The S&P 500 has pulled back a bit during the trading session on Tuesday but found buyers yet again as we dipped. As cheap money flows into the marketplace, it does make sense that we will continue to see people buying stocks, not to mention the fact that they buy the same stocks over and over. The S&P 500 is driven by a handful of leaders, and it is the only game in town unless you are buying bonds.

The US dollar is losing strength, and that has people trying to protect their wealth by buying stocks or any other asset they can. This is what has been driving the gold market higher, right along with stocks, even though there is no fear trade going on right now, which is typically the case for gold. With this situation that we have going on right now, anything that is measured against the US dollar should continue to gain, including the stocks that make up the bulk of the S&P 500. Remember, we are in the midst of earnings season so we may get the occasional headache, but as long as the Federal Reserve continues to loosen monetary policy there is only one direction for stocks.

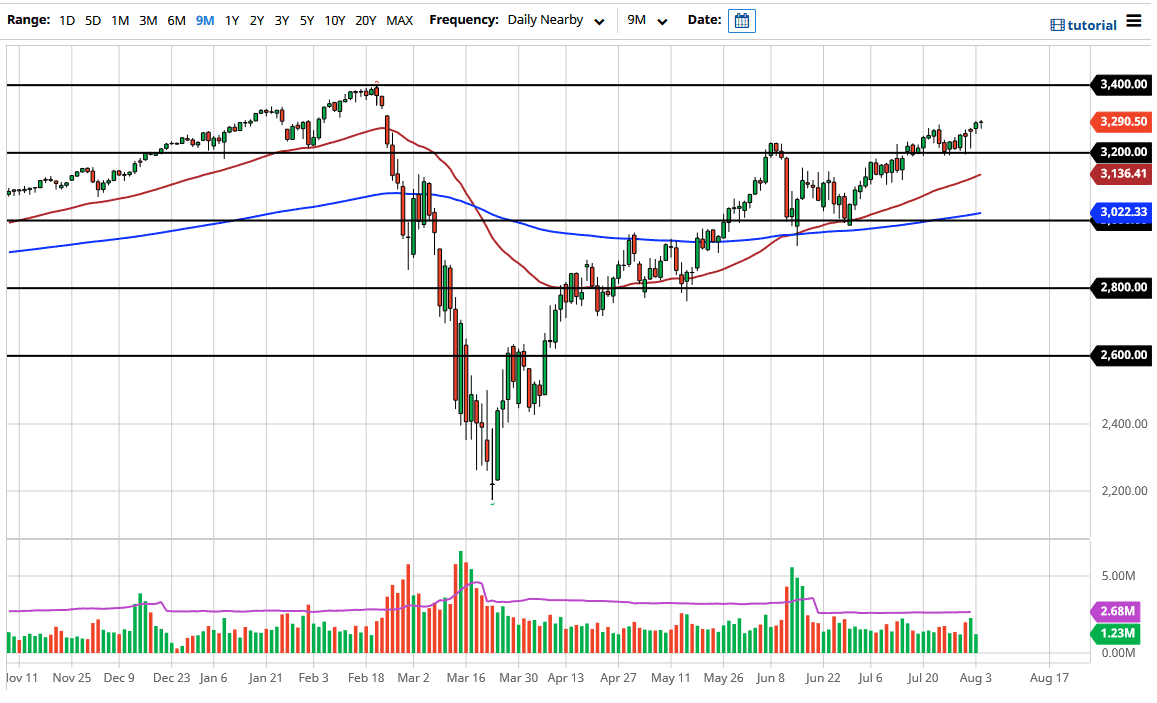

After all, the Federal Reserve liquefies the markets and that is the only thing that they react to longer-term. Fundamentals do not matter in this type of environment when it is about liquidity flows. Yes, I am fully aware of the fact that this will end poorly eventually, and the stock market crash that we had seen back in February is probably going to be something that becomes more frequent. However, it is also worth noting that the stock market reacts positively every time this central bank gets involved. With that being the case, as long as the spigot for money continues to flow fully, the stock markets will continue to rise. I believe that the S&P 500 is going to try to fill the gap near the 3030 handle, and then perhaps reach towards the 3400 level which is the recent all-time high. I do believe that we break above there eventually as well, so buying dips as we go along continues to be the best way to play this market. The 3200 level should be massive support going forward, just as the 50 day EMA will be.