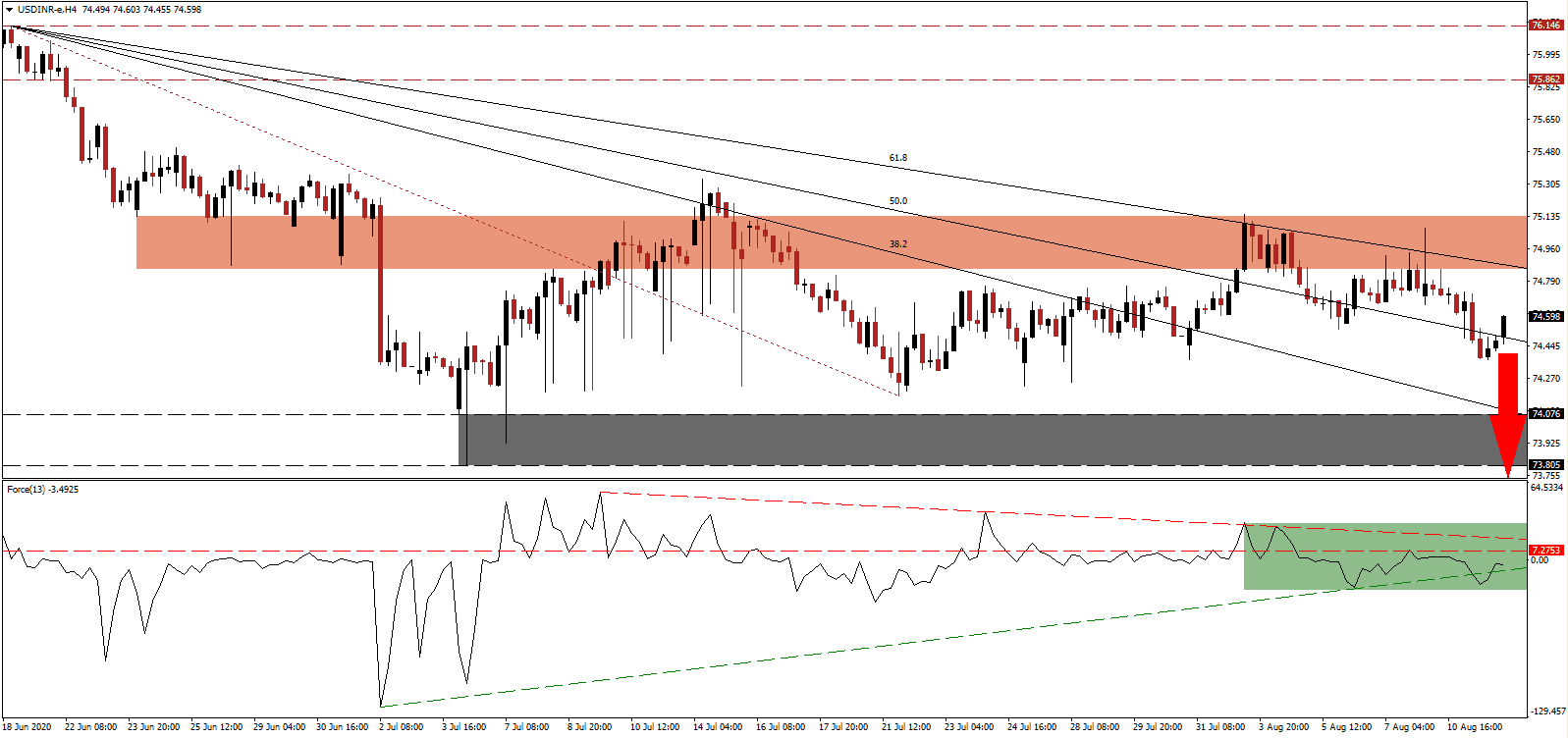

Manmohan Singh, the former Prime Minister of India, and current leader of the opposition, in an interview with the BBC, outlined three essential steps the government should take to ensure an economic recovery. This consists of financial support for consumers to have spending power, to businesses in the form of government-backed credit guarantee programs, and financial sector reforms. India is the most-infected country with COVID-19 in Asia, and on course to overtake Brazil as the second-most infected globally in as little as three months during present conditions. The USD/INR completed a breakdown below its short-term resistance zone and is positioned to accelerate farther to the downside.

The Force Index, a next-generation technical indicator, briefly dipped below its ascending support level before reclaiming it but remains below its horizontal resistance level. Maintaining bearish pressures is the descending resistance level, as marked by the green rectangle. This technical indicator moved below the 0 center-line, and bears wait for a renewed push lower to gain complete control over the USD/INR.

Indian Prime Minister Narendra Modi is under pressure to borrow from international institutions like the International Monetary Fund, the World Bank, and the New Development Bank. He stressed the importance of fiscal responsibility during the Covid-19 pandemic, boosting the Indian Rupee. His approval rating remains high at 78%, with just 5% viewing his government’s performance as unfavorable. After the USD/INR moved below its short-term resistance zone located between 74.851 and 75.133, as marked by the red rectangle, bearish pressures are expanding, while price action entered a minor reversal.

One significant roadblock to a sustained economic recovery remains in the labor market. Following 121.5 million job losses in April, 21.2 million were recovered in May. June and July witnessed 70.4 million and 18.9 million job additions, respectively. The issue is that the majority of jobs are in the low-income informal job sector, while the high-paying formal job sector remains dismal. With the US labor market under increasing stress and debt favored to soar, the USD/INR is expected to retreat below its descending 50.0 Fibonacci Retracement Fan Support Level again and fall into its support zone located between 73.805 and 74.076, as identified by the grey rectangle. A breakdown extension into its next support zone between 72.433 and 73.214 is likely.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.600

Take Profit @ 73.000

Stop Loss @ 75.100

Downside Potential: 16,000 pips

Upside Risk: 5,000 pips

Risk/Reward Ratio: 3.20

Should the Force Index push higher, driven by its ascending support level, the USD/INR may seek more upside. The outlook for the debt-fueled US economy remains bearish, adding downside pressure to the US Dollar. Forex traders are advised to consider any advance from present levels as a secondary short-selling opportunity. The upside potential is reduced to its downward revised resistance zone between 75.862 and 76.146.

USD/INR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 75.350

Take Profit @ 75.850

Stop Loss @ 75.100

Upside Potential: 5,000 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 2.00