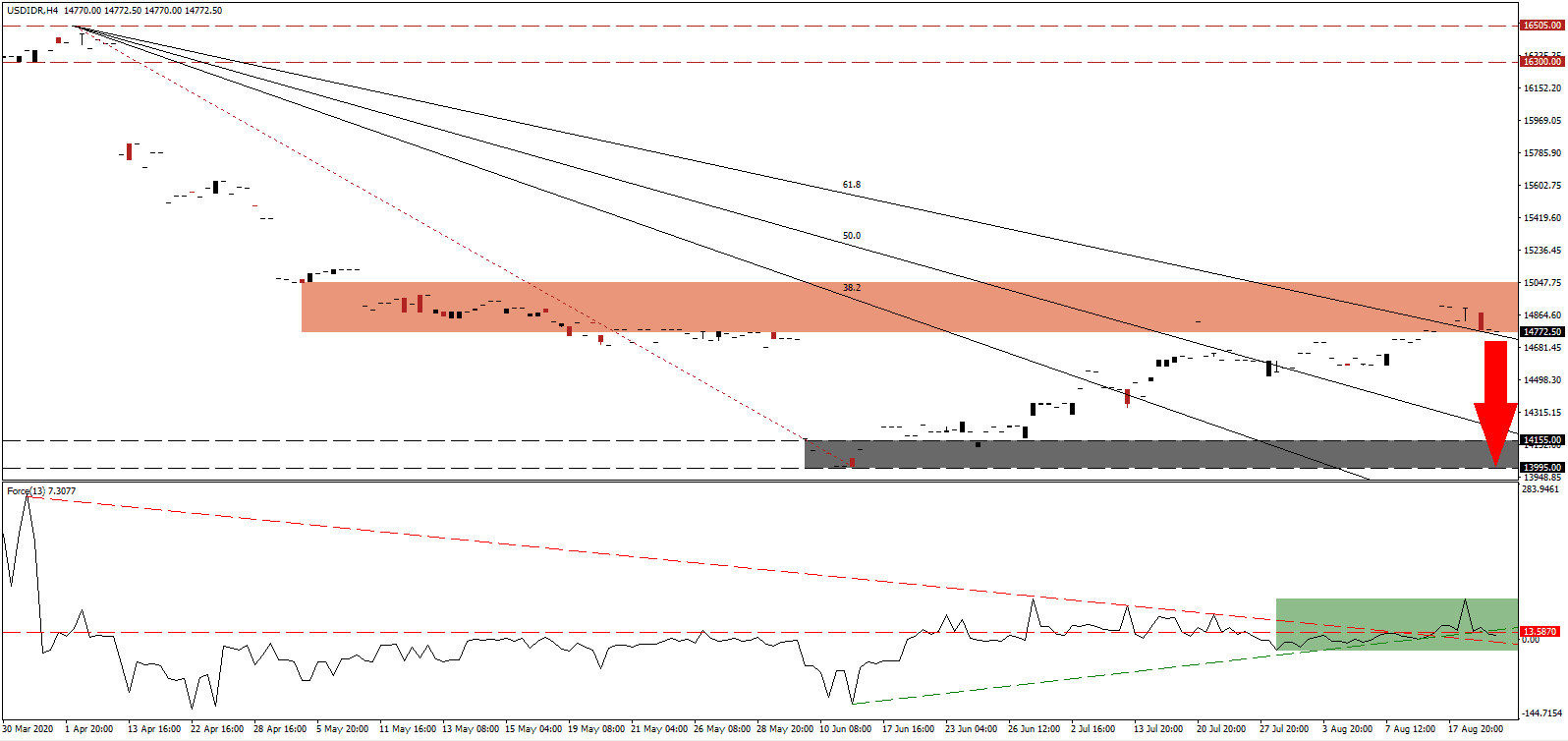

Indonesia has a comparably low Covid-19 infection count with 529 confirmed cases per 1,000,000, but total testing capacity remains insufficient with just 6,991. By comparison, the US has 17,209 cases and 220,715 tests per 1,000,000. Indonesia is the most-infected country in Southeast Asia, and the economy is forecast to flatline in 2020, after the 5.00% GDP growth rate posted in 2019. President Joko Widodo compared the virus to a computer crash, adding the county needs to restart following the shutdown, and reboot. The USD/IDR advanced into its short-term resistance zone from where breakdown pressures emerged.

The Force Index, a next-generation technical indicator, briefly spiked above its horizontal resistance level before swiftly collapsing below it. Adding to bearish pressures is the correction below its ascending support level, as marked by the green rectangle, while it remains above its descending resistance level. Bears wait for this technical indicator to cross below the 0 center-line to regain full control over the USD/IDR.

Health sector reforms and food security remain primary objectives. President Widodo noted plans for a food estate on Borneo Island. Addressing expensive oil imports, Indonesia plans to displace them with domestic biodiesel made from palm oil. State-owned oil and natural gas conglomerate Pertamina produced the first series of it at its Dumai refinery, labeled D100. Capacity is scheduled to increase to 20,000 barrels per day. The USD/IDR is breakdown pressures inside of its short-term resistance zone located between 14,765 and 15,050, as marked by the red rectangle.

Adding to government-sponsored job creation are downstream projects for raw materials. Indonesia printed a 2.97% GDP expansion in the first quarter, followed by a 5.32 drop in the second quarter. President Widodo did note an opportunity to catch up to the developed world, which posted double-digit contractions. A breakdown in the USD/IDR below its descending 61.8 Fibonacci Retracement Fan Support Level will clear the path into its support zone located between 13,995 and 14,155, as identified by the grey rectangle.

USD/IDR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 14,770

Take Profit @ 14,000

Stop Loss @ 14,970

Downside Potential: 770 pips

Upside Risk: 200 pips

Risk/Reward Ratio: 3.85

In case the Force Index reclaims its ascending support level, serving as resistance, the USD/IDR may attempt a breakout. After the US Federal Reserve warned on the ongoing economic fallout from the Covid-19 pandemic, the bearish outlook intensified. Forex traders should consider any advance as a selling opportunity, with the upside potential reduced to its intra-day high of 15,125.

USD/IDR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 15,020

Take Profit @ 15,100

Stop Loss @ 14,970

Upside Potential: 80 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 1.60