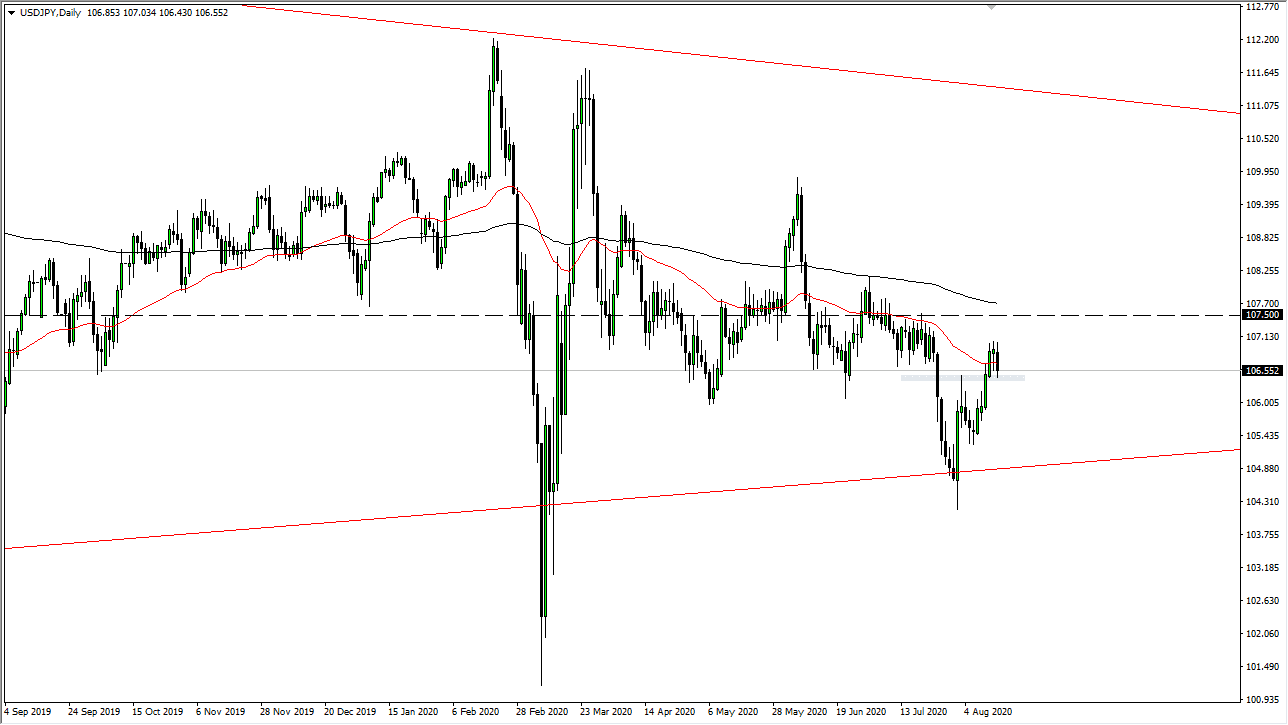

The US dollar initially tried to rally during the trading session on Friday but gave back the gains at the ¥107 level for the third day in a row, showing real weakness. That being the case, I do think that we are more than likely going to continue to see sellers jump into the marketplace and push the US dollar lower. We should also keep in mind that it was the Friday candlestick, so there might have been a little bit of profit-taking. Because of this, we cannot just jump in with massive amounts of position, but I do think that it is only a matter of time before we break down.

I look at the ¥106.50 level as an area of support, if we can break down below there then it is likely we drift back towards the lows again. This was basically where the market ran into trouble to the downside on Friday, so it would be a continuation of what we have seen. The currency pair features a couple of safety currencies, so it does make it a little bit more choppy than some of the others, as the Federal Reserve is flooding the market with US dollars, but at the same time the bank of Japan continues to be ultra-loose with its monetary policy, as it has been for decades. In other words, this might be a little bit slower moving than some of the other pairs.

Looking at the size of the candlestick, it is bigger than the Thursday candlestick, and it definitely has the look of turning the Thursday candlestick into a “hanging man” pattern and therefore is a negative sign in and of itself. We also can take a look at the top of the candlestick as confirming that the ¥107 level as being massive resistance. I think that resistance extends to at least the ¥107.50 level, an area that has been important several times in the past. With this, I think that the market is priming itself to go lower. This makes sense, as the FX market seem to be focusing more on the Federal Reserve than anything else right now, as liquidity measures continue to be a major influence in not only the FX markets but also stock markets and commodity markets as well. I believe that this pair could go looking towards the ¥105 level eventually.