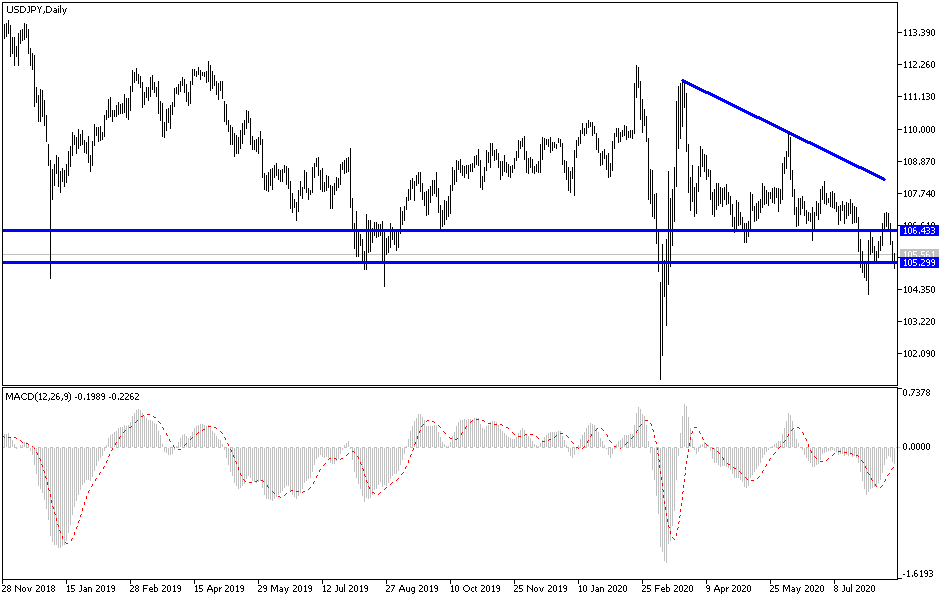

For four trading sessions in a row, the USD/JPY was under downward pressure that pushed it towards the 105.28 support before settling around 105.33 at the time of writing. This was ahead of the most important US event for this week, the announcement of the contents of the July meeting of the US Federal Reserve Bank at a time when the markets want new assurances of providing more stimulus to the US economy. It is still suffering from the country leading numbers of coronavirus cases and deaths, along with the increasing trade and political tensions around the world. This is the best environment for stronger gains for the Japanese yen as it is a traditional safe haven for the markets in times of uncertainty.

New home construction in the United States increased by 22.6% last month as home builders recovered from the recession caused by the Coronavirus pandemic. The US Commerce Department reported that new home starts increased at an annual rate of about 1.5 million in July, the highest level since February and much higher than economists had expected. Housing stats are now up for three months in a row, after falling in March and April as the virus outbreak crippled the US economy. The pace of construction last month was 23.4% higher than in July 2019.

The big gains came from the construction of apartments and condominiums which increased by 56.7%. But single-family home construction also increased by 8.2%. Construction across the northeast increased by -35.3% and by 33.2% in the south, and by 5.8% in both the Midwest areas.

In the same performance, applications for building permits, a good indicator of future activity, jumped by 18.8% from June to an annual rate of 1.5 million, the highest rate since January and an increase of 9.4% from July 2019. At the beginning of this week, the National Association of Home Builders reported that this month's builders' confidence matched the record for the first time in December 1998, according to economists Nancy Vanden Houten. “Strong demand and record level of confidence in home construction will support housing construction in the second half of 2020,” wrote Gregory Daco of Oxford Economics, but warned that failure of Congress to approve yet another bailout could negatively affect the economy. They write that “the Coronavirus that is still prevalent and the economy that is struggling to recover without financial support may limit the uptrend” of the housing industry.

In terms of US/Chinese tensions: China accused Washington of harming global trade through sanctions threatening to paralyze the technology giant Huawei, and yesterday it said it would protect Chinese companies, but gave no indication of possible retaliation. The US Commerce Department confirmed rules preventing suppliers from using US technology to produce Huawei chips and other components. The company, the first global technology competitor in China, is the largest supplier of switching equipment to telephone companies and a leading brand of smartphones.

The State Department called on the Trump administration to "stop cracking down on Chinese companies."

Huawei Technologies Ltd is at the center of the escalating dispute between Washington and Beijing over technology and security. US officials claim that Huawei represents a security risk, which the company denies, and they are pressuring European and other allies to avoid granting the company licenses to access next-generation networks. The conflict between the two largest economies in the world has increased to include the Chinese-owned short video application TikTok and the messaging service WeChat, which the US government has announced that they possess security risks because it transfers personal information about American users to the Chinese authorities. The Trump administration is pressuring the TikTok owner to sell it and ordering US companies to stop doing business with WeChat.

In response to the US actions, the Chinese Ministry of Commerce spokesman Zhao Legian said that the United States "violates international trade rules and undermines the global industrial chain and global supply chains."

According to the technical analysis of the pair: There is no change in my technical view of the USD/JPY, as the bearish momentum is still the strongest, and a break below the 105.00 support, which is very close now, will push the pair towards new record support levels, as it tested in last March's trading. From which we prefer to buy pending bounce positions upward. Technical indicators have reached strong oversold areas. There will be no real reversal of the general trend to the upside without surpassing the 108.00 resistance. Today, the pair will react to the release of the Trade Balance figures in Japan. Then to the most important, which is the contents of the last US Central Bank MoM, as the markets are looking for confirmations for more stimulus plans to revive the US economy in the face of the devastating COVID-19 pandemic.