Mexico started to witness a gradual decrease in new daily Covid-19 infections but is distant from claiming control over the pandemic. Peru surpassed Mexico on a global scale, with Colombia likely to move ahead in a matter of days. With the end of summer, the virus is forecast to regain strength, while less testing manipulates the official data. Latin America’s second-largest economy, measured by GDP, remains third globally in total death count related to Covid-19. After the USD/MXN embarked on a brief counter-trend advance, price action was rejected by its downward revised short-term resistance zone.

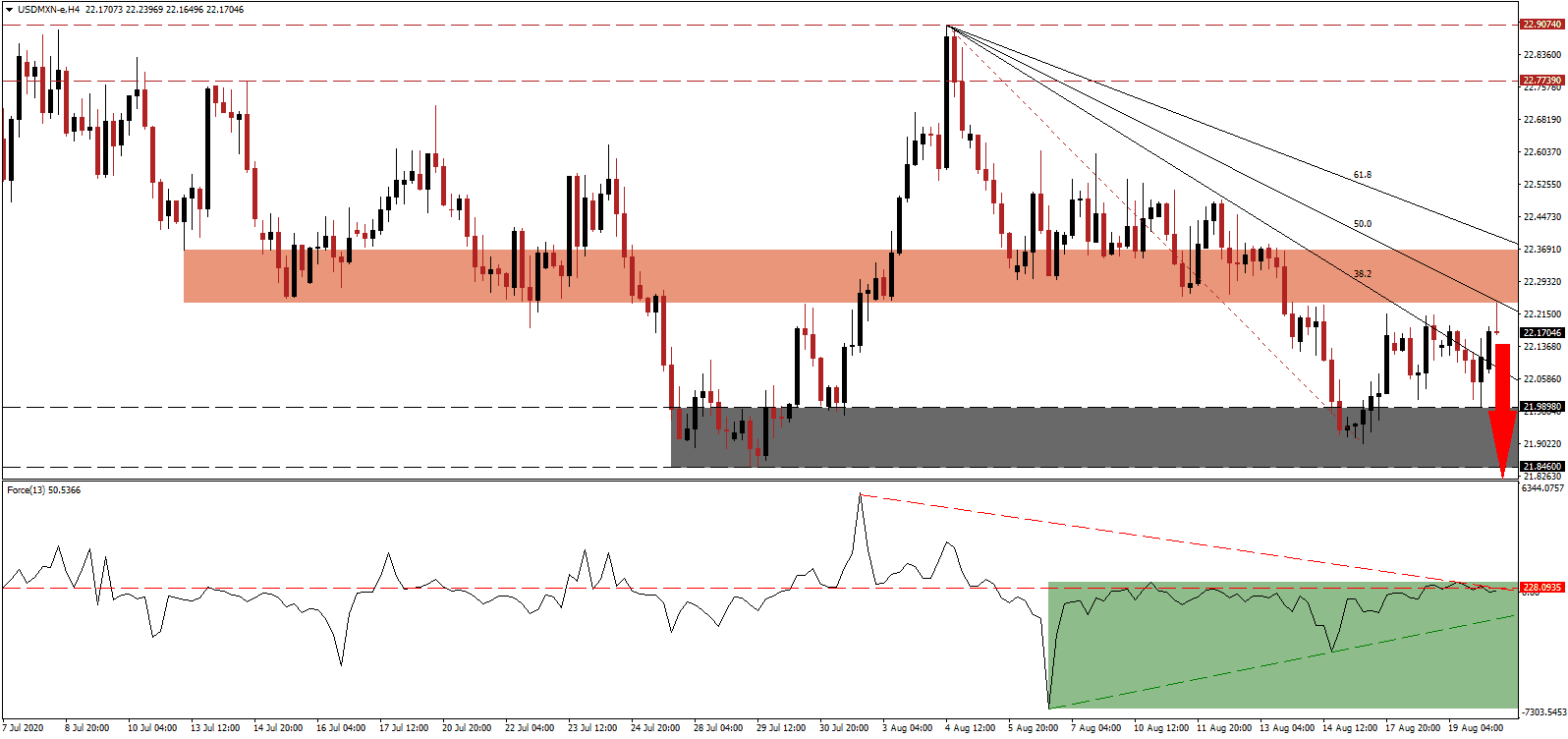

The Force Index, a next-generation technical indicator, reversed after recording a new multi-week low before being rejected by its horizontal resistance level, as marked by the green rectangle. A higher low followed, resulting in a redrawn ascending support level. This technical indicator is presently pressured lower by its descending resistance level, favored to guide it into negative territory, granting bears complete control over the USD/MXN.

President López Obrador announced 52,455 formal job additions in August, suggesting Mexico is recovering despite the global criticism of his response. Per data from the Instituto Mexicano del Seguro Social (IMSS), the social security institute of Mexico, over 1.1 million formal job losses occurred between March and July, which does not account for millions more in the dominant informal job sector. Following the rejection of the USD/MXN by its short-term resistance zone located between 22.2397 and 22.3671, as identified by the red rectangle, a new breakdown sequence should materialize.

Minutes from the latest Federal Open Market Committee (FOMC) meeting of the US Federal Reserve showed concern by the central bank over ongoing economic harm from the Covid-19 pandemic. It also highlighted skepticism over bond purchases to manipulate the government yield curve. The descending 50.0 Fibonacci Retracement Fan Resistance Level is anticipated to pressure the USD/MXN into its support zone located between 21.8460 and 21.9898, as marked by the grey rectangle. A breakdown extension into its next support zone between 21.0833 and 21.3602 is probable.

USD/MXN Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 22.1700

Take Profit @ 21.1700

Stop Loss @ 22.4200

Downside Potential: 10,000 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 4.00

Should the ascending support level pressure the Force Index higher, the USD/MXN may attempt a breakout. Forex traders should consider any price spike from current levels as a selling opportunity, based on intensifying weakness in the US Dollar. The upside potential remains confined to its continuously downward revised resistance zone located between 22.7739 and 22.9074.

USD/MXN Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 22.5700

Take Profit @ 22.8200

Stop Loss @ 22.4200

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67