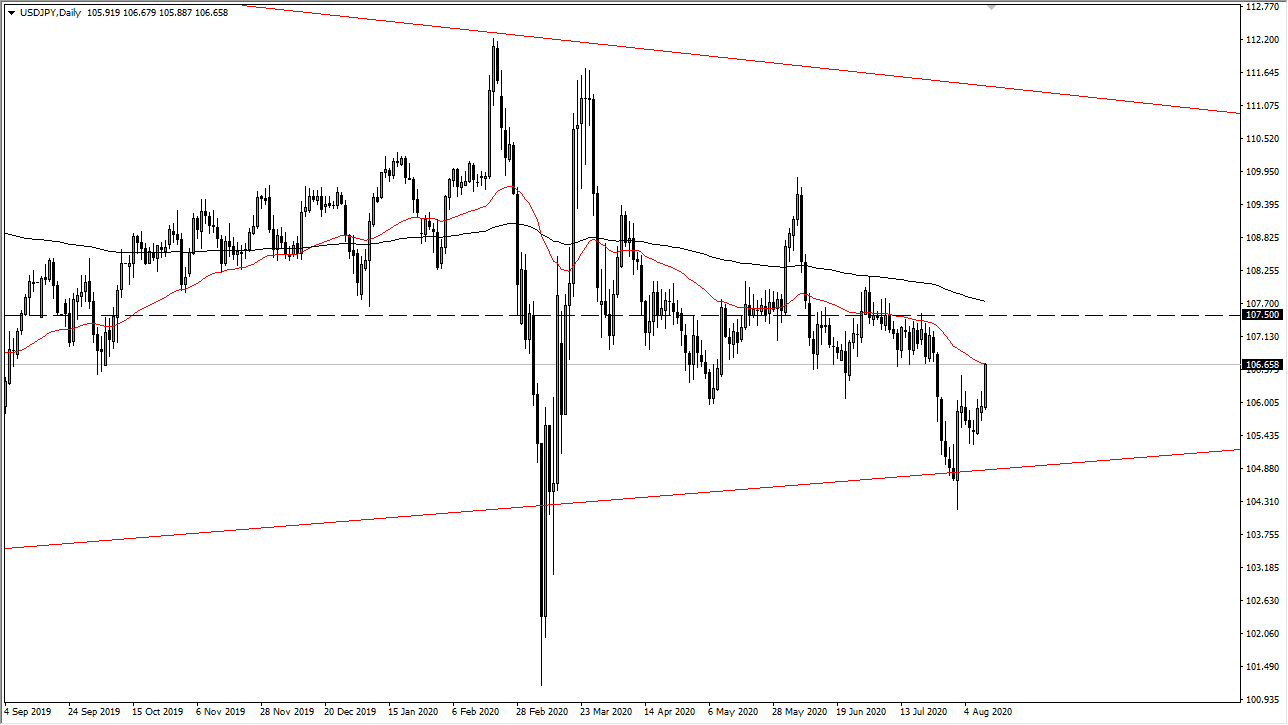

The US dollar has rallied rather significantly during the trading session on Tuesday, breaking towards the 50 day EMA. We are getting close to an area of significant resistance, so I think it is only a matter of time before the sellers come back. I am looking for some type of shorting opportunity above that I can take advantage of. The ¥107.50 level is a major resistance barrier, with the 200 day EMA sitting just above there. Somewhere between the 50 day EMA and the 200 day EMA should see a lot of selling pressure, so I am waiting for an opportunity to short this market.

The market should continue to find plenty of sellers given enough time due to the fact that the Federal Reserve continues to float greenbacks into the marketplace. This has been a nice rally, but ultimately, I think it is only a matter of time before it fails. The ¥107.50 level has been crucial more than once and I think it is only a matter of time before the sellers step up in that general vicinity. To the downside, I believe that the ¥105 level is an area that we will probably target. If we were to break down below that level, it is likely that the market then goes to the ¥104 level, and then possibly the ¥102 level after that. I do think that eventually what happens is that we have seen a nice rally over the last several sessions, but the longer-term fundamental analysis of the Federal Reserve still has the pair falling given enough time.

That being said, the market has to clear the 200 day EMA, and perhaps even the ¥108 level, then we may go higher. At that point, I would anticipate a move to the ¥110 level, but that would take a significant amount of momentum to make that happen. All things being equal though, it looks as if the US dollar is oversold in general, so that might be showing itself over here. The candlestick closed very positively, so it will be interesting to see what the Wednesday candlestick brings. If you bring some type of shooting star, then I think it might be an even better selling opportunity and we had previously. A lot of energy has been expended to get this market to the upside, so do not be surprised at all to see it fail given enough time.