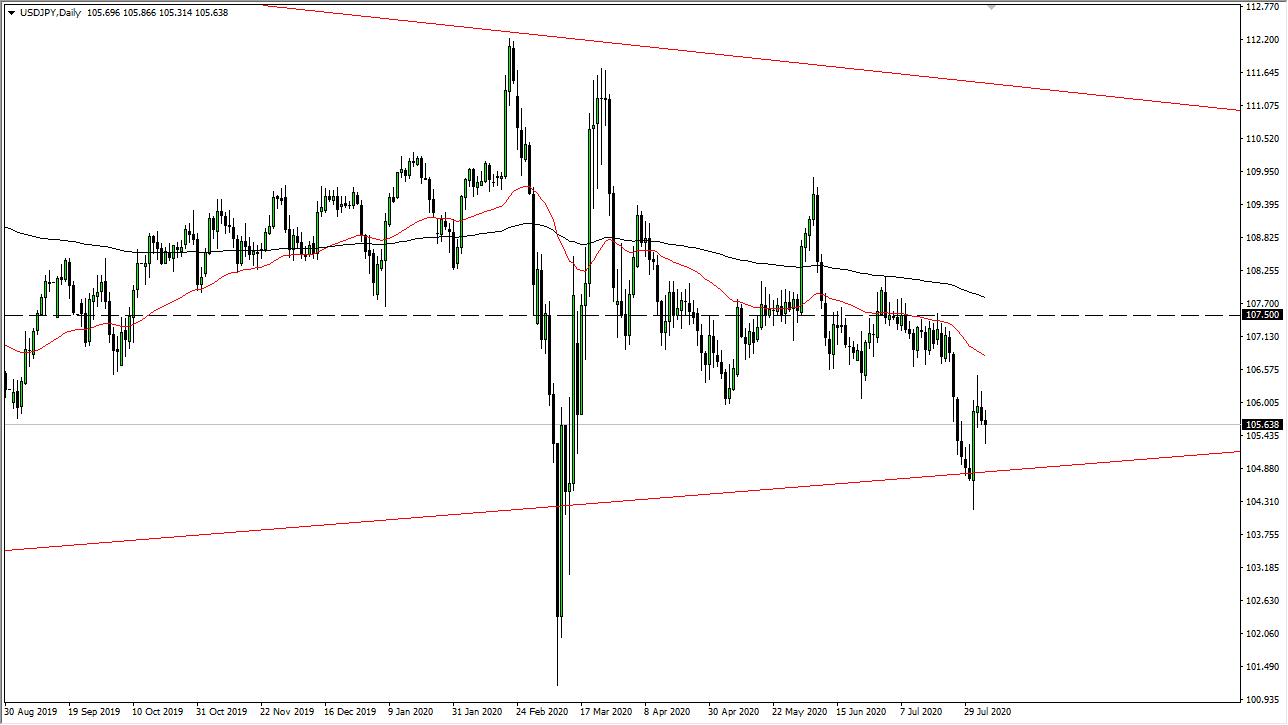

The US dollar has fallen a bit during the trading session on Tuesday against the Japanese yen, as we continue to see a lot of noise. That being said I believe it is only a matter of time before the markets roll over again because the US dollar has to deal with the Federal Reserve printing as many of those dollars as possible. The shape of the candlestick for the Tuesday session was a hammer, I feel that is at least in theory a bullish candlestick. Having said that, we still have quite a bit of fundamental and economic reasons to think that this could continue to drop.

The coronavirus numbers in the United States continue to be very difficult, so if the market continues to pay attention to those numbers, it makes sense that they would sell off the US dollar. Furthermore, with the Federal Reserve loosening monetary policy it makes sense that the greenback loses value against other currencies. Having said that, the Japanese yen is also considered to be a safety currency, much like the US dollar is, so I do not know that this is going to be a sudden meltdown. I believe it is more likely than not that we see some type of break down, but I think it will be quite a bit slower than the US dollar which may fall against other currencies. I anticipate that we will probably go looking towards the ¥104 level, and short-term rallies at this point will probably be best sold into on signs of exhaustion. Until the Federal Reserve changes its overall attitude, the US dollar is going to struggle against almost everything, the Japanese yen included.

To the upside, I believe that there is significant resistance near the ¥107 level, and most certainly at the ¥107.50 level. I would be surprised if we got all the way up there, but I would be aggressively short of this pair if we did break out to the upside like that. If we were to break above the 200 day EMA, it would obviously change a lot of things, but I do not anticipate that happening anytime soon. After we break down below the lows, I believe that we are going to go down to the ¥102 level. I do not have too much in the way of interest when it comes to buying.