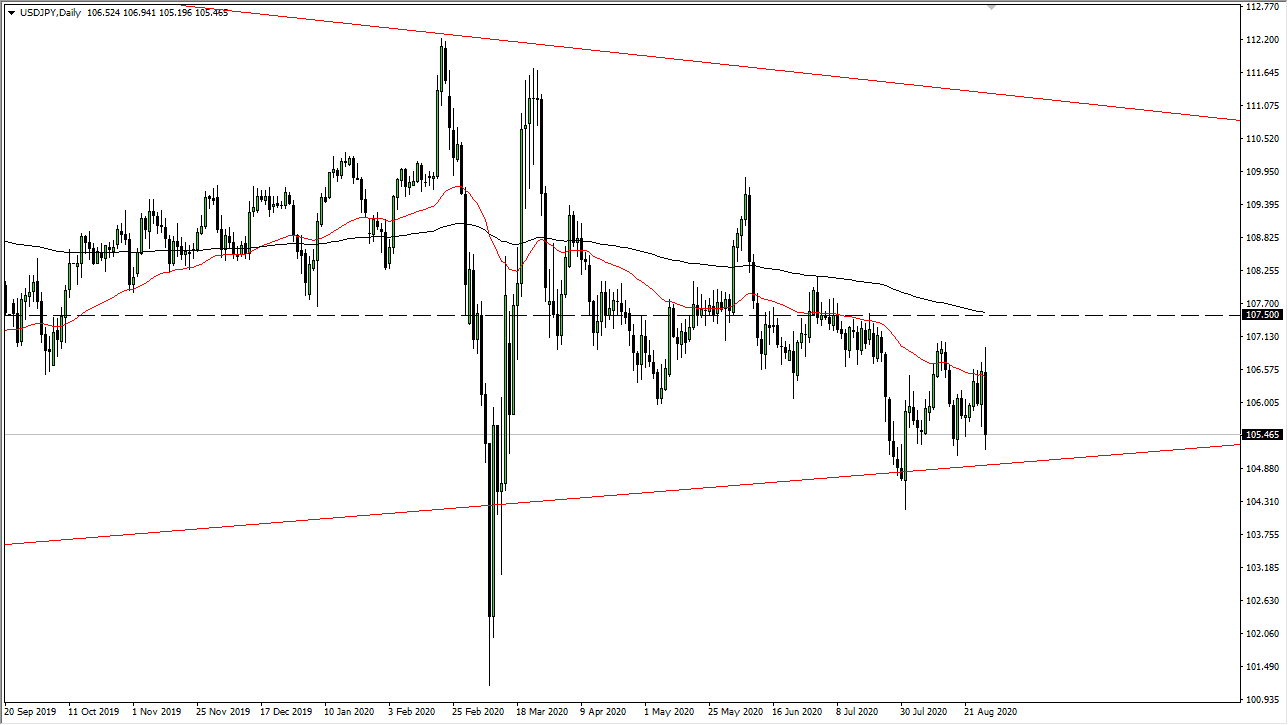

The US dollar has initially rallied during the trading session on Friday but then broke down rather significantly. The 50 day EMA has caused a significant amount of resistance, and I think that resistance extends all the way to the ¥107.50 level. The 200 day EMA is above there, and at this point in time, I am simply looking to fade short-term rallies. I am a bit surprised by the complete breakdown during the trading session, but ultimately the direction makes quite a bit of sense.

Looking at this chart, if we break down below the ¥105 level it is likely that we will go down towards the 100 for ¥0.25 level, and then possibly even down to the ¥102 level. Ultimately, this is a market that I think does do that, but we may need to bounce between now and then. If we do, I am more than willing to start selling again as the market is clearly favoring selling the US dollar in general.

This market continues to be a bit difficult to trade though, because the central banks of both countries are extraordinarily loose, and they both are considered to be “safety currency.” If that is going to be the case, then there are a lot of crosswinds that continue to be noisy in this marketplace. The candlestick is extraordinarily negative, so we could get a bit of follow-through, but I would wait until we got a solid move below the lows of the Friday session. If you are looking to short the US dollar it might be easier to do against other currencies, but either way that is the major direction that you should be looking at, too short the US dollar.

If we did turn around and break above the ¥107.50 level, then it would be an extraordinarily bullish sign for the US dollar, something that seems to be very unlikely to happen anytime soon due to the fact that Jerome Powell has done so much to work against the value of the greenback, suggesting that it is going to be a long time before we see any type of monetary tightening, and therefore the greenback will continue to be one of the worst performers in the Forex world, even against the lowly Japanese yen.