South Africa wants to examine all naturally attributed deaths across the country for Covid-19 to obtain a more precise picture of the pandemic. Many cases go unreported across the world, with epidemiologists suggesting the actual infection and death count exceeds official statistics. The new directive by the Department of Health appears to have been issued without consulting the industry, creating several issues in the execution of it. It serves as a reminder that the Covid-19 pandemic is far from under control. Dominant bearish momentum in the USD/ZAR is likely to keep the correction intact, while a new breakdown cannot be excluded.

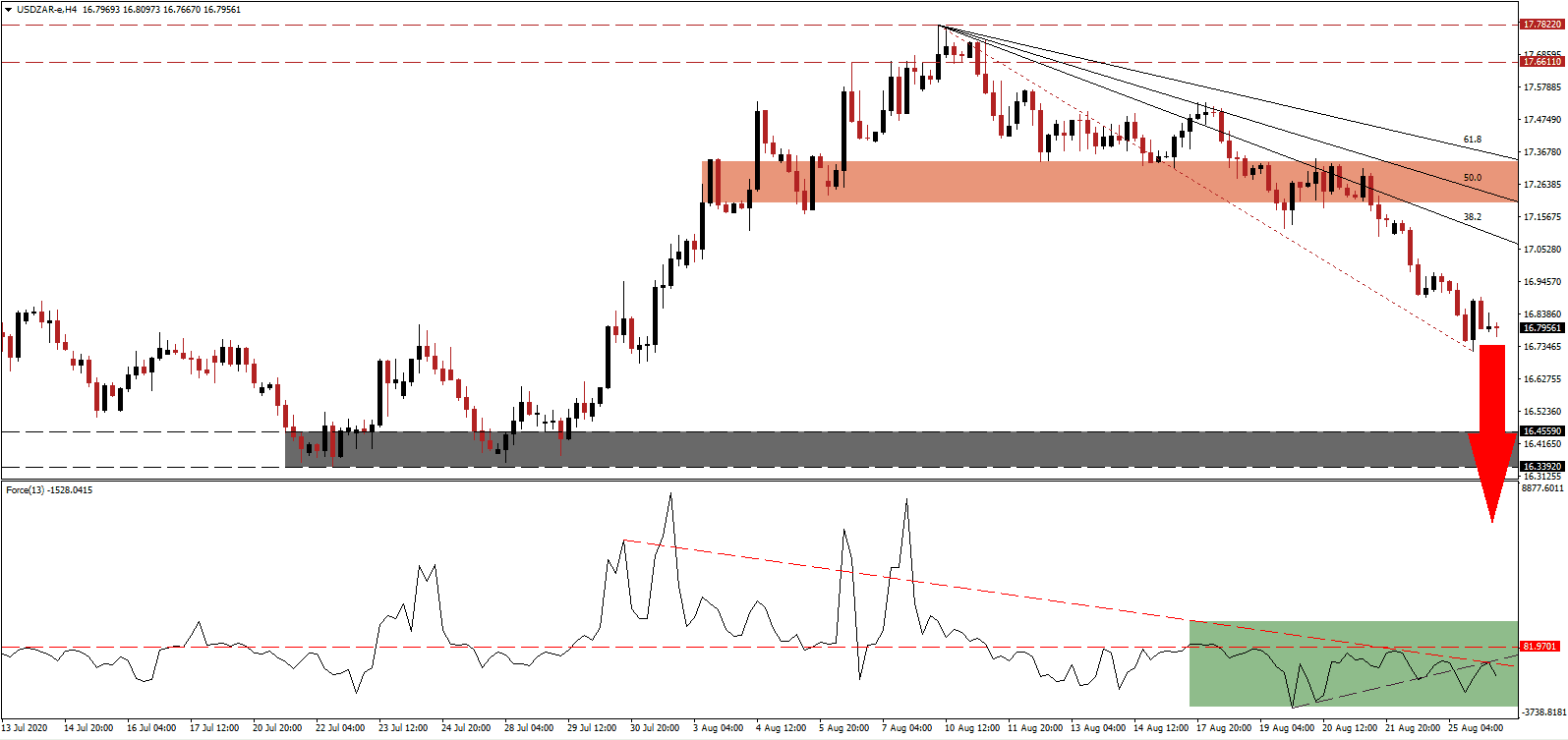

The Force Index, a next-generation technical indicator, confirms bearish pressures after the positive divergence was invalidated by a breakdown, as marked by the green rectangle. Following the rejection by its horizontal resistance level, the Force Index collapsed below its ascending support level. This technical indicator is in negative territory, with the descending resistance level magnifying downside pressures, and bears in full control over the USD/ZAR.

GDP expectations for 2020 continue to face downward revisions, presently at 8.0% versus 7.5% in a similar poll conducted four weeks ago, despite the ongoing easing of lockdown restrictions. The primary risk to the South African economy remains a slow implementation of reforms. Reserved optimism remains that the pandemic will force the government to act more swiftly than before. After the USD/ZAR accelerated below its short-term resistance zone located between 17.2006 and 17.3370, as marked by the red rectangle, bearish pressures accumulated.

Adding pressures on the government, and potentially widening rifts within the ruling ANZ party, is a controversial interview by former finance minister Trevor Manuel. He stated that South Africa lost three decades of history under the ANZ rule. He later confirmed he referenced ten lost years under former President Zuma rather than three decades. Either scenario confirms the lack of urgency by the ANZ to act, which the Covid-19 pandemic could rectify. The descending Fibonacci Retracement Fan sequence is well-positioned to push the USD/ZAR into its support zone located between 16.3392 and 16.4559, as identified by the grey rectangle. The next support zone awaits between 15.5235 and 15.7482.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.7900

Take Profit @ 15.5400

Stop Loss @ 17.0900

Downside Potential: 12,500 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 4.17

Should the Force Index reclaim its ascending support level, the USD/ZAR may initiate a temporary short-covering rally. Forex traders should consider any advance from present levels as an excellent entry opportunity for new net short positions, due to the intensifying bearish pressures in the US Dollar. The upside potential is limited to its redrawn 61.8 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 17.1900

Take Profit @ 17.3400

Stop Loss @ 17.0900

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50