With the beginning of this week’s trading, the American currency tried to recover some of its sharp recent losses. Accordingly, the USD/JPY price pair completed the upward and long-awaited correction moves to move towards the 106.47 resistance before settling around the 106.10 level at the time of writing. Bear’s control pushed the pair towards the 104.18 support during last Friday's trading session, its lowest level since last March.

US manufacturing improved again in July, with a leading indicator for activity higher in the growth area. The ISM, which is a consortium of purchasing managers, reported that the manufacturing index rose to a reading of 54.2 last month, up from a June reading of 52.6. According to the index data, any reading above the 50 level indicates that manufacturing in the United States is growing. The index fell below 50 in March, in a strong indication of a slump in manufacturing as the COVID-19 pandemic caused factories to close. The overall economy fell to a recession in February, and the government reported last week that GDP fell at an annual rate of - 32.9% in the April-June quarter, the largest drop in records dating back to 1947.

While it is the second month in a row that the index has been above the 50 threshold, indicating that manufacturing is growing again, economists have warned that the outlook is mixed due to widespread infection in the United States in the south, west, and Midwest. "Industrialization is recovering from low levels and unconfirmed expectations, given the risk of repeated disruptions from the new virus outbreak," said Rubeela Farooqi, senior US economist at High-Frequency Economics.

From Japan, the Cabinet Office said that the final reading of Japan's GDP in the first quarter of 2020 was unchanged, as it showed an annual decrease of - 2.2 percent and a seasonal decrease of - 0.6 percent. This did not change from June's prior reading and was in line with expectations. This puts Japan in a formal recession since GDP fell by -1.9% on a quarterly basis and 7.2% on a yearly basis in the fourth quarter or 2019.

Capital spending rose 1.7 percent on a quarterly basis after falling - 4.8 percent in the previous three months - while external demand fell 0.2 percent on a quarterly basis after rising 0.5 percent in the fourth quarter. Private consumption decreased by 0.8 percent on a quarterly basis, after falling by -2.9 percent in the previous three months.

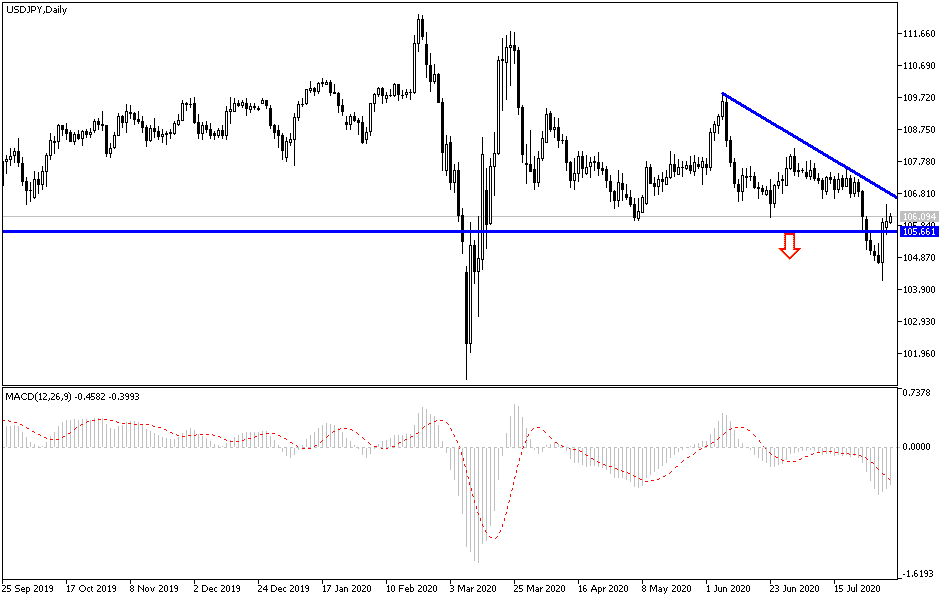

According to the technical analysis of the pair: The USD/JPY is heading lower on the four-hour time frame, as the price formed high highs and low lows inside the falling channel. It appears that the pair is fully ready for an upward correction. The top of the channel is lining up with the 61.8% Fibonacci retracement level, which already seems to keep the gains under control. This is also in line with the previous support area that can now hold up as resistance. The 200 SMA coincides with the top of the channel to add to its power as a roof. The 100 SMA is located below the slower moving average to confirm that the general trend remains bearish.

The gap between the moving averages continues to widen to reflect the bearish momentum. The RSI is already in overbought territory to confirm the buyers are running out of strength and will begin to decline to indicate that bears are taking over. Likewise, the stochastic has reached the overbought zone, so buyers can take a break and let the bears regain control. In this case, the USD/JPY might slide to the swing low around 104.25 or to the stronger support at 104.00.

As for the economic calendar data today: From Japan, CPI will be announced from Tokyo. From the US, factory orders numbers will be released.