The risk aversion and the weakness of the US currency after the announcement of the Federal Reserve Bank’s new monetary policy were strong incentives for the USD/JPY to fall strongly to the 105.20 support, which confirms the strength of the bears' control over the performance. The pair has now fallen to the oversold levels of the 14-hour RSI on the hourly time frame chart. The Japanese yen did not pay much attention to the announcement of the Japanese Prime Minister to resign from his post due to the deterioration of his health at a time when the third-largest economy in the world needs wise leadership at a time when the world is exposed to a deadly pandemic that pushed the global economy to its lowest levels since World War II.

On the economic front, from Japan, the Industrial Activity Index for June beat expectations (monthly) at -0.8% with a reading of 6.1%. On the other hand, Tokyo's CPI reading for August came in line with expectations (year over year) at 0.3% with a decrease of -0.3%. The general consumer price index in Tokyo for this month was below expectations of 0.8% (YoY) with a change of 0.3%. On the other hand, Tokyo's CPI excluding food and energy came in below expectations at 0.5% with a change of 0.1%. Prior to that, it was announced that the leading Japanese economic index for June was expected to decline to 85, with a reading of 84.4.

From the US, the US core PCE price index for July came in below expectations on a monthly basis of 0.5% with a reading of 0.3%. The general personal consumption expenditures price index came in below expectations by 1.2% with a change of 1%. On the other hand, income for US citizens increased by 0.4% compared to the expected decline of 0.2% while personal spending exceeded expectations by 1.5% with a rate of 1.9%. The core PCE price index for the month beat expectations (YoY) by 1.2%, with a record of 1.3%.

On the other hand, the Chicago PMI for August missed expectations at 52 with a reading of 51.2, while Michigan Consumer Confidence outperformed expectations by 72.8, with a reading of 74.1. Preliminary US GDP growth for the second quarter exceeded expectations (on an annual basis) but missed an estimate (quarterly). Both initial and continuing jobless claims came in below expectations while durable goods orders for July beat expectations by 4.3%, with a record 11.2%. Non-defense capital goods orders from aircraft reached expectations of 1.9%.

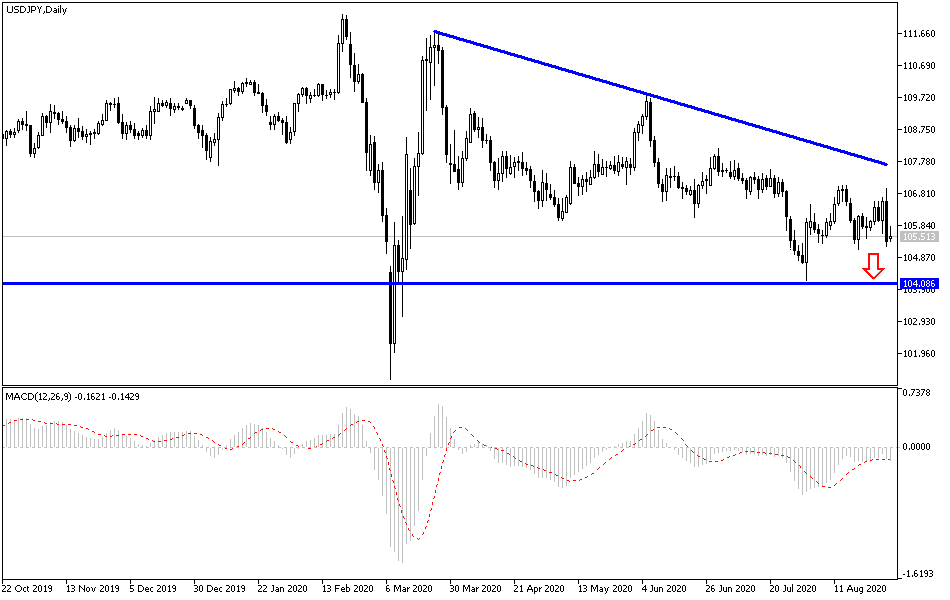

According to the technical analysis of the pair: In the near term, it appears that the USD/JPY is trading away from the ascending channel formation. This comes after the pair's sudden downturn. This indicates a possible change in market sentiment. Accordingly, bulls will target short-term rebound gains around 105.67 or higher at 106.00. On the other hand, bears will look to extend the current decline towards 105.00 or lower to 104.68.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY is trading within a sharp downward channel. And it is placed inside a larger channel, which appears to have a slight downward slope. This indicates that the bears have long-term control over the pair. Accordingly, bulls will be looking to make long-term gains around 107.00 or higher at 109.00. On the other hand, bears will look to extend the decline towards 104.00 or lower at 102.00.

As for the economic calendar today: From Japan, the rate of industrial production, retail sales, household confidence index, and housing starts will be announced. In contrast, there is no significant US economic data expected today.