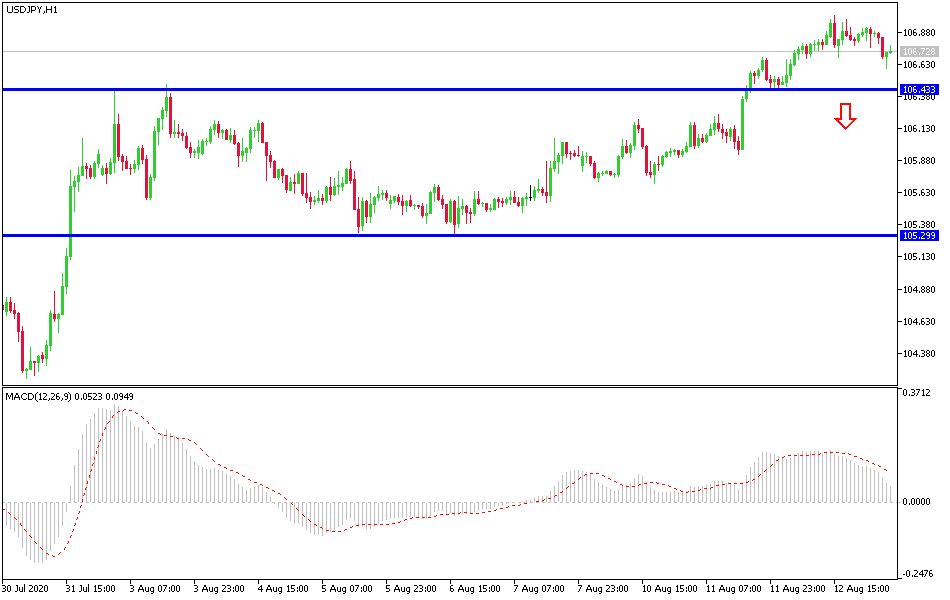

USD/JPY: Trend reversal starts.

Today’s USD/JPY Signals

- Risk 0.75%.

- Trades may only be taken between 8 am New York time and 5 pm Tokyo time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame time immediately upon the next touch of 165.20 or 105.60.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 106.35 or 107.00.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Pair Analysis

The price of the USD/JPY pair tried to take advantage of the investors’ risk appetite and pull the USD from its lowest levels in more than two years. However, retracement gains did not exceed the 107.01 resistance before settling around 106.68. And as I mentioned yesterday, the pressure factors on the US currency are still in place, which are the US numbers for COVID-19 cases and deaths, US/Chinese tensions, and the delay in passing economic stimulus plans.

Survey data from the Japanese Cabinet Office showed that the overall assessment gauge of the Japanese economy rose for the third consecutive month in July. Accordingly, the Current Conditions Index of the Economic Watchers Survey, which measures the current state of the economy, rose to a reading of 41.1 in July from 38.8 in June. The expectation index indicating future activity fell to a reading of 36.0 in July, from a reading of 44.0 in the previous month. The last reading decreased for the first time in three months.

On Thursday, the Bank of Japan announced that Japan's producer prices rose 0.6 percent month-on-month in July. This exceeded expectations for a 0.3 percent increase after a 0.6 percent increase in June. On an annual basis, producer prices sank 0.9 percent - which also beat expectations for a 1.1 percent decline after a 1.6 percent drop the previous month. The bank said export prices rose 0.8 percent month-on-month and decreased 3.2 percent year-on-year, while import prices rose 1.9 percent month-on-month and tumbled 12.6 percent year-on-year.

Regarding the US economy, after the announcement of a stronger than expected rise in US consumer prices, the Treasury Department said the US budget deficit rose to $2.81 trillion in the first 10 months of the budget year, surpassing any recorded deficits. The budget deficit is expected to eventually reach the levels of the fiscal year ending on September 30, more than double the largest annual deficit on record.

I still advise forex traders currently to buy the USD/JPY pair from the support levels at 105.85 and 104.90.

Regarding the US dollar, weekly unemployed claims be announced. For the Japanese yen, PPI data will be released.