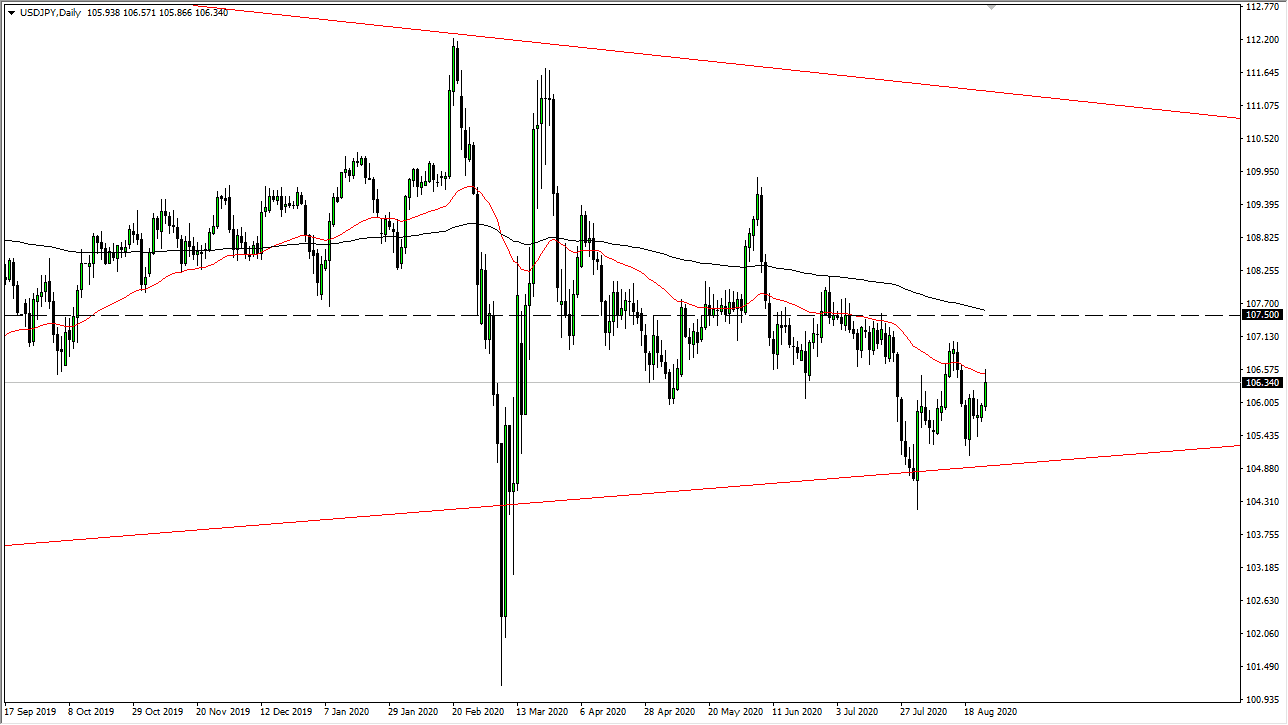

The US dollar has rallied significantly during the trading session on Tuesday but has failed to break above the 50 day EMA. At this point in time, it looks very likely that we are going to short the market in that general vicinity, and perhaps break down in order to reach the lows again. Although the candlestick for the day is rather bullish, the reality is that we did give up almost half of the candlestick as soon as we ran into the slightest hint of trouble.

Keep in mind that the pair has been moving on multiple different scenarios, but perhaps part of the reason we have rallied during the trading session on Tuesday was due to the fact that there is a press conference suddenly scheduled for the Bank of Japan on Friday, perhaps announcing some type of new monetary policy and therefore the Japanese yen got sold off against almost everything. At the end of the day though, the US dollar should continue to feel pressure due to the fact that the Federal Reserve continues to loosen monetary policy. Later during the week, we have a speech coming out of Jackson Hole Symposium by Jerome Powell, which could give us a little bit of a heads up as to where the US dollar goes next. All things being equal, it is very likely that we will see some type of dovish statement coming out of his mouth, because that is what the Federal Reserve does, at least in the last 12 years or so.

The ¥105 level underneath is a short-term target, and I do think that we will get there given enough time. However, if we do break above the top of the candlestick during the trading session on Tuesday, then it is very likely that we will see quite a bit of resistance near the ¥107 level, and most certainly at the ¥107.50 level where we also have structural resistance and the 200 day EMA. If we were to break down below the ¥105 level, then the market is likely to go looking towards the ¥104 level, possibly even as low as the ¥102 level, followed by the crucial ¥100 level which will almost certainly get a reaction from the Bank of Japan sooner or later. This is a market that has a couple of central banks trying to outdo each other with loose monetary policy, so it will remain choppy regardless.