The US dollar has gone back and forth during the trading session again on Thursday as the markets get ready for the Non-Farm Payroll numbers. That of course is very influential when it comes to this pair, and with that being the case it is likely that we will see a lot of back and forth volatility until 830 in the morning New York time. Between now and then, I would anticipate a lot of choppy and lackluster trading, but we will see a surge and volatility around that announcement.

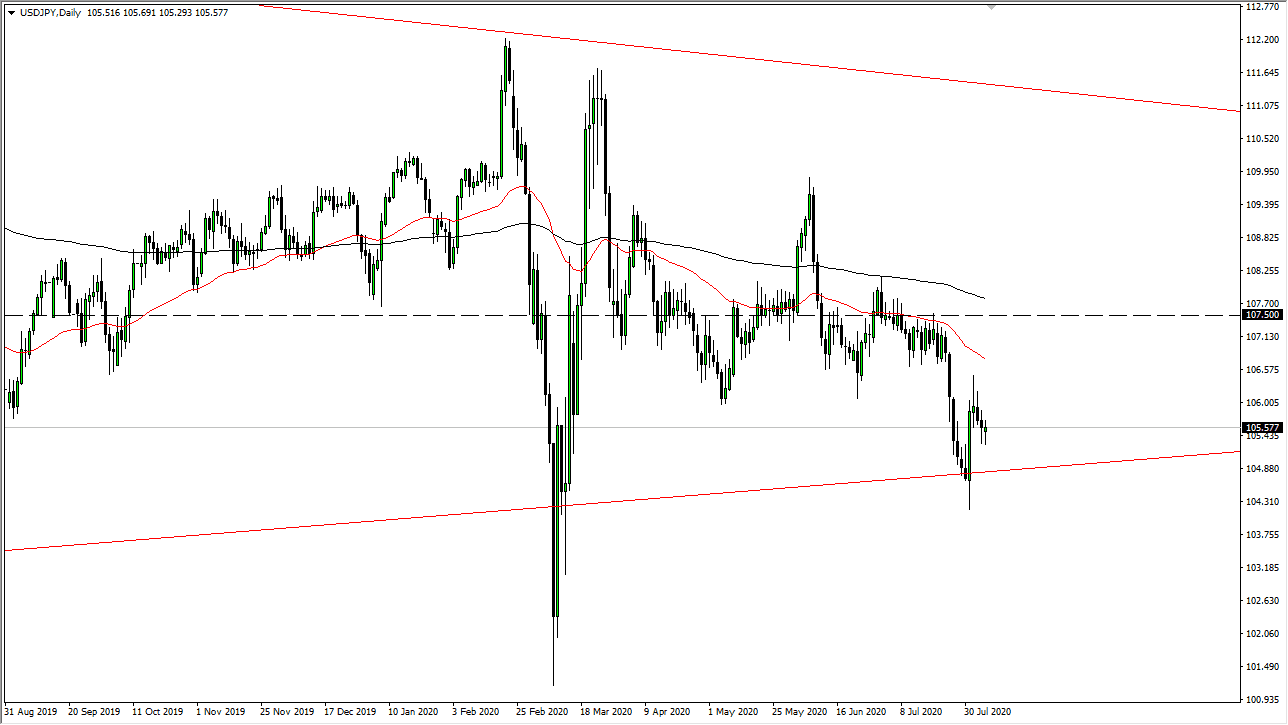

To the downside, the ¥104.30 level will be a target, just as the 50 day EMA will be a significant resistance barrier. Beyond that, we have the ¥107 level, and then of course the ¥107.50 level. Fading short-term rallies on signs of exhaustion will be the way going forward, and therefore I like the idea of looking to short term charts in order to find the signal. The hammer that formed during the trading session on both Wednesday and Thursday showed just how noisy this market might be, but in the end, we should get some type of clarity. When you look at the action that we have seen of the last several weeks, it is obvious to me that the market favors the downside, but that does not necessarily mean that we will go straight down there. Eventually, I anticipate that we break down below the massive candlestick from last Friday, and then go looking towards the ¥102 level.

All things being equal, keep in mind that the US dollar continues to struggle against most currencies, although the Japanese yen may be a little bit stubborn due to the fact that the central bank policy out of Tokyo is extraordinarily loose as well. With that being the case, this may not move as quickly against the US dollar as we have seen in other pairs, but ultimately the direction of the US dollar is lower against everything, so look at any rally at this point as a potential opportunity. The knee-jerk reaction that we will almost certainly have could be the cause of a selling opportunity at the 8:30 AM timeframe in New York, but ultimately this is a market that will remain very noisy so you have to keep that in mind, but obviously buying is all but impossible until we can break above the ¥107.50 level.