According to the assessment of Hugo Lopez-Gatell, the Deputy Health Minister of Mexico, the Covid-19 pandemic is in a sustained decline across the country. A 20% drop in fatalities through the week ending August 17th, as compared to the seven-day moving average, served as the basis of his claims. Despite Mexico being the seventh most infected country globally with the third-highest death rate, Hugo Lopez-Gatell and President López Obrador embarked on a series of speeches claiming sustained progress over the pandemic. The USD/MXN corrected into its support zone with bearish momentum dominant.

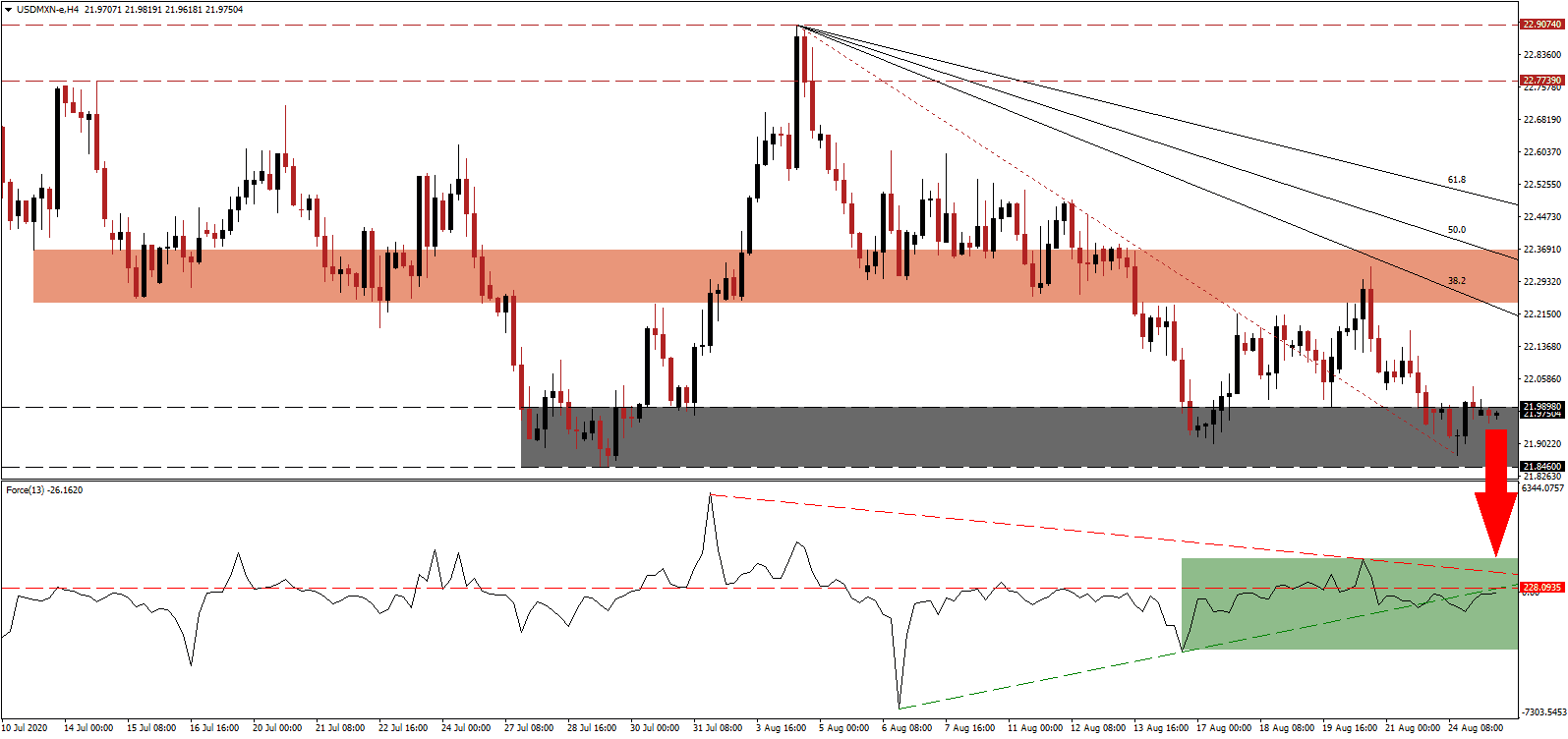

The Force Index, a next-generation technical indicator, maintains its positioned below its horizontal resistance level and its ascending support level, as marked by the green rectangle. Expanding downside pressures is the descending resistance level, favored to push this technical indicator farther into negative territory. Bears remain in complete control over the USD/MXN, suggesting a continuation of the corrective phase.

Since June, the Mexican government began easing Covid-19 restrictions, which resulted in an expected retail sales recovery, up 7.8% per official data from the Instituto Nacional de Estadística y Geografía (INEGI). Wholesale sales increased by 11.1%, prompting the Deputy Governor of the Banco de México, Jonathan Heath, to proclaim the beginning of a recovery, which could be a premature assessment. After a brief price spike in the USD/MXN was swiftly reversed by its short-term resistance zone located between 22.2397 and 22.3671, as marked by the red rectangle, breakdown pressures have expanded.

Economic recovery hopes presently rest with mega infrastructure projects, and President López Obrador will deliver an update on the state of the public-private plans worth nearly $100 billion. While criticism labeled them as the president’s job creation programs, with no viable alternatives, they may deliver the necessary spark Mexico requires. The descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to force the USD/MXN below its support zone located between 21.8460 and 21.9898, as identified by the grey rectangle. The next support zone awaits between 21.0833 and 21.3602.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 21.9700

- Take Profit @ 21.1700

- Stop Loss @ 22.1700

- Downside Potential: 8,000 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 4.00

Should the Force Index reclaim its ascending support level, the USD/MXN could attempt a second reversal. Given the deteriorating outlook for the US economy and downside pressures on the US Dollar, any price spike will offer Forex traders a secondary selling opportunity. The upside potential is reduced to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/MXN Technical Trading Set-Up - Reduced Reversal Scenario

- Long Entry @ 22.2700

- Take Profit @ 22.4200

- Stop Loss @ 22.1700

- Upside Potential: 1,500 pips

- Downside Risk: 1,000 pips

- Risk/Reward Ratio: 1.50