Anders Tegnell, the State Epidemiologist of the Public Health Agency of Sweden and architect of the no-lockdown response to the Covid-19 pandemic, had defended his approach for the past six months. Sweden, on a population-adjusted death rate, ranks eighth in the world. Over the past two weeks, new infections and the death toll fell to levels which rekindled the herd-immunity debate, the unofficial goal of the Swedish government. Despite the lax approach, the export-oriented economy fared worse than the European Union as measured by PMI data. After the USD/SEK completed a healthy counter-trend breakout, price action is exposed to new selling and a breakdown extension.

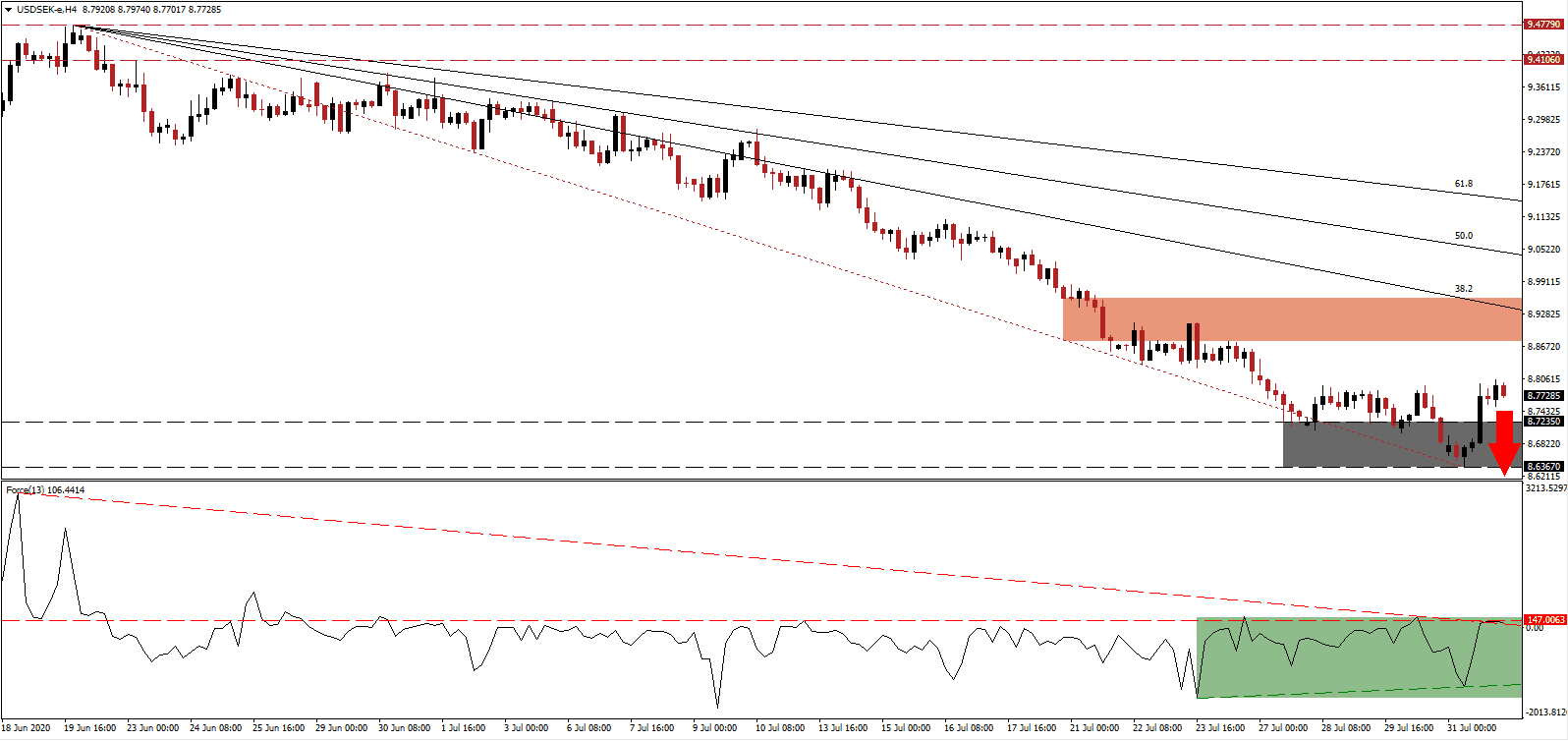

The Force Index, a next-generation technical indicator, was rejected by its horizontal resistance level, suggesting bullish momentum is fading. It is now being pressured lower by its descending resistance level, as marked by the green rectangle. Bears have partial control over the USD/SEK and wait for this technical indicator to move below the 0 center-line, from where a collapse below its ascending support level is likely, to regain full control.

While Sweden acknowledged that the second wave of Covid-19 infections is expected, the government and healthcare experts believe it is in a superior position to handle it than most countries. Lena Hallengren, the Minister for Health and Social Affairs of Sweden, warned against complacency heading into the fall, where infections are forecast to spike. Tegnell confirmed the outlook but assured his strategy resulted in herd-immunity, which will result in a few new cases. After the USD/SEK moved out of its support zone located between 8.6367 and 6.7235, as marked by the grey rectangle, bearish pressures are expanding.

It remains premature to judge the Swedish model, but for now, it caused more deaths without an economic benefit. With the condition significantly worse in the US, the USD/SEK is well-positioned to accelerate to the downside. The continuously downward revised short-term resistance zone, presently located between 8.8766 and 8.9592, as marked by the red rectangle, follows the descending 38.2 Fibonacci Retracement Fan Resistance Level. Price action is anticipated to collapse and accelerate into its next support zone between 8.1967 and 8.3180.

USD/SEK Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 8.7700

- Take Profit @ 8.2000

- Stop Loss @ 8.8700

- Downside Potential: 5,700 pips

- Upside Risk: 1,000 pips

- Risk/Reward Ratio: 5.70

In case the Force Index can eclipse its descending resistance level and mount a significant advance, the USD/SEK may attempt to push higher. The upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level. Forex traders should take advantage of any price spike with new net sell positions, as the US debate on more stimulus stalled and initial jobless claims are on the rise. Regardless of the outcome of the agreed assistance, debt levels will continue to soar, pressuring the US Dollar to the downside.

USD/SEK Technical Trading Set-Up - Confined Breakout Extension Scenario

- Long Entry @ 8.9350

- Take Profit @ 9.0350

- Stop Loss @ 8.8700

- Upside Potential: 1,000 pips

- Downside Risk: 650 pips

- Risk/Reward Ratio: 1.54