is only about six stocks that push the stock market indices higher anymore, so it is obvious that it has nothing to do with the overall economy.

As the Federal Reserve has people choking on the flutter US dollars, there is nothing better to do with your money than to buy assets. This will continue to push the value assets higher, especially as the US dollar loses value. In short, it just takes more of those US dollars to buy stocks as they lose value. We are still in a strong uptrend, and as we get through earnings season relatively unscathed, that is only going to drive the point home further for most traders. Stock indices are built to go higher over time, which is exactly what we are seeing.