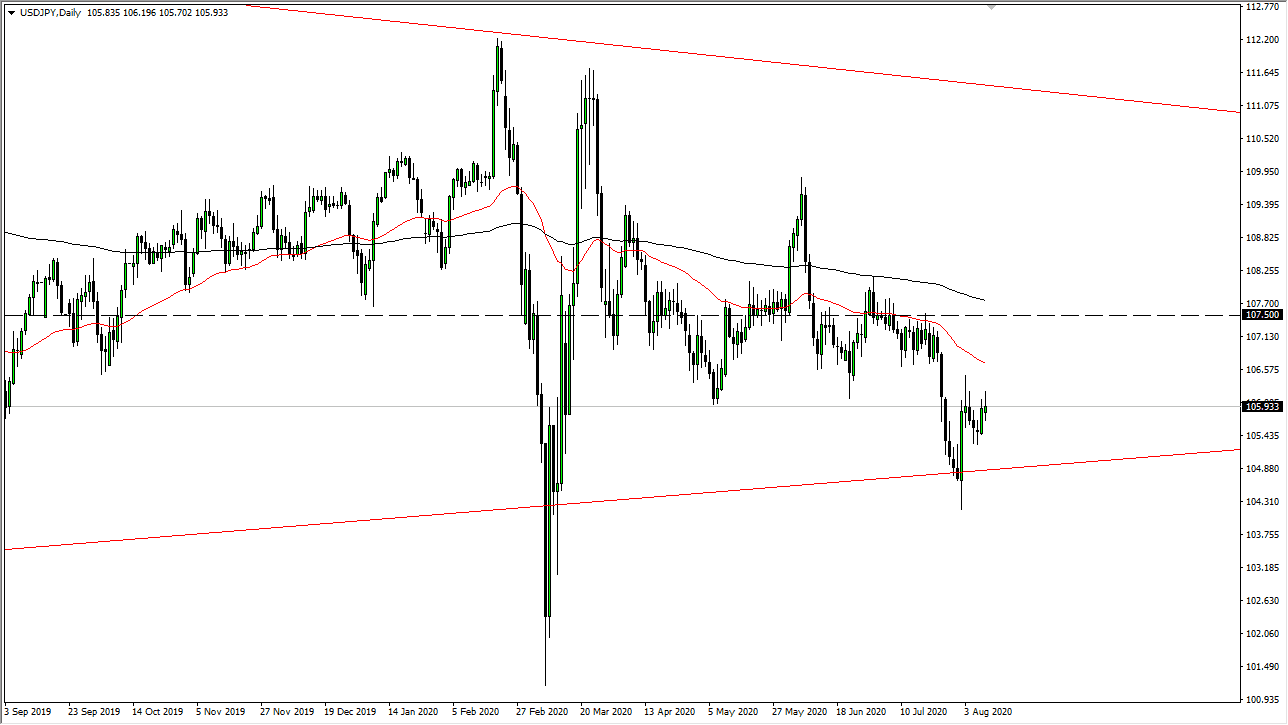

The US dollar rallied significantly during the trading session initially on Monday against the Japanese yen but gave back a significant amount of the gains to form a bit of a shooting star. This is a negative sign, so if we break down below the bottom of the candlestick for the day is likely that we go much lower, perhaps reaching towards the ¥105 level again. This is a pair that has been driven by Federal Reserve measures more than anything else, and as the Federal Reserve continues to flood the market with greenbacks, that will continue to push this pair lower, despite the fact that the Japanese yen is considered to be a “safety currency” as well.

Looking at this chart, you can see that we have been rather choppy as of late, but it is likely that the overall attitude of this pair has not changed, despite the fact that we had such a bullish candlestick during the end of two weeks ago. That was the end of the month, so it might have been short-covering more than anything else as options were expiring.

To the upside, I see a significant amount of resistance near the ¥106 level which is basically where we are at, followed by the 50 day EMA as well, which is near the ¥106.75 level. After that, the ¥107.50 level is a massive ceiling that I doubt we get above anytime soon. We have seen a lot of selling in that general vicinity and it is likely that will continue to be the case. If we were to turn around and breakdown below the bottom of that massive candlestick from a couple of weeks ago, we would break below the ¥140 level and go looking towards the crucial ¥102 level, an area that is very important from the longer-term standpoint. Either way, I have no interest whatsoever in trying to buy this market, as the recent break down has been so convincing. Furthermore, the US dollar has been on its back foot against several other currencies, so this one will not be any different. Ultimately, I believe that this market goes looking towards the ¥100 level below, which is a major level that gets the attention of almost everybody out there, unfortunately, this also includes the Bank of Japan that could get involved at that point in time.