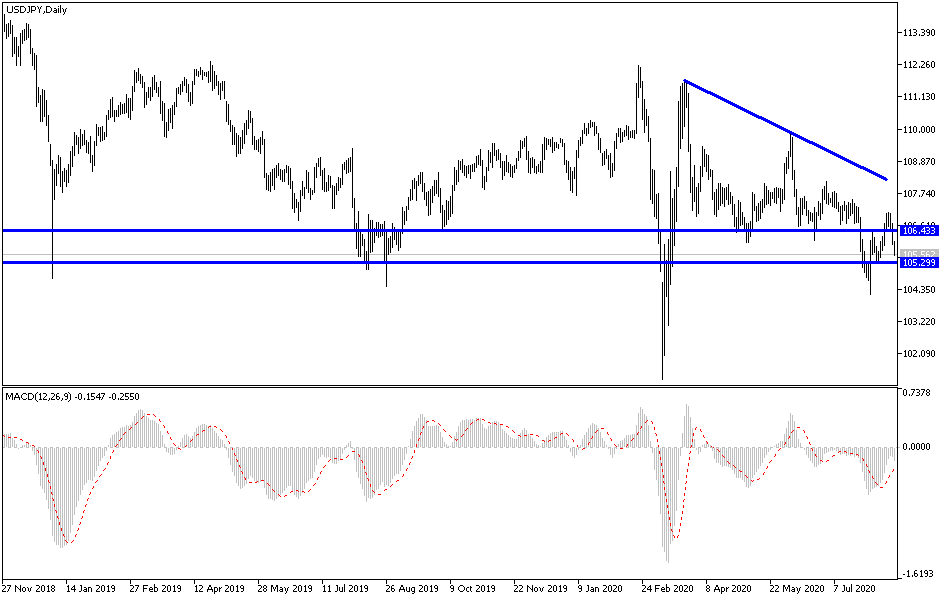

For the third day in a row, the USD/JPY is moving in the same long-term downtrend towards the 105.92 support at the beginning of Tuesday's trading. Trade and political tensions around the world continue to support investors' appetite for safe havens, and as is known, the Japanese currency is the most prominent of them. The pair did not pay much attention to the official data, which confirmed that the Japanese economy contracted at the fastest pace ever in the second quarter of 2020 due to restrictions imposed to curb the spread of the Coronavirus.

Preliminary data from the Japanese Cabinet Office revealed that the gross domestic product of the third-largest economy in the world contracted by -7.8 percent in the second quarter, the third consecutive decline. This was also larger than economists' expectations for a decline of- 7.6%, and the first quarter slowed by 0.6%. On an annual basis, GDP decreased by -27.8% against an expected slowdown of -27.2%. The output has shrunk to its greatest extent since records began in 1955.

The record annual Japanese contraction was driven largely by a 30.1 percent drop in household spending and a 56 percent decrease in exports. Government spending fell by only 1 percent, meanwhile, business investment fell 5.8 percent in the second quarter.

Commenting on the alarming figures, Marcel Thieliant, an economist at Capital Economics, said that the Japanese economy will recover faster than many other large advanced economies. The economist added that this reflects its strong corporate balance sheets, a generous credit guarantee scheme, and a low reliance on tourism.

On the other hand, and during a widening dispute between the two largest economies in the world, Trump administration is tightening restrictions on the Chinese company Huawei and is seeking to starve it of key ingredients by cutting off access to US technology. "We don't want their equipment in the United States because they are spying on us," Trump told Fox News on Monday. "And whatever country uses it, we will not do anything regarding intelligence sharing with them." The new rules of the US Department of Commerce will prevent Huawei from accessing chip technology.

Washington cut off Huawei's access to US components and technology, including Google Music and other smartphone services, last year. These sanctions were tightened in May when the White House banned vendors around the world from using US technology to produce components for Huawei. For his part, a Huawei executive said this month that the company has started to run out of processor chips to make smartphones as a result of those sanctions, and it may have to stop production of its advanced chips.

Huawei has been at the center of the growing US-China tensions over technology and security. The confrontation has now covered the popular Chinese-owned video app TikTok and the China-based messaging service WeChat, both of which are at risk of being banned in the United States starting in September. Huawei, for its part, refused to comment but has repeatedly denied accusations that it may facilitate Chinese spying. Chinese officials accused Washington of using national security as an excuse to prevent a rival of US tech industries.

According to the technical analysis of the pair: The expanding disagreement between the two largest economies in the world, in addition to the Corona pandemic, we will support the continuation of safe havens’ gains, and therefore the continuation of the USD/JPY downward momentum. The closest support levels for the pair currently are 105.65, 104.90, and 104.00, respectively, and I see that the last level is ideal to buy the pair for a long-term target towards 108.00. Technical indicators are still heading towards oversold levels, which confirms our trading strategy which is buying the pair from every descending level.

As for today's economic calendar data: All focus will be on the US data, which includes building permits and housing starts.