Singapore reports less than 100 new Covid-19 infections per day and has a remarkably low total death toll of just 27 from nearly 57,000 infections. Despite the positive domestic progress related to the pandemic, the global economy remains depressed. July industrial production dropped 8.4% year-over-year, with an uncertain outlook. South Korean industrial production for July missed expectations, Japanese retail sales disappointed, and the Chinese manufacturing PMI for August slowed marginally compared to the previous month. It confirms the global economy is far away from sustained recovery, but intensifying US Dollar weakness keeps the breakdown sequence in the USD/SGD intact.

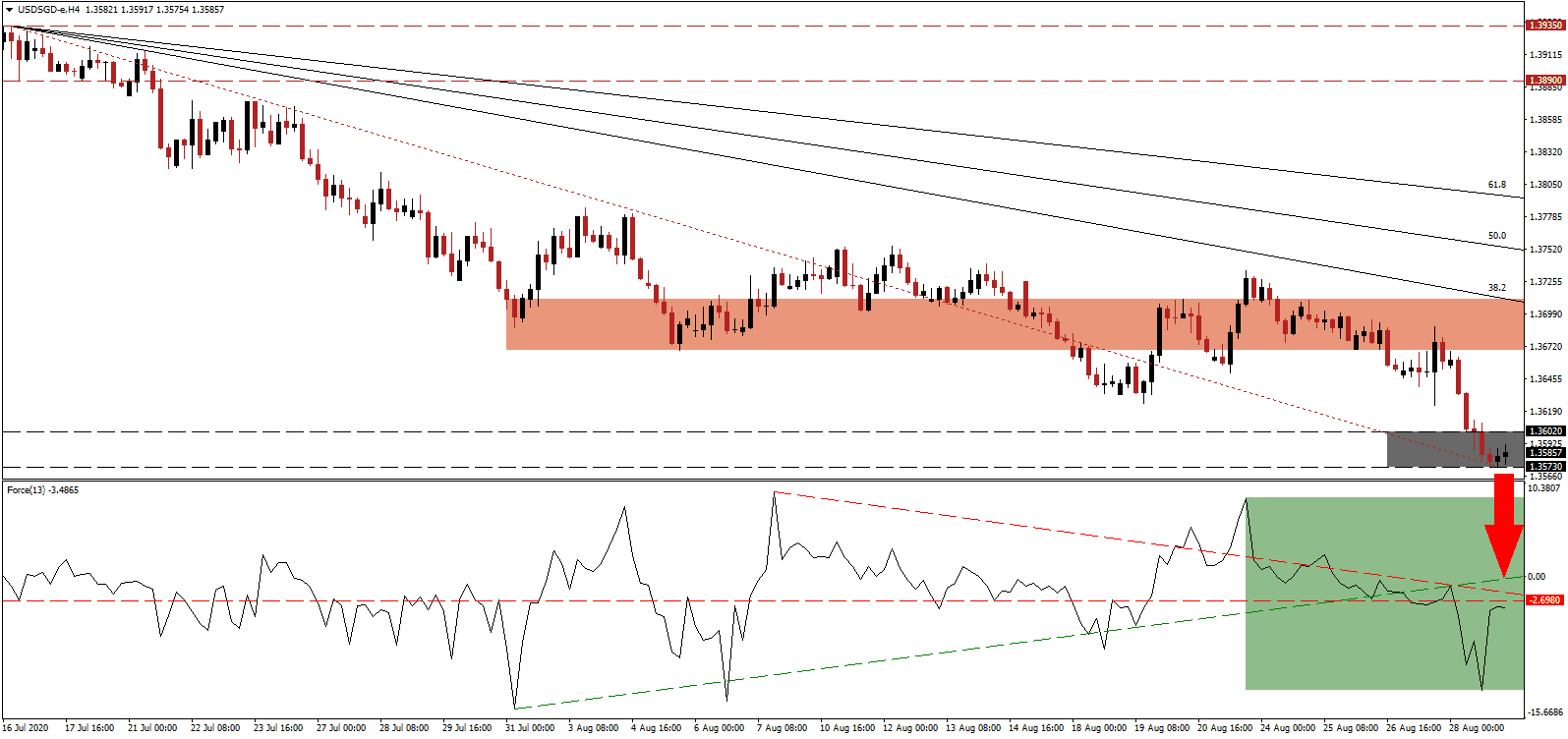

The Force Index, a next-generation technical indicator, reversed from its most recent plunge while maintaining its position below the horizontal resistance level. Adding to bearish momentum was the collapse below its ascending support level, as marked by the green rectangle. The descending resistance level is expected to pressure this technical indicator farther into negative territory, and bears remain in complete control over the USD/SGD.

One area of immediate change related to the Covid-19 pandemic is the labor market. A growing list of countries examines more stringent restrictions on foreign employees, with a distinct focus to fill positions domestically. Chan Chun Sing, the Minister for Trade and Industry, conformed Singapore will remain an open and connected financial hub but seeks quality foreign labor. Following the breakdown in the USD/SGD below its short-term resistance zone located between 1.3669 and 1.3711, as marked by the red rectangle, bearish momentum is anticipated to extend the sell-off.

US Dollar weakness remains dominant after the US Federal Reserve signaled interest rates would remain low until inflation exceeds 2.0% for several months. The labor market is depressed, and the reduction in government subsidies to the unemployed is favored to translate into disappointing economic data moving forward. The descending Fibonacci Retracement Fan sequence is well-positioned to keep the correction intact, with the USD/SGD inside of its support zone located between 1.3573 and 1.3602, as identified by the grey rectangle. Price action will challenge its next support zone between 1.3443 and 1.3482.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3585

Take Profit @ 1.3445

Stop Loss @ 1.3625

Downside Potential: 140 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.50

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/SGD may retrace its most recent sell-off. Forex traders should consider any short-term reversal as an excellent selling opportunity, on the back of bearish progress for the US economy and the US Dollar. The upside potential remains confined to its descending 50.0 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 1.3655

Take Profit @ 1.3700

Stop Loss @ 1.3625

Upside Potential: 45 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.50