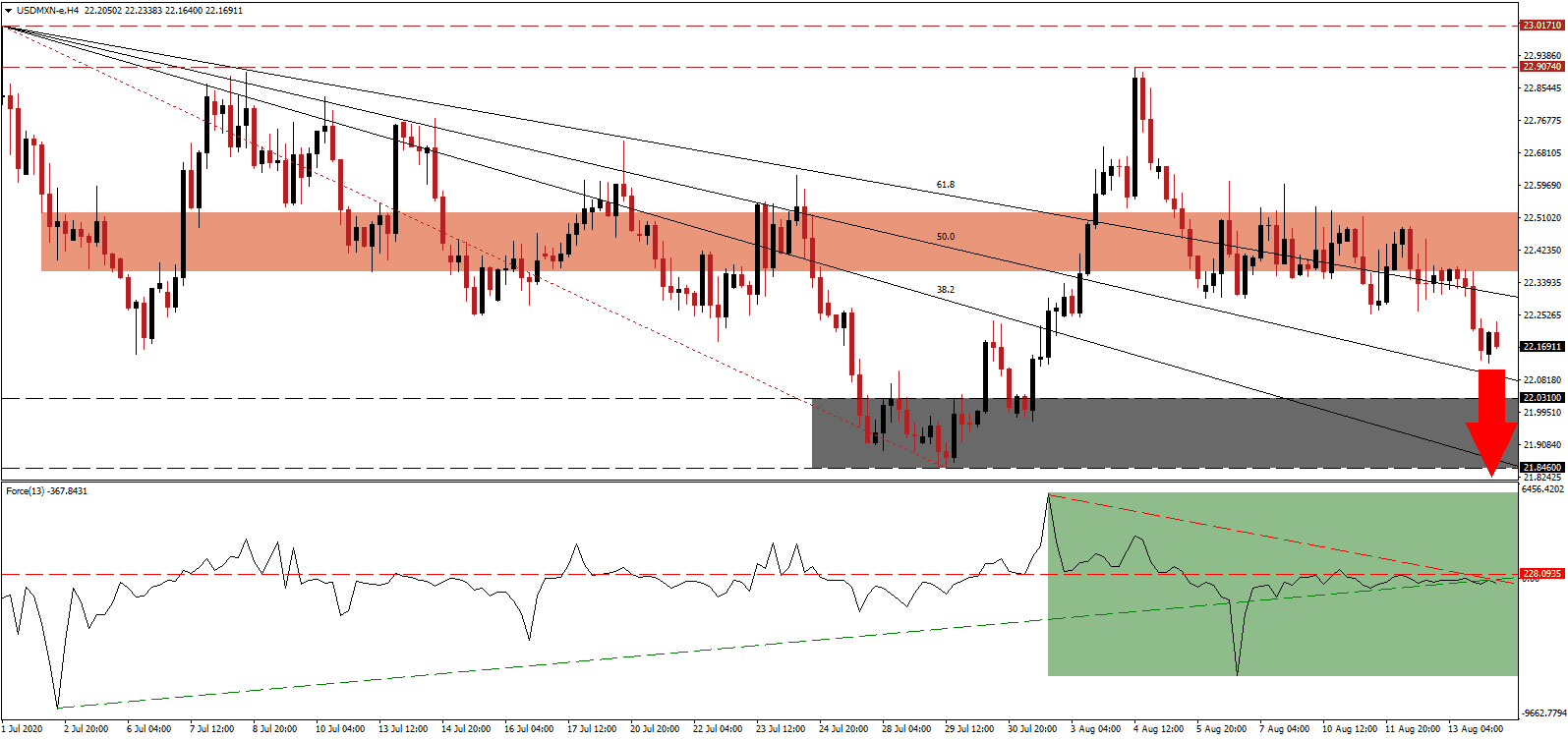

Mexico will cross 500,000 Covid-19 infections today, but testing remains comparably low, with just over 8,700 per 1,000,000. Economists in developed markets forecast a limited recovery amid the lack of fiscal stimuli, but it remains premature to make such an assessment. While President López Obrador favors financial responsibility and addressing long-term structural issues, Mexico may accelerate out of the pandemic at a delayed stage, but with a healthier foundation. The USD/MXN completed a breakdown below its short-term resistance zone with bearish pressures expected to extend the sell-off.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level and its ascending support level below the 0 center-line. Increasing downside pressures is the descending resistance level, as marked by the green rectangle. This technical indicator is anticipated to contract deeper into negative territory, strengthening the control bears exercise over the USD/MXN.

In an attempt to grant a necessary boost to the economy, select public spaces across Mexico City will be allowed to reopen at 30% capacity is operators enforce social distancing measures. Hopes are for a reduction of further layoffs in the hospitality sector. President López Obrador defends his approach to the pandemic, amid criticism he has not taken it seriously. Following the collapse in the USD/MXN below its short-term resistance zone located between 22.3671 and 22.5236, as identified by the red rectangle, bearish pressures have accumulated.

One silver lining for Mexico and its overwhelming informal labor force, dominant across Latin America, can be found in an ongoing FinTech revolution. Traditional banks are inaccessible for most day laborers, who often require micro-loans to start a business or expand in their existing infrastructure. The Covid-19 pandemic accelerated a trend that will likely improve the lives of tens of millions across Latin America this decade. After the USD/MXN dropped below its descending 61.8 Fibonacci Retracement Fan Support Level, a move into its support zone located between 21.8460 and 22.0310, as marked by the grey rectangle, is favored to result in a breakdown. The next support zone awaits between 21.0833 and 21.3602.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 22.1700

- Take Profit @ 21.1700

- Stop Loss @ 22.4200

- Downside Potential: 10,000 pips

- Upside Risk: 2,500 pips

- Risk/Reward Ratio: 4.00

A breakout in the Force Index above its ascending support level, serving as temporary resistance, may allow for a temporary reversal. With more debt pressuring the US Dollar to the downside, as the post-lockdown economic rebound is showing signs of exhaustion, Forex traders should consider any advance as a selling opportunity. The upside potential is reduced to its downward revised resistance zone between 22.9074 and 23.0171.

USD/MXN Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 22.6200

- Take Profit @ 23.9200

- Stop Loss @ 22.4200

- Upside Potential: 3,000 pips

- Downside Risk: 2,000 pips

- Risk/Reward Ratio: 1.50