The US dollar showed some strength against other major currencies during last Friday's trading session, after data showed a larger than expected increase in US employment in July. Despite this, the price of the USD/JPY moved from the 105.47 support to the 10605 resistance before closing trading around the 105.91, which confirms the stronger bears’ control, and the recovery of the USD in this pair was lower than what it was in front of the other currencies. The USD/JPY currency pair rose in the last trading session of last week towards the 61.80% Fibonacci level, as it recovered from the massive decline it experienced late last month. The pair traded lower for most of week before attempting to rebound on Friday. The currency pair has now climbed towards the overbought levels at the 14-hour RSI on the hourly chart and has crossed above the 100-hour simple moving average while its 200-hour counterpart remains several levels lower.

Data from the US Labour Department showed that employment increased by 1.763 million jobs in July, after rising by 4.791 million jobs revised down in June. Economists had expected an increase in employment of 1.6 million jobs compared to the 4.8 million jobs originally reported from the previous month. The average hourly wage for the month increased by 4.8% compared to the expected increase of 4.2%. The US unemployment rate fell to 10.2% in July from 11.1% in June. The rate was expected to decline to 10.5% and the labour force participation rate came at 61.4% against a forecast of 61.1%. The failure of American Democratic leaders and White House officials to make any meaningful progress on a new bill to help combat the consequences of the Coronavirus contributed slightly to diminishing the USD gains.

From Japan, the Cabinet Office revealed that the main index, which measures future economic activity, rose to a reading of 85.0 in June from a reading of 78.3 in May. The synchronous index rose to a reading of 76.4 in June from 72.9 in the previous month. The Bank of Japan Consumer Price Index remained unchanged at 2.2%. Tokyo's Fresh Food CPI beat expectations by 0.2% (annualized), with a rate of 0.4%. The general CPI beat expectations by 0.4% with 0.6%, while the previous CPI for food and energy exceeded expectations by 0.5% with 0.6% (year on year). Household public spending for June decreased by 1.2% in June (year over year), which was better than the expected decline of 7.5%.

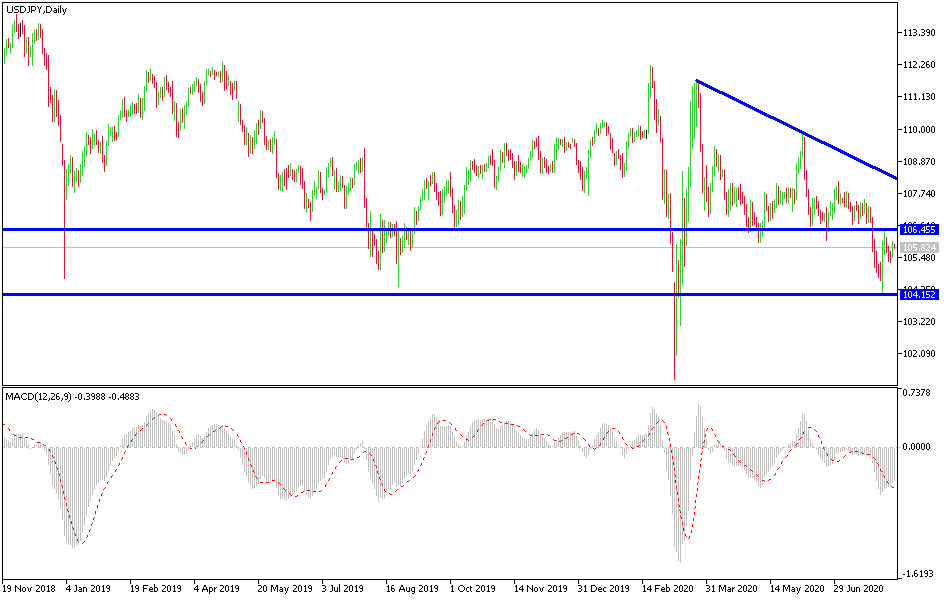

According to the technical analysis of the pair: On the near term, it appears that the USD/JPY pair is trading within a steep upward curve after falling earlier in the week. The pair is now up again to trade within walking distance of 61.80% Fibonacci retracement level. Accordingly, bulls will target short-term gains around 106.19 or higher at the 76.40% Fibonacci at 106.50. On the other hand, bears will be looking for short-term gains at 50% and 38.20% Fibonacci retracement levels at 105.69 and 105.34 respectively.

On the long term, and according to the performance on the daily chart, it appears that the USD/JPY pair is trading within a sharp downtrend channel. This indicates a strong long-term bearish bias in market sentiment. Therefore, bears will look to extend the current lows towards 104.96 or less, to 103.98. On the other hand, bulls will target long-term rally gains around 106.95 or higher at 107.97.

As for the economic calendar data: There is a holiday in Japan. From Asia, Chinese inflation figures will be announced. Then the US jobs vacancies numbers will be released.