USD/JPY: The strength of the decline remains

Today’s USD/JPY Signals

- Risk 0.75%.

- Trades may only be taken between 8 am New York time Thursday and 5 pm Tokyo time today.

Short Trade Ideas

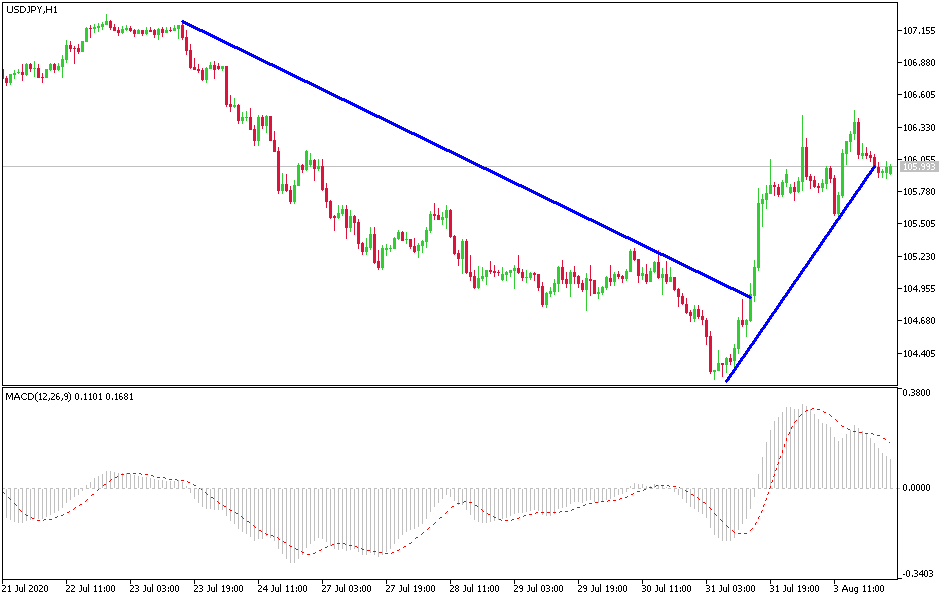

- Go short following a bearish price action reversal on the H1 time frame time immediately upon the next touch of 106.45 or 107.20.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 104.80 or 105.35.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Pair Analysis

The USD/JPY fell by nearly 2.0% during July, which is the largest decline in a year. Most losses occurred in the second half of July, as the lower end of the range of 108-106 levels retreated before the big surprise in the last trading day of July, where it dropped to the 104.18 support, the lowest level since mid-March. While many Japanese companies can manage the strength of the yen, as it approaches 100 yen, profits may be squeezed. The Japanese yen was not only the only one to rise against the dollar, as most of its trading partners in Asia this year rose as well. Therefore, Japanese officials may be reluctant to say a lot for fear of hostility to the United States, the most important trading and political partner. In general, new political initiatives are not expected in August, but an additional budget is likely to increase in October, especially in light of a new outbreak of the deadly Coronavirus.

Over the past three months, the US Treasury has sold about $400 billion of bonds. It is expected to double that in the next three months. In addition to the Treasury announcement, the US also released Markit and ISM Manufacturing PMI reading, both were consistent with the gradual recovery in the manufacturing sector, which we expect to be reflected in the employment data this weekend. The US also announced auto sales in July, and the continued recovery indicates stronger consumption and production than expected.

USD/JPY move below the 105.00 support level will increase the desire of forex traders to think about the most appropriate buying levels, waiting for the opportunity to bounce up. The most suitable ones would be 105.35, 104.44, and 103.90 respectively.

Regarding the US dollar, factory order numbers will be released. As for the Japanese yen, the CPI reading will be announced from Tokyo.