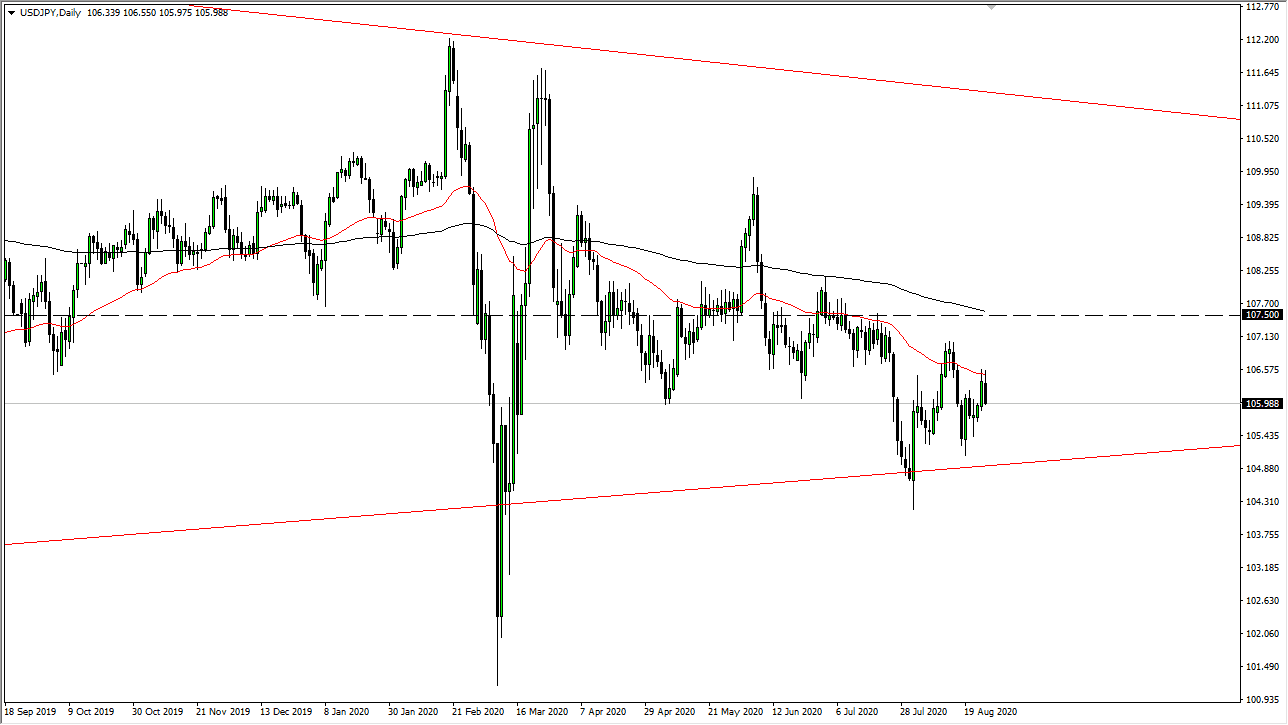

The US dollar initially tried to rally during the trading session on Wednesday but gave back the gains near the 50 day EMA. By doing so, it looks as if we are ready to continue the same type of trading action that we have seen before, meaning that we will be fading short-term rallies. Longer-term, I believe that the market goes looking towards the ¥105.50 level, possibly even the ¥105 level. I think this pair continues to wait on Chairman Powell and whatever it is he may decide to do, but clearly his Jackson Hole speech will be parsed during the day on Thursday.

With that being said, we most certainly have seen a lot of US dollar bearishness as of late, and I think that is going to continue to be the case overall. The market is likely to continue to be very choppy in this particular pair, mainly because it is a fight between a couple of central banks that are trying to loosen monetary policy as quickly as possible. This is a market that probably has nowhere to be anytime soon so I would not be overly excited about it. However, for me it is obvious that the easier path overall seems to be down, so that is why I have more of a negative bias.

If we were to break out above the ¥107.50 level, at that point I think we could start to think about buying, because it would slash through the 200 day EMA and an area that had previously attracted a lot of attention. Until then, I will keep my negative bias, but I recognize that choppiness will probably be the word that describes this market more than anything else. Longer-term, I do anticipate that we break down towards the ¥100 level, but that is further down the road, and may take some time to happen. If we were to break above the ¥107.50 level, then it is possible that the market may go looking towards the ¥110 level. That to me seems to be the least likely of scenarios but we always need to keep those possibilities in the back of our heads as the market can do just about anything at any given moment. This is especially true this time year as a lot of the larger players are away on vacation anyway.