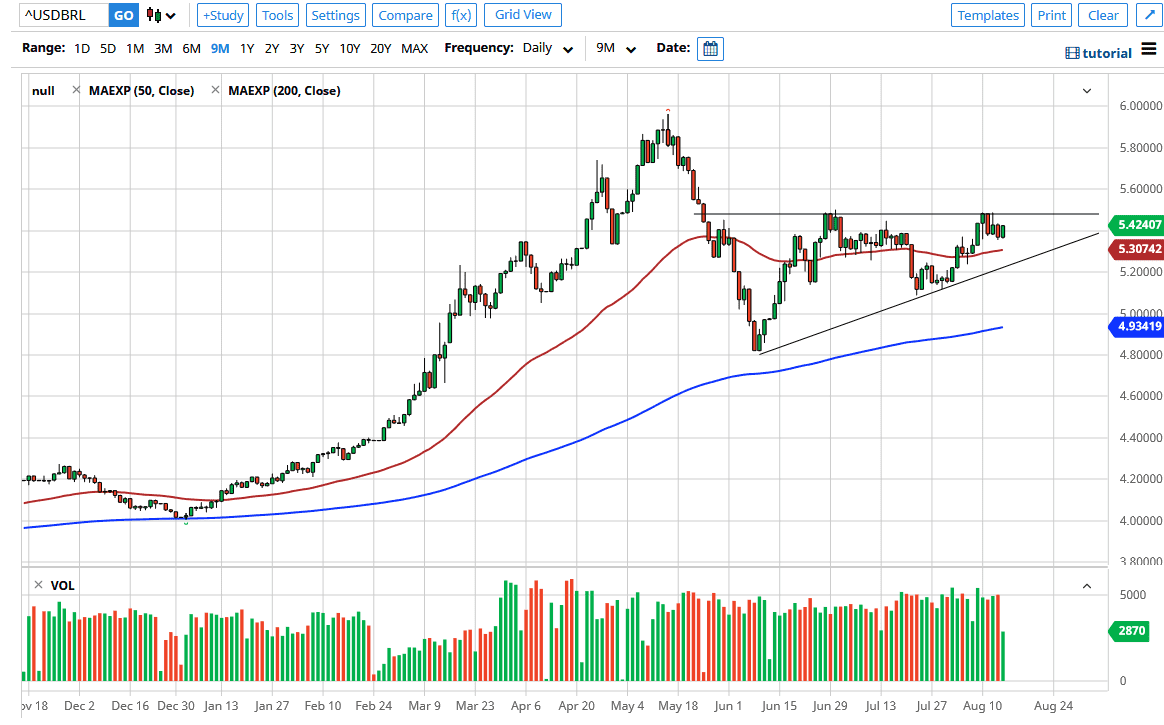

The US dollar has been grinding higher against the Brazilian real for some time now but continues to find resistance near the 5.50 level. Ultimately, this is a market that will probably break out above there, as we are forming a larger ascending triangle. We are also above the 50 day EMA which helps the situation also.

Brazil continues to struggle with its coronavirus figures, and if there are a lot of concerns out there about that infection climbing, then it will cause problems when it comes to the Brazilian economy, and therefore the Brazilian real. All things being equal, I think that we will eventually break out as the world will favor the US dollar with so much uncertainty in Latin America when it comes to the coronavirus, and there is still a significant bid for US Treasury markets. That drives up the value of the US dollar against emerging markets because it suggests that there are still a lot of concerns when taking risks on the far end of the spectrum as Brazil would be.

The 50 day EMA underneath should offer a certain amount of technical support, and therefore I think that short-term pullbacks will be bought into. It is not until we break down below the uptrend line of this ascending triangle that I would consider selling, which right now is somewhere near the 5.25 level. The Brazilian real is a gateway currency for the Latin American part of the world, so I think until people are much more comfortable with South America, this is a currency that will suffer.

On the breakout above the 5.50 level I anticipate that the market will go looking towards the 5.75 real level, and then possibly even the 6.00 level, which is my longer-term target on a breakout. That does not mean we get there overnight, but clearly, it would be a retest of the highs again, and that is quite often what markets do. On the other hand, if we break down below the 5.20 real level, then we could go towards the 5.00 level, which will be met by the 200 day EMA. I still favor the upside, simply because I do not trust what is going on in Brazil but if we suddenly get a major “risk-on rally”, that could help this currency. However, I would be much more comfortable going long some other emerging market currencies such as the South African Rand, India rupee, and so on.