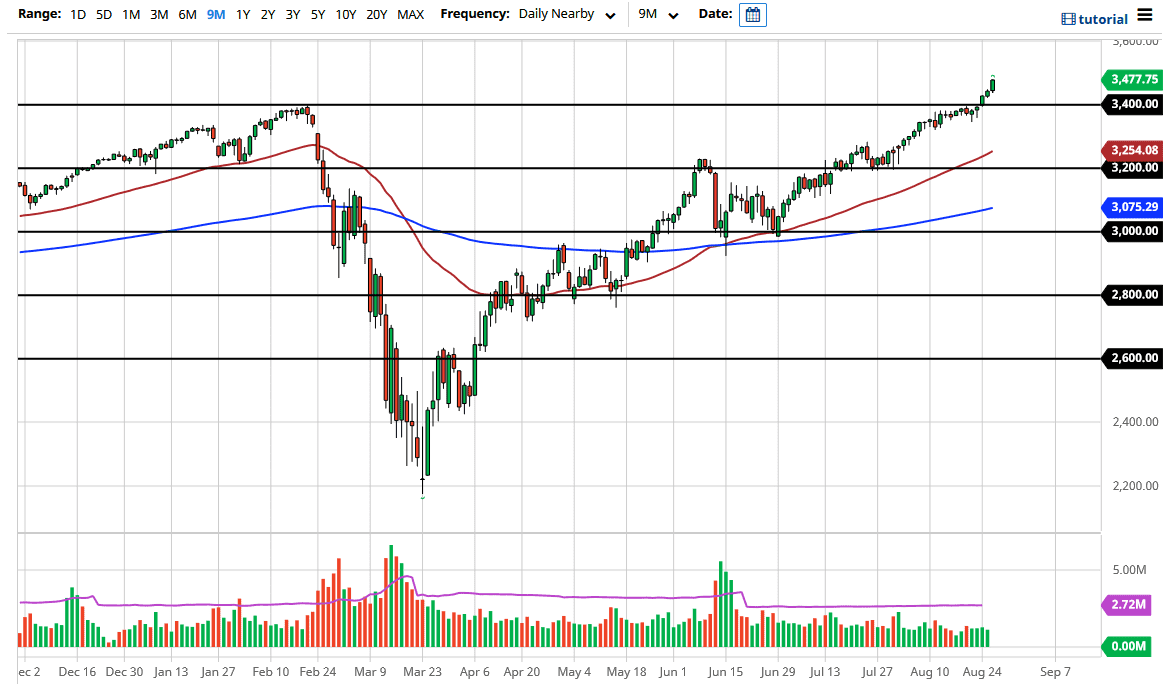

The S&P 500 rallied significantly during the trading session on Wednesday, reaching towards the 3450 level and then breaking above there to go looking towards the 3475 handle. I had talked about how 3500 was going to be my target by the end of the year, but now it looks like we are getting ready to see that within the next few days. With Jerome Powell speaking on Thursday, it is very likely that we will continue to pay attention to the Federal Reserve and all of the nonsense that they bring to the table. As they continue to loosen monetary policy, people jump into the stock market in order to find some type of value.

After all, a lot of people are watching their currency dwindle, and that of course will have people looking for ways to protect purchasing power. By buying “things”, such as stocks, they continue to protect themselves. Beyond that, there is almost no returns on bonds, and therefore I think that we will have quite a bit of money flowing into the stock market because there is no other alternative at this point. The 3400 level underneath could be targeted, at least on some type of pullback. Having said that, I think that the 3400 level is going to be massive support. The candlesticks underneath there from last week show a significant amount of momentum building pressure, and therefore it is likely that the buyers will jump all over this given half a chance.

To the upside, the 3500 level of course offer a bit of psychological resistance, but when you look at the S&P 500 you can see that we do tend to move in 200 point increments, so we could even see this market go overshooting towards the 3600 level. The candlestick for the Wednesday session is closing at the top of the range, and that is of course a very bullish sign and does suggest that there could be a bit of follow-through. Ultimately, I do think that value hunters will continue to flock towards this market on these pullbacks, so that is probably the only way to play this market. For what it is worth, the VIX is rising right along with stock markets, which shows that we may very well get some type of sharp correction. Because of this you need to be very cautious about your position size.