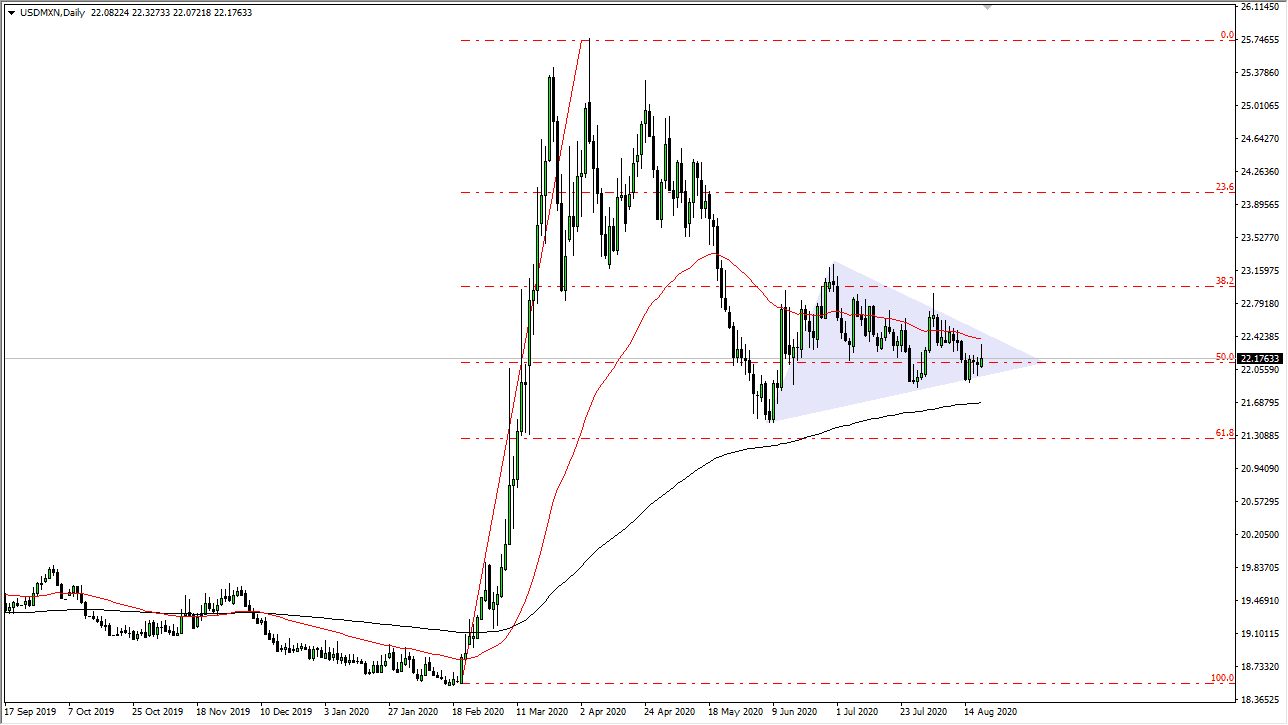

The Mexican peso has lost a little bit of strength during the trading session on Thursday as the US dollar reached towards the 50 day EMA. However, we have seen the US dollar giveback some of the gains, and therefore it looks as if there is still a little bit of hesitation out there to pick up the US dollar overall. There are a multitude of different things going on in the chart right now, which of course is causing a lot of different outlooks for when the next move will come, and of course what that next move could mean.

The initial observation should be that the 50% Fibonacci retracement level is essentially being danced around right now, which of course is an area that a lot of people will be paying attention to. The fact that we had formed a couple of hammers proceeding the candlestick during the Wednesday session suggested that perhaps the US dollar was suddenly going to strengthen against the Mexican peso, and then possibly emerging markets in general.

Furthermore, the 50 day EMA is just above, and has offered a bit of resistance during the trading session on Thursday. Ultimately, we did up forming a bit of a shooting star. At this point, it suggests that we are compressing and that it is only a matter of time before we break either higher or lower. As you can see, I have also drawn a triangle on the chart, but that is just to give a visualization of the compression, not necessarily something that you should trade off of. Underneath, we have the 200 day EMA that should offer a significant amount of support, so therefore I think it is only a matter of time before the buyers would be interested in that area. If we were to break down below the 200 day EMA, that could open up a huge move lower.

For what it is worth, the US dollar did get a bit of a reprieve during the trading session but against most of the majors it ended up losing strength by the end of the day. This would in fact jive well with the overall trend in the US dollar, and as the Federal Reserve continues to flood the world with greenbacks, that should continue to work against the value of that currency. However, the Mexican peso is a bit out on the risk spectrum, so it is very likely that we have choppy and somewhat sideways action with a slight downward tilt.