During last week’s trading, the USD/JPY collapsed towards the 105.09 support. With the recovery of the US currency’s exchange rate against the rest of other major currencies, the pair’s share of the bounce pushed higher to the 106.21 level, with the bulls losing necessary momentum to completely rebound. The pair returned to stability lower, towards the 105.70 level at the beginning of today's trading and was not affected at all by US President Donald Trump's announcement that the Food and Drug Administration had issued an emergency authorization to use convalescent plasma to treat COVID-19 patients.

Trump announced the decision at the White House, describing convalescent plasma as a "powerful cure." He says the FDA action will expand access to a treatment that is already in use. Treatment includes transferring antibodies from recovering COVID-19 patients to patients with the disease. The announcement comes days after suggestions by White House officials about politically motivated delays by the Food and Drug Administration in approving a vaccine and treatments for the disease caused by the Coronavirus.

Trump's announcement came on the eve of the Republican National Convention, in which he will run against Democrat Joe Biden for president.

Regarding the COVID-19 outbreak: The state of Florida broke numbers the 600,000 confirmed coronavirus cases barrier, but it reported one of the lowest daily rates in two months, in light of the downtrend continuation that began five weeks ago. Florida reported 2,974 new infections on Sunday, the second time since June 22 that the number was lower than 3,000 new cases were recorded in a single day. On Monday, 2,678 cases were reported. Sundays and Mondays often have few reports as not all hospitals submit a report on the weekend.

Accordingly, the daily total reached its peak on July 15, when more than 15,000 cases were reported, but has since decreased. The number of hospital admissions due to COVID-19 has decreased. Late Sunday morning, 4,578 patients were treated in Florida hospitals, compared to 4,773 on Saturday, lower by about 800 since last Thursday. The number of hospitalizations peaked above 9,500 on July 23.

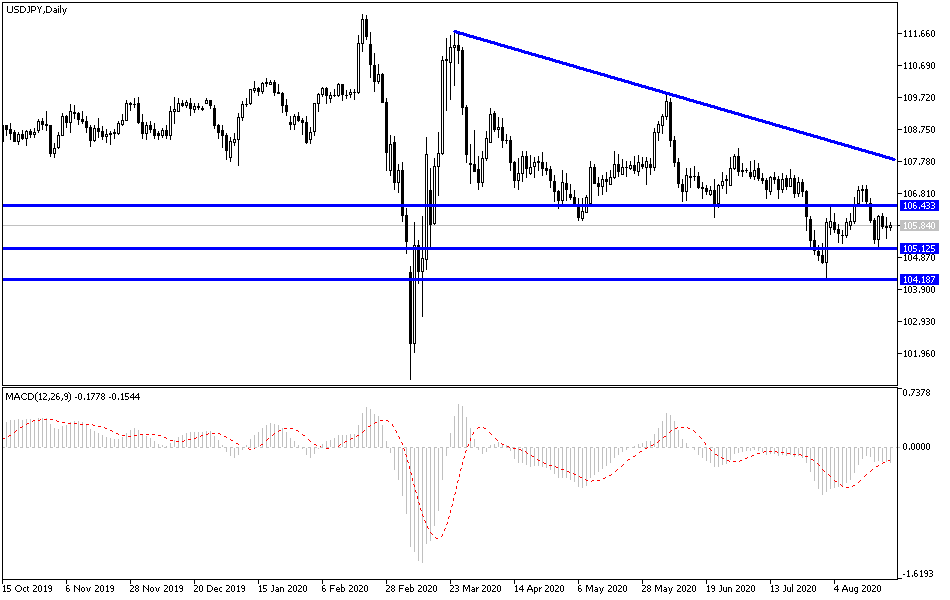

According to the technical analysis of the pair: As shown on the USD/JPY daily chart below, the general trend is still strongly bearish and the pair may push to stronger support levels if the bears move below the 105.45 support. Investors are indifferent to the pair's arrival to oversold areas, as pressure factors on the US dollar are still present and the demand for the Japanese yen as a safe haven is constantly increasing. As I mentioned before, I now confirm that the 108.00 resistance is still a very important factor for the success of the bullish correction attempts.

Today's economic calendar has no important economic releases from Japan or from the USA. The market’s attention will turn to the annual Jackson Hole Symposium, where Fed Chairman Jerome Powell and Bank of Japan Governor are expected to speak on monetary policies.