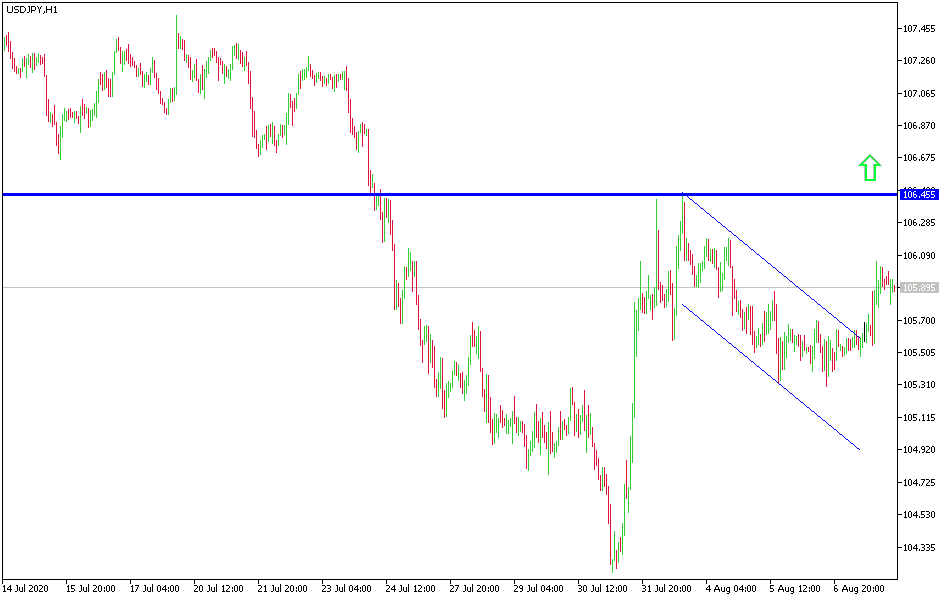

USD/JPY: Bullish break still weak.

Today’s USD/JPY Signals

- Risk 0.75%.

- Trades may only be taken between 8 am New York time and 5 pm Tokyo time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame time immediately upon the next touch of 106.20 or 107.00.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 105.00 or 104.30.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Pair Analysis

As I mentioned in the recent USD/JPY technical analysis, bears will continue to dominate the performance of the pair for a longer period of time, as the appetite for safe havens will be in favor of the Japanese yen at the expense of the USD, which suffers from the strength of the new Coronavirus outbreak and the increase in tensions with China. US President Trump is determined to go further against China than imposing customs tariffs, but rather work to ban companies and people, which confirms that his victory in the upcoming elections will cause global financial markets, including the currency exchange market, more anxiety for years to come. The latest US job numbers began to lose optimism from what it had immediately after the reopening of US economic activity after months of closure to contain the coronavirus outbreak that has caused the evaporation of all the US jobs gains since Trump took over the country.

A new cold war with China would be bad news for markets and would prolong the economic defeat caused by Covid-19. Given Biden's previous relationship with Chinese Prime Minister Xi Jingping, Biden's victory appears to be the most favorable outcome to the market as he will be more likely to set off a conciliatory tone and defeat some, if not all, obstacles.

Past relationships are no guarantee of future political actions. Since Trump's economic ammunition is lost, he will raise his point of criticizing Biden for being weak with China; Trying to force him out of the fence and into a strong position. The ongoing political crisis in Hong Kong clashes over climate change and the inevitable investigation into the Covid-19 pandemic will bring Biden relation with China to an end. Companies that rely on China as a major export market should take that into account.

With three months left until the presidential election in November, investors should start preparing for a possible victory for Joe Biden, according to mounting expectations recently. Republican presidents are often seen as more investor-friendly as they have a history of more bias in tax cuts and lower government participation in markets. However, after the Covid-19 crisis, Trump's chance of winning became slim.

Despite the bears control over the USD/JPY, I recommend buying the pair if it breaks the 104.80 support. At the same time, it is not clear whether more clarity about the financial support extended to the US economy will be sufficient to maintain the USD recovery.

Regarding the US dollar, JOLTS numbers will be announced. As for the Japanese yen, it is a holiday in Japan today.