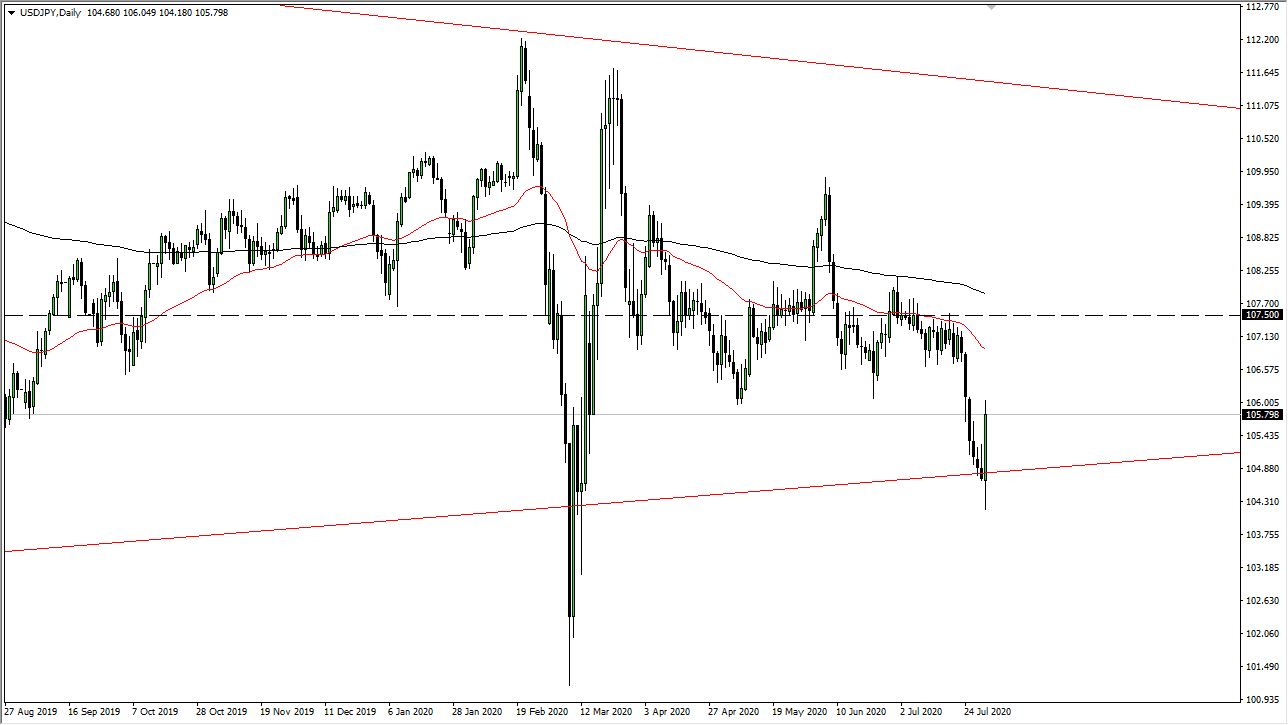

The US dollar initially pulled back and fell towards the ¥104 level during the trading session on Friday but then turned around to rally rather significantly, reaching towards the ¥106 level. The market is showing signs of weakness there though, so I do not know whether or not we can continue to go higher but I am looking for signs of exhaustion in order to short this market. It is very possible that Monday may see a little bit more buying but given enough time I believe that there are multiple areas where the sellers could return.

It is a bit difficult to figure out exactly what happened, but there is the possibility that the economic numbers in Japan overnight were enough to spook the market. There is also the possibility that it was perhaps a simple profit-taking. Regardless, this is a market that will continue to see a lot of noise, but I am simply waiting for signs of exhaustion that I can take advantage of. This market will continue to see volatility as it typically does, and at this point, I think it is obvious that the pair has broken to the downside, though the Friday candlestick was rather impressive. I think at this point in time it is likely that we are going to see more jittery trading ahead, but again it is only a matter of time before we see exhaustion.

Eventually, I fully anticipate that we are going to break down below the bottom of the candlestick for the Friday session and continue much lower. If that is going to be the case, then we could go as low as ¥102, perhaps even ¥100. In that general vicinity, we will more than likely see the Bank of Japan get involved, although direct intervention seems to be unlikely. They will start to jawbone first, and that will cause a bit of reaction. At that point though, we will be much lower and ultimately this is something to think about down the road. While this was a rather impressive candlestick, the reality is that the Federal Reserve will continue to drive the value of the greenback longer term. Take your time, wait for signs of weakness, and then start shorting this again.