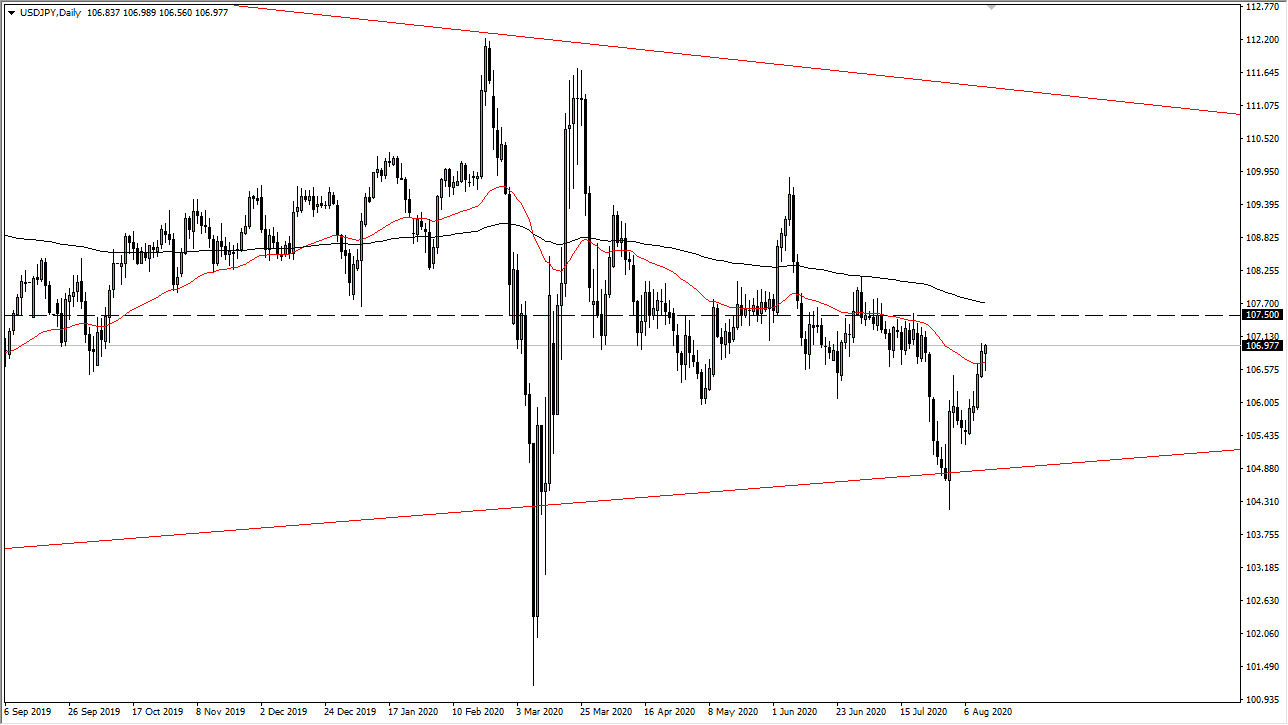

The US dollar initially fell during the trading session on Thursday, and then shot higher. Furthermore, we pull back from there again and then shot higher again. With that being the case, it is likely that we will continue to see a lot of volatility, but I am still looking for selling opportunities in this market, if we can get some type of exhaustive looking candlestick. The Bank of Japan continues to be very easy with monetary policy, so it does of course make quite a bit of sense that the Japanese yen loses value, but it is a bit different in this pair due to the fact that the Federal Reserve is so loose with its monetary policy.

The shape of the candlestick is a little bit of a hammer, but if we were to break down below the bottom of this candlestick it would turn that hammer into a “hanging man.” We are most certainly in the vicinity of significant resistance as we approach the ¥107 level, so if we are going to see selling pressure in this market, it is very likely to be relatively soon. As we head into the weekend, it will be interesting to see what happens with the US dollar, and whether or not it translates into selling over here. Ultimately, it is not until we break above the 200 day EMA above that I would be a buyer of this pair, because quite frankly there are so many things working against the US dollar in general. Yes, we could get a short-term pop, but I still think it is much easier to simply fade rallies that show opportunity to do so. We have seen a lot of strength over the last couple of weeks but longer-term we still have a lot of issues.

The USD/JPY pair is highly sensitive to risk appetite, so the fact that we are rallying is not the hugest of surprises, but I will admit that eventually I expect this market to fall over due to the US dollar itself. Granted, it is probably easier to short the US dollar against other currencies, but the fact that it has been so weak in general, suggests to me that you cannot buy this pair, at least not with economic conditions being what they are.