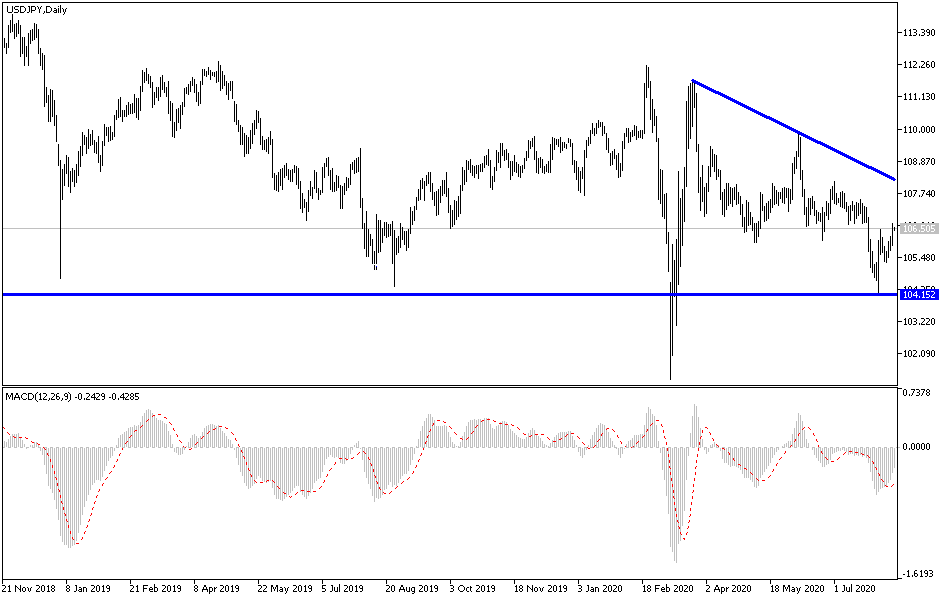

Ahead of the announcement of the important consumption figures to measure the US inflation, the USD/JPY is moving in a cautious upward correction that pushed it towards the 106.79 resistance in Wednesday morning trading. Now, it is stable around that level at the time of writing. For the fourth day in a row, the pair has been in an upward correction range, after it retreated to the 105.29 support last week. By the end of last month’s trading, it moved strongly down to the 104.18 support, the lowest for the pair since last March. On the economic front, US wholesale prices jumped 0.6% in July, the largest increase since October 2018, as energy prices rose sharply.

The Labour Department said that last month's jump in the producer price index - which measures inflation before it reaches consumers - followed a decline of -0.2% in June and rose 0.4% in May. The increase last month was about double what economists had expected. Wholesale energy prices rose 5.3% in July, including a 10.1% increase in gasoline prices. Food prices fell 0.5%. Excluding volatile food and energy prices, core producer prices rose 0.5% last month. Over the past year, US producer prices fell -0.4%, and core prices rose 0.3%. Inflation was curbed by the severe recession caused by the outbreak of the Coronavirus and the resulting closures and fear that kept Americans away from restaurants, planes, and shopping malls. Producer prices for aviation services fell 7% last month.

"Core inflation readings are likely to remain muted over the coming months in response to continued weak demand and increased capacity," Rubeela Farooqi, chief US economist at High-Frequency Economics, wrote in a research report.

After the spring restrictions, many US states prematurely declared victory over the virus and began reopening their economies, resulting in a resurgence of COVID-19 cases. With confirmed infections increasing in most states, many companies have been forced to scale back or even cancel reopening plans. Although it does not dominate global trade as it did 20 years ago, America is still by far the largest economy - accounting for 22% of total economic output, versus 14% in China in the second place, according to World Bank statistics.

The United States is unlikely to pull the global economy out of its predicament as it did in previous recessions such as the Asian financial crisis in the late 1990s. "The US is not going to be the locomotive," said Nariman Behravesh, chief economist at IHS Markit. The US economy contracted at an annual pace of 32.9% from April through June, the worst quarter on record. Numbers are expected to rise strongly in the second half, but they will leave the US economy much lower than it was at the beginning of 2020.

According to the technical analysis of the pair: Despite USD/JPY gains in the last trading sessions, the general trend is still down as long as it is stable below the 108.00 resistance. Surpassing it will support the immediate move to the 110.00 psychological resistance, which is the most important for a real shift in the pair’s performance. The continued domination of the bears may push the pair back towards the support levels at 106.20, 105.45, and 104.90, respectively. Nevertheless, I would still prefer to buy the pair from every lower level. The pair will react strongly today to the announcement of the US Consumer Price Index reading and the extent of the investor’s risk appetite.