Norway passed the 10,000 Covid-19 infection mark on Monday, as hundreds of thousands of students returned to school. The Oslo-area witnessed a new infection cluster, bringing the total number of active cases close to 1,000. While students are physically present in classrooms, the government wants as many workers as possible to work from home to ease congestion on the public transport system and contain the spread of the virus. The government also added a recommendation that face masks should be worn in public. Breakdown pressures on the USD/NOK remain elevated after reaching its support zone.

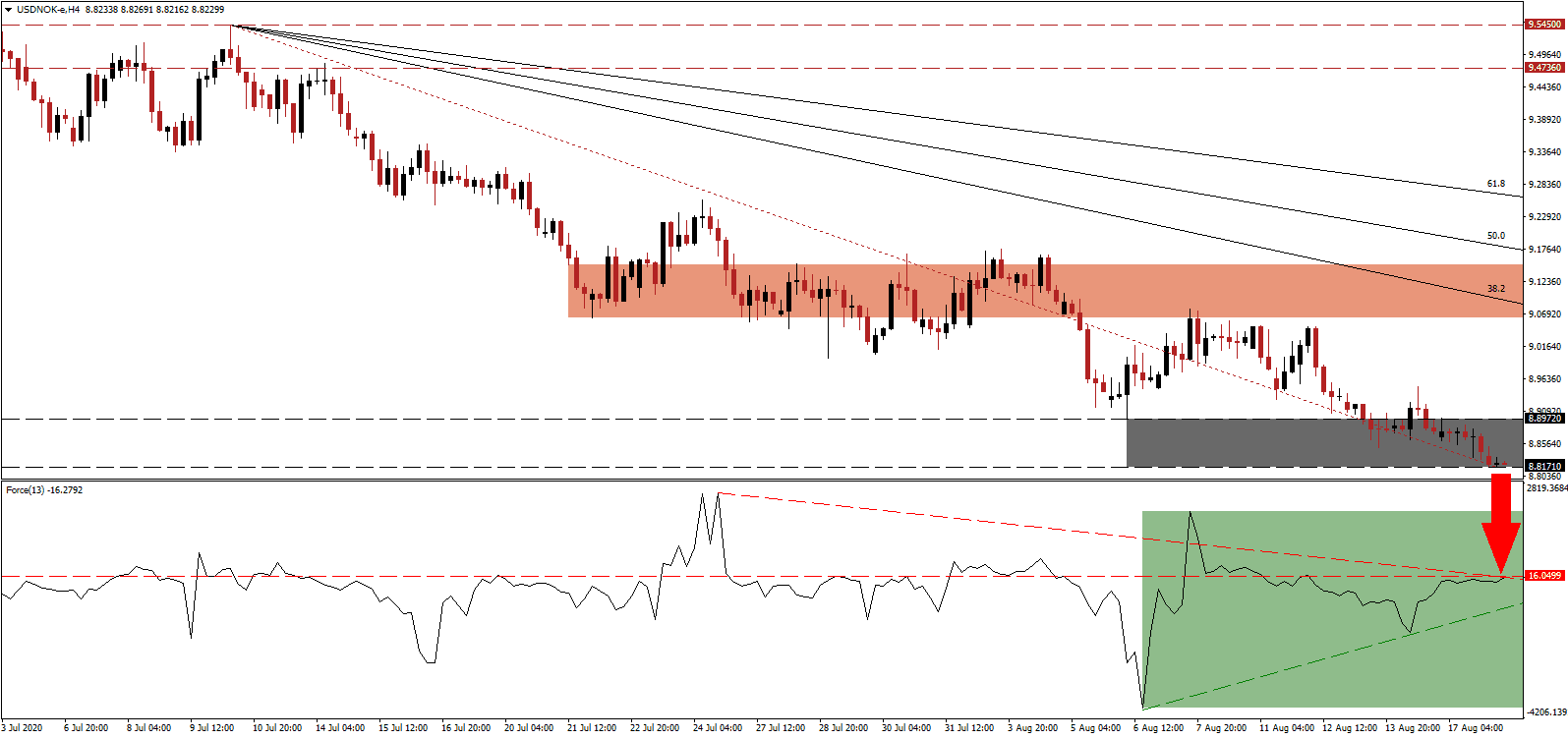

The Force Index, a next-generation technical indicator, was able to recover from multi-week lows, and an ascending support level emerged following a higher low. It does remain below its horizontal resistance level, as marked by the green rectangle, and is presently challenging its descending resistance level. This technical indicator maintains its position below the 0 center-line and bears wait for a new contraction to regain full control over the USD/NOK.

While the Norwegian government promotes work-from-home, Anne-Kari Bratten, the leader of the Spekter, an employer organization, calls for a return to the office. She highlighted the popularity of work from home was especially notable during Friday’s and Monday’s, embarking on long weekends and neglecting their duties. Bratten was criticized in public for her remarks. The USD/NOK ended a brief counter-trend advance with the rejection by its downward revised short-term resistance zone located between 9.0629 and 9.1502, as marked by the red rectangle, with breakdown pressures intact.

Oslo Mayor Raymond Johansen announced new temporary measures to halt the surge in Covid-19 infections, including security guards in outdoor spaces to discourage large gathering and a NOK2,500 fine for drinking in public. With the descending Fibonacci Retracement Fan sequence maintaining the well-established bearish chart pattern, the USD/NOK is expected to collapse below its support zone located between 8.8171 and 8.8972, as marked by the grey rectangle. Price action will challenge its next support zone between 8.5576 and 8.6036.

USD/NOK Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 8.8200

Take Profit @ 8.5500

Stop Loss @ 8.9100

Downside Potential: 2,700 pips

Upside Risk: 900 pips

Risk/Reward Ratio: 3.00

In case the ascending support level pushes the Force Index higher, the USD/NOK may attempt a limited reversal. The $300 weekly subsidy to the unemployed in the US, signed by President Trump via an executive order to replace the expired $600 weekly assistance, is set to expire in just three weeks. It adds to growing uncertainty over the US economy and the US Dollar. With the upside potential limited to its 38.2 Fibonacci Retracement Fan Resistance Level, Forex traders are advised to sell any rallies from present levels.

USD/NOK Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 8.9700

Take Profit @ 9.0700

Stop Loss @ 8.9100

Upside Potential: 1,000 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 1.67