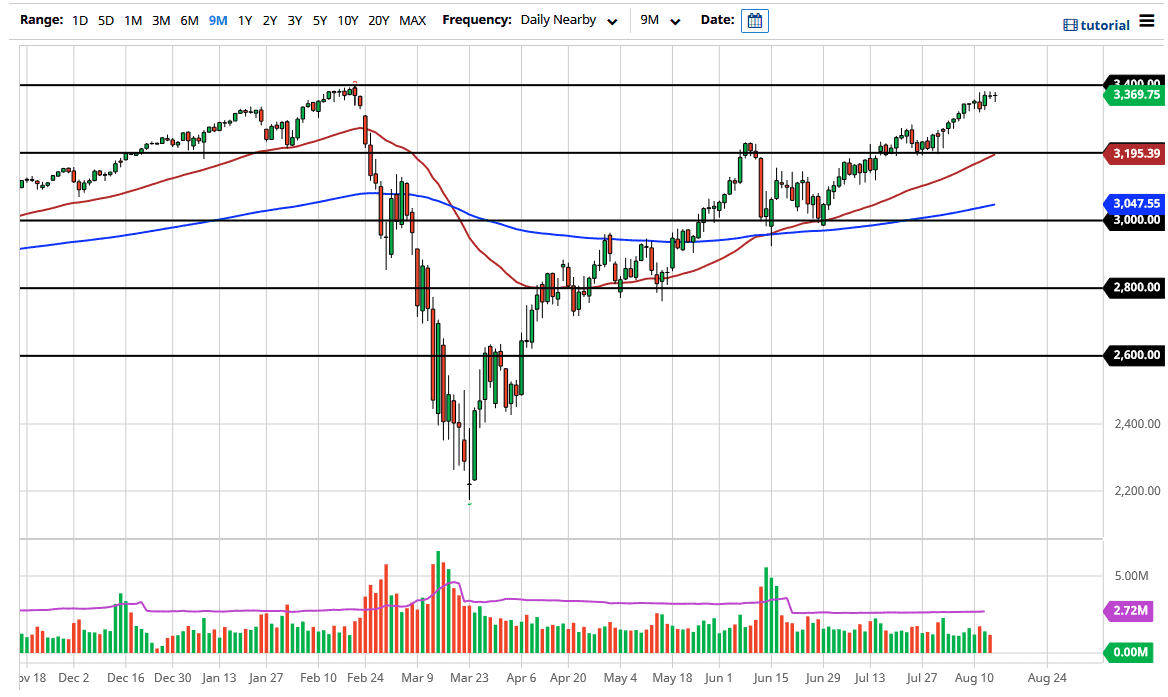

The S&P 500 pulled back a bit during the trading session on Friday, and at first, looked a little bit limp. However, by the time we got to the end of the day, we had recovered quite nicely, so it looks as if we are trying to pick up enough momentum to break out to the upside. If we can clear the 3400 level, it is a fresh, new high and the market should continue to go towards the 3500 level. That is a large, round, psychologically significant figure, and a lot of people will be paying attention to it.

To the downside, I believe that the 3300 level would be supportive, perhaps even the 3350 level before that. A break down below the 3300 level could open up the door to the 3200 level underneath, which is an area that has already shown itself to be supportive. We tried to break down through it a couple of weeks ago, but three or four days in a row found plenty of buyers. Beyond that, we also have the 50 day EMA sitting at that area, as it reinforces the idea of the 3200 level.

The market should see plenty of buyers in that area and it would offer a lot of value in what has been an extraordinarily strong move. Having said that, I think it is only a matter of time before buyers will return so I do not have any interest in shorting this market. The Federal Reserve continues to flood the markets with US dollars, causing traders to buy assets in order to protect wealth. At this point in time, is likely that we will continue to see dips offer plenty of value the people are more than willing to take advantage of. If we break out to the upside, I would be willing to buy up there as well. There is no way right now that we can short this market and therefore it is a one-way trade. You should be asking yourself which of the two following scenarios makes the most sense: “Am I buying the S&P 500, or am I on the sidelines and waiting for a better price?” With this being the case, it is worth noting that the markets have had much smaller moves over the last couple weeks, so we may be getting a little exhausted.