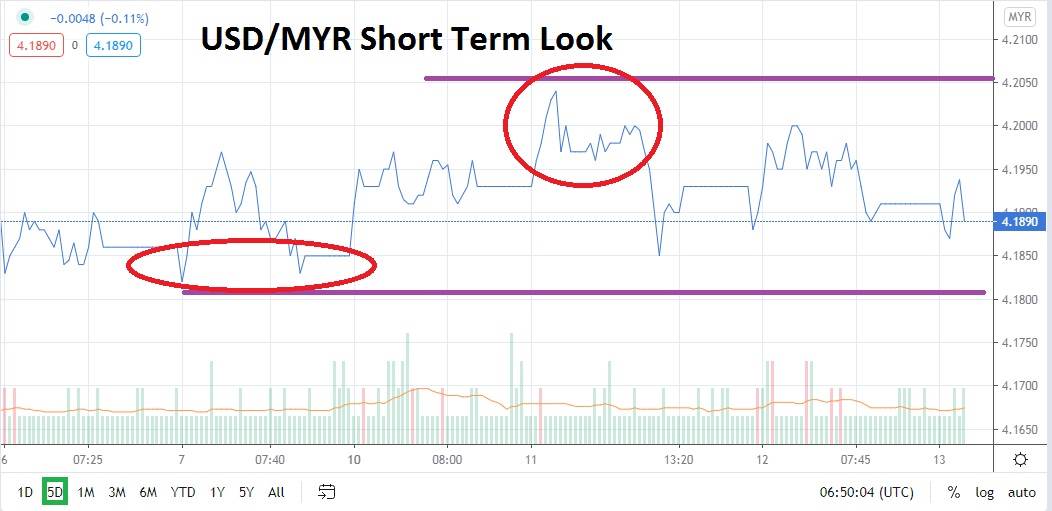

The USD/MYR has produced a satisfying bearish trend for patient speculators. The Malaysian Ringgit is certainly an emerging market currency, but its lack of extreme volatility allows it to be considered by a variety of forex traders. Choppy trading can be seen with a quick glance at a five-day technical chart of the USD/MYR, but what should get the attention of speculators is the ability of the Malaysian Ringgit’s to maintain it demonstrated bearish trend.

Incrementally the USD/MYR has consistently produced lower resistance levels. The value of the USD/MYR is testing important support levels not experienced since early March. The current support junctures for the Malaysian Ringgit are important because if it breaks below the 4.1830 mark, the USD/MYR could produce fireworks as programmed trading get activated.

Risk appetite in Asian markets is steady this morning and equities globally are certainly going to have an interesting couple of days before going into the weekend. The Malaysian Ringgit enjoys a solid amount of appeal from forex speculators because of Malaysia’s usual economic transparency and core governance. The USD/MYR value has been in a solid bearish trend since late March. Yes, the past week and a half of trading have produced a test of resistance near the 4.2000 level, but this came after the 4.1830 support level was tested last week.

The current price range of the USD/MYR is an important inflection point and speculators should be aware the Malaysian Ringgit is a solid barometer regarding risk sentiment in emerging markets. If the USD/MYR can sustain its current price range and trade within a vicinity of 4.1875 and 4.1940 it will give speculators a chance to take advantage of short term trends when using limit orders for buying and selling using current support and resistance levels as a gauge.

The mid-term trend of the USD/MYR has been bearish. However, short term the USD/MYR may continue to consolidate as it awaits another dose of impetus. Technically, it may prove wise to trade this forex pair using limit orders and looking for reversals, but because of the bearish trend which does exist, selling the USD/MYR in the 4.1910 to 4.1930 range and seeking targeted support below maybe the best speculative and patient maneuver.

Malaysian Ringgit Short Term Outlook:

Current Resistance: 4.1940

Current Support: 4.1875

High Target: 4.2000

Low Target: 4.1830