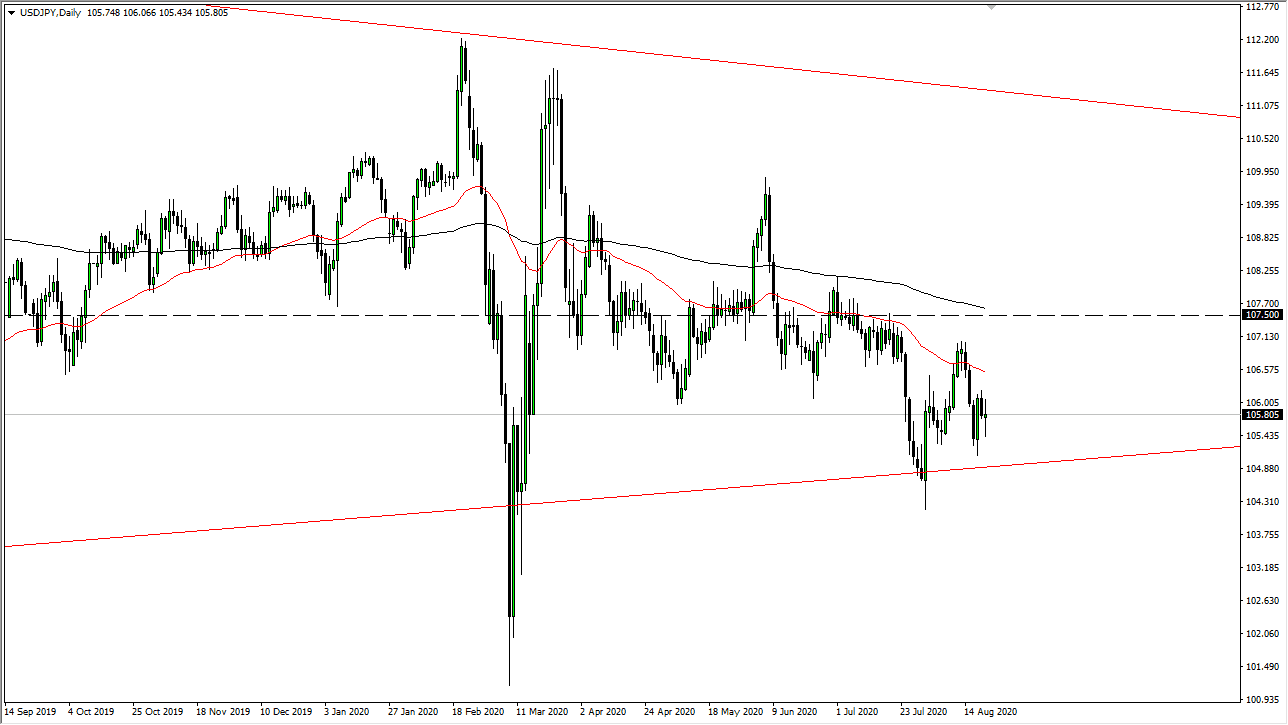

The US dollar has gone back and forth during the trading session on Friday as we continue to see a lot of noise just below the ¥106 level. This is a very neutral candlestick with two long legs, so at this point in time, I think this signifies that we are going to see a lot of back and forth on short-term time frames, as the market seems like it is struggling to bit to make up its longer-term mind.

A breakdown below the bottom of the candlestick for the session opens up the possibility of a move towards the ¥105 level, and then possibly even down to the ¥104 level. To the upside, if we break higher the 50 day EMA is going to cause a significant amount of resistance, just as the recent 107.50 highs will. We would also be between the 50 day EMA and the 200 day EMA, and as a result, it is likely that the resistance would start to get rather drastic. Keep in mind that the Federal Reserve continues to flood the markets with monetary easing, and that can have a major influence on what happens here.

The biggest trick here is that the Bank of Japan is doing the same thing. Both of these are considered to be “safety currencies”, and that will have a major influence on the fact that it will be very choppy. All things being equal, the US dollar is going to be on its back foot against most currencies and therefore I think we will see this market dropped a bit from here. It does not mean that will happen quickly though, because the marketplace for selling US dollars will be easier against other currencies such as the Canadian dollar, the Australian dollar, the British pound, etc.

I believe at this point in time we will continue to see a lot of noisy trading, but I still favor the downside. In fact, I prefer shorting rallies on signs of exhaustion, probably again on short-term charts as a longer-term move seems very unlikely without some type of catalyst. Expect more back-and-forth, and a longer-term “buy-and-hold” or “sell and hold” situation probably will not happen right away. The ¥106 level continues to be important.