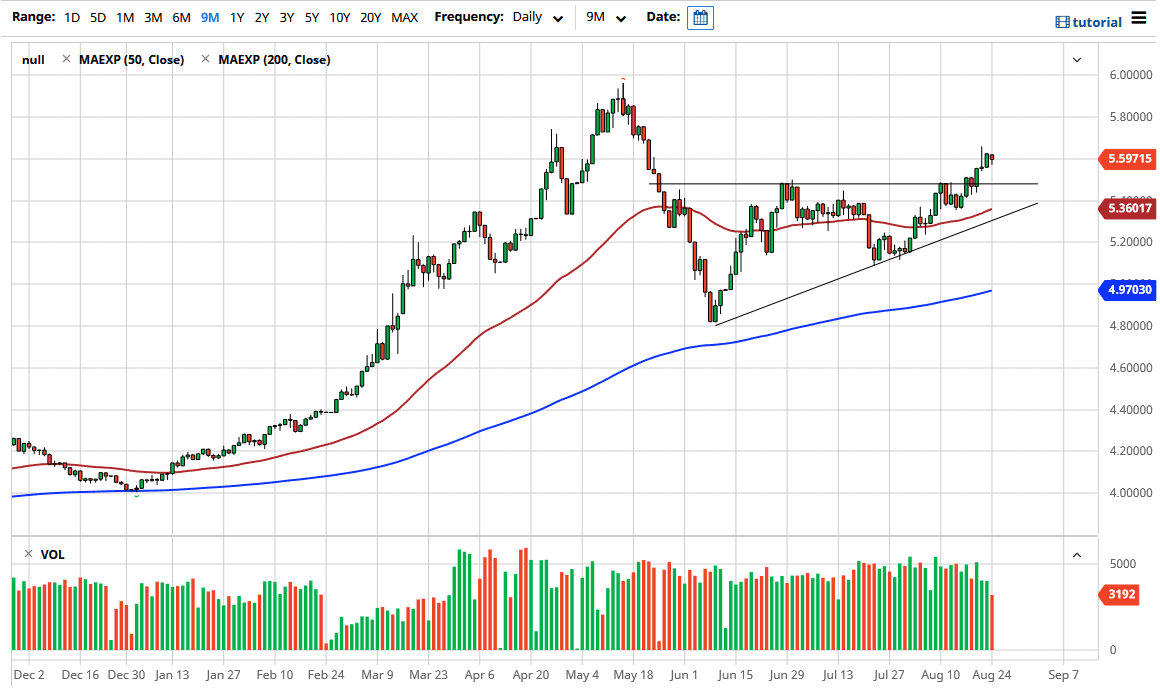

The US dollar has pulled back a bit against the Brazilian real but still looks very bullish as we have recently broken out of an ascending triangle, continuing a longer-term uptrend. This makes sense, because the US dollar had a reasonably strong day during the trading session on Monday, so the fact that we ended up forming a bit of a hammer shaped candlestick is not a huge surprise. Furthermore, we got close to the 5.60 real level, which has a certain amount of psychological importance attached to it.

Looking at the ascending triangle, in theory we should see a move to the 6.20 real level, which is slightly above the recent highs. This could be driven by either a major “risk off” type of move or the fact that coronavirus figures in Brazil are still a major concern. The US dollar looks as if it is trying to strengthen against multiple currencies, not just emerging markets. Because of this, if the US dollar finds itself strengthen against other currencies such as the Euro and the British pound, a smaller currency like the Brazilian real does not stand much of a chance. Because of this, I do think that we continue to grind higher and I look at pullbacks as a potential buying opportunity as the greenback will continue to show strength against emerging market currencies in this type of environment anyway.

All things being equal, I do believe that it is only a matter of time before the market finds itself breaking the highs, but that does not necessarily mean that has to happen quickly. In fact, this pair does tend to grind for long periods of time, so do not be surprised at all if you have to be very patient with your trade. That being said, some secondary indicator so pay attention to might be the EUR/USD pair, as a break down below the 1.17 level would show extreme US dollar strength suddenly, which will almost certainly send this pair towards the highs rather quickly. Alternately, if we see the US dollar sell off drastically, then it is possible that we may be able to break back towards the 50 day EMA, but right now that is the least likely of scenarios. We would need to see a major “risk on rally” overall globally, and I mean far beyond just the US stock markets, to make something like that happen.