Singapore gained relative control over the Covid-19 pandemic, but the risk of a secondary wave remains globally. For now, the city-state brought new daily infections below 100. Deputy Prime Minister and Finance Minister of Singapore, Heng Swee Keat, announced a fifth economic stimulus, of S$8 billion, to assist businesses and the labor market, together with a seven-month plan to kickstart the economy. One significant difference with the new round of aid is that it draws capital from approved and delayed projects due to Covid-19, rather than drawing on reserves. The USD/SGD ended its counter-trend advance with rejection by its short-term resistance zone, with more downside expected.

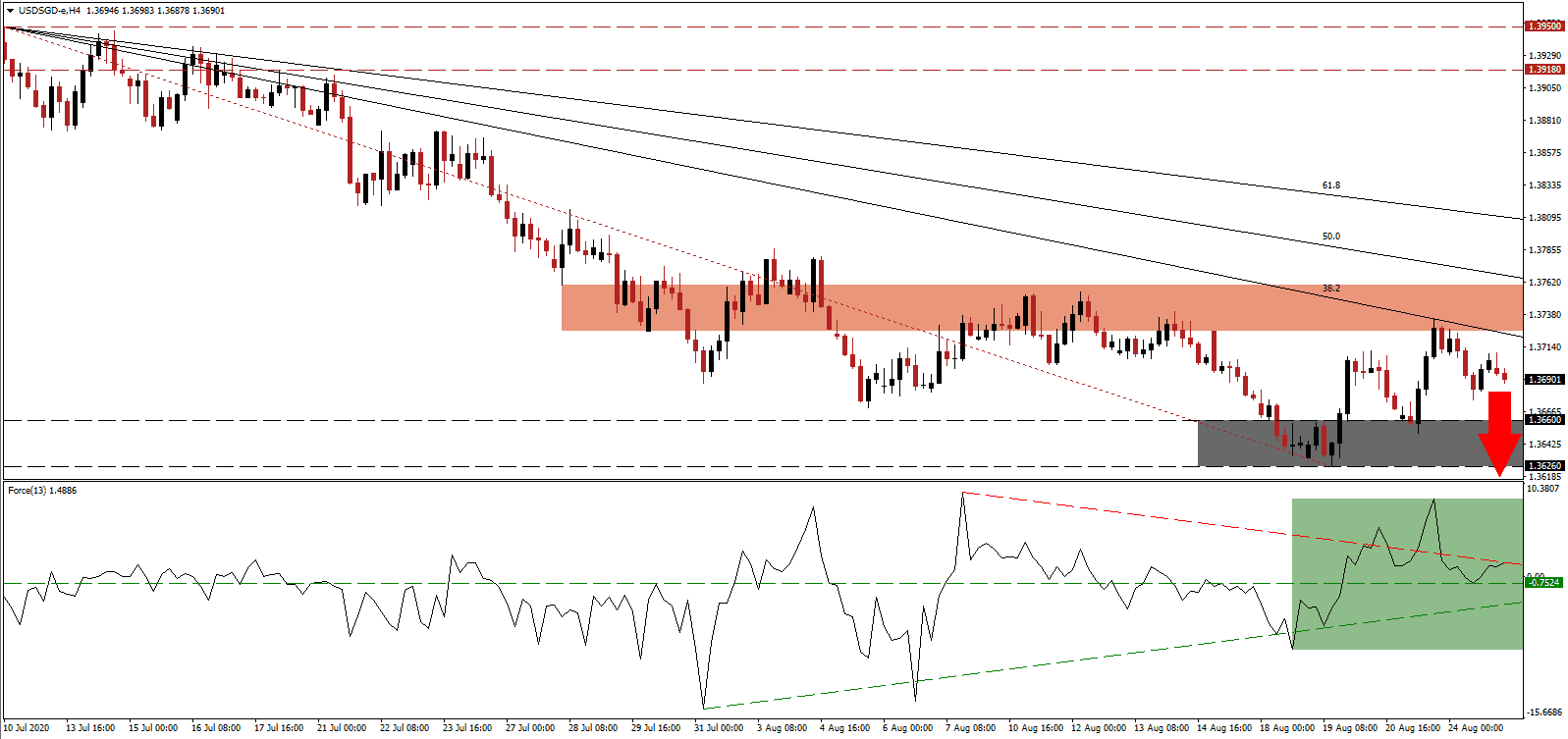

The Force Index, a next-generation technical indicator, points towards rising bearish momentum after collapsing below its descending resistance level. It remains above its horizontal support level, as marked by the green rectangle. A renewed push to the downside is favored to take this technical indicator below it and its ascending support level into negative territory. Bears will then regain complete control over the USD/SGD.

Under the Job Support Scheme, the government classified industries into three tiers, assisting those most impacted more significantly and reducing capital allocation in sectors poised to recover first. Precision manufacturing, biotechnology, financial services, and telecommunication remain the hope for a sustained economic recovery. The USD/SGD gained bearish momentum after being rejected inside of its short-term resistance zone located between 1.3726 and 1.3760, as marked by the red rectangle, by its descending 38.2 Fibonacci Retracement Fan Resistance Level.

While many countries struggle with a combination of political division, economic malaise, and a persistent Covid-19 virus, Singapore continues to innovate and recalibrate. Primary examples are the two biggest port operators, PSA Container and Jurong Port. Both have implemented a green technology overhaul, making the former one home to the largest solar installation at a port globally, and the latter the operator of the largest electric ground vehicle fleet. Innovation across industries will deliver a long-term boost to the economy. The USD/SGD is well-positioned to accelerate into its support zone located between 1.3626 and 1.3660, as identified by the grey rectangle. A breakdown is anticipated to take price action into its next support zone between 1.3567 and 1.3597.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.3690

- Take Profit @ 1.3570

- Stop Loss @ 1.3725

- Downside Potential: 120 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 3.43

In case the Force Index pushes above its descending resistance level, the USD/SGD may seek more upside. While the US and China held a phone call discussing the phase one trade deal, no material change in the status quo appears imminent. The US continues to add debt, hoping the labor market and economy will recover. Forex traders should sell any rallies with the upside potential limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 1.3755

- Take Profit @ 1.3800

- Stop Loss @ 1.3725

- Upside Potential: 45 pips

- Downside Risk: 30 pips

- Risk/Reward Ratio: 1.50